Unilever (NYSE: UL) is a consumer goods juggernaut that owns some of the world’s most recognizable brands, including Dove, Axe, Vaseline, Knorr, and Ben & Jerry’s. With this arsenal of popular items across the consumer staples industry, the company is a perfect example of a bedrock stock that can be the cornerstone of any portfolio.

With a beta of 0.45, Unilever is a more stable stock than the market. However, despite being viewed as a flight to safety investment, Unilever could provide investors with market-beating total returns over the next decade.

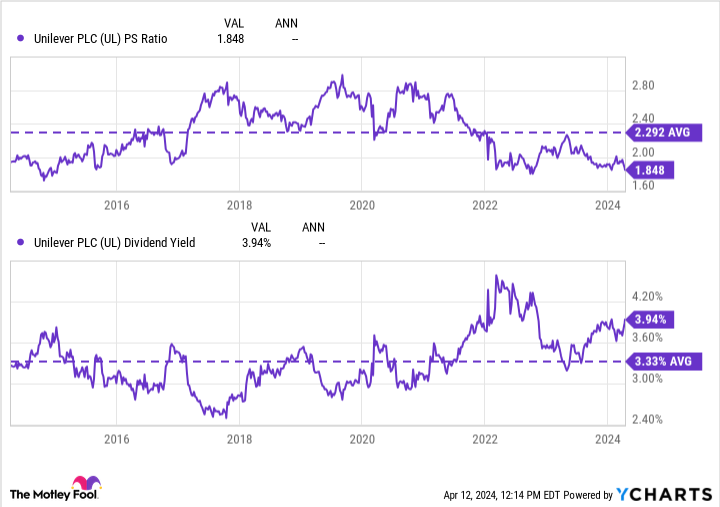

This stock is down 27% from its all-time highs, trading at a once-in-a-decade valuation, and paying a hefty (but safe) 3.9% dividend yield. Here’s why Unilever looks like a buy right now.

Unilever’s portfolio of powerful brands

Unilever is home to more than 400 brands sold in 190 countries. The company categorizes its operations into the following five business segments, with a few examples from each:

-

Beauty and wellbeing (21% of sales): Dove hair and skin care, Sunsilk, TreSemmé, and Clear hair care, along with Pond’s and Vaseline skin care.

-

Personal care (23% of sales): Dove body wash, Axe and Rexona deodorants, and Pepsodent and Signal toothpaste.

-

Home care (20% of sales): OMO detergent, Comfort fabric softener, Sunlight dish soap, and Cif cleaning products.

-

Nutrition (22% of sales): Knorr noodles, Hellmann’s dressings, and other regional favorites.

-

Ice cream (13% of sales): Ben & Jerry’s, Talenti, Cornetto, and Magnum.

What makes Unilever unique is that it generates around 78% of its sales outside North America, including 58% of its revenue from emerging markets. These international markets provide the company with higher-than-expected growth potential for a company operating in the consumer staples industry.

However, despite growing underlying sales (minus foreign exchange effects) by 7% in 2023, Unilever’s generally accepted accounting principles (GAAP) sales dipped 1% due to the strengthening U.S. dollar. Ultimately, these headwinds should be temporary fluctuations and are merely a byproduct of Unilever’s massive global scale.

Keeping things streamlined with a worldwide reach like this is of the utmost importance for the company, so management is turning its marketing focus to its 30 “power brands.” These brands accounted for roughly 75% of the company’s sales in 2023 and grew by 9% during the year — outpacing companywide growth by 2 percentage points.

To further this streamlining process, Unilever recently made a surprise announcement: The upcoming separation of its ice cream unit.

No more Ben & Jerry’s?

Unilever recently announced that it plans to spin off or sell its ice cream business, the lowest-margin unit of its five business segments. With an operating margin of just 11% — compared to an average of 17% across the other four segments — the company’s ice cream operations are a drag on Unilever’s profitability.

The ice cream unit requires more capital than the other units because of its cold storage supply chain needs. As a stand-alone company, it could benefit from focusing on its unique business model and generating new synergies as part of a more straightforward operation.

As for the new-look Unilever, this separation should create a leaner, meaner enterprise that could receive a friendlier valuation from the market thanks to the higher profit margins that should result. This proposed demerger could be the spark needed to restart Unilever’s share price ascension as the company trades near its lowest valuation since 2015.

Unilever’s once-in-a-decade valuation

Unilever’s 3.9% dividend yield and 1.8 price-to-sales (P/S) ratio combine to highlight that the company may be trading at its most attractive valuation of the last decade.

Unilever recorded a free cash flow (FCF) margin of 12% in 2023, and trades at a diminutive 15 times FCF. For context, the company’s most similar consumer staples peers trade at between 24 and 31 times FCF.

Armed with its impressive cash creation, the company only needed to use 62% of the FCF generated in 2023 to pay its impressive 3.9% dividend yield. This excess cash leaves room for future dividend increases alongside continued share repurchases, which have helped lower Unilever’s share count by 2% annually over the last three years.

These shareholder-friendly cash returns, combined with Unilever’s global scale, streamlining operations, and discounted valuation, create a compelling bedrock investment for patient investors who are willing to buy and hold for years.

Should you invest $1,000 in Unilever right now?

Before you buy stock in Unilever, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Unilever wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool recommends Unilever Plc. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 27% to Buy Right Now Near a Once-in-a-Decade Valuation was originally published by The Motley Fool