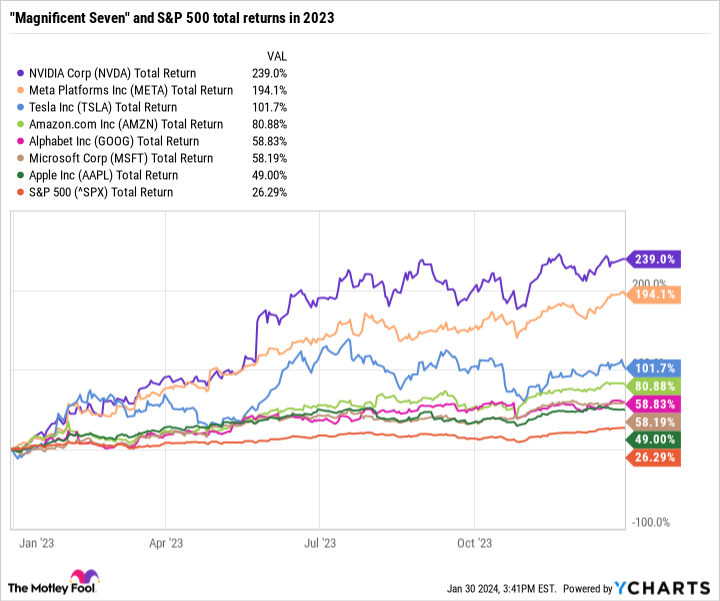

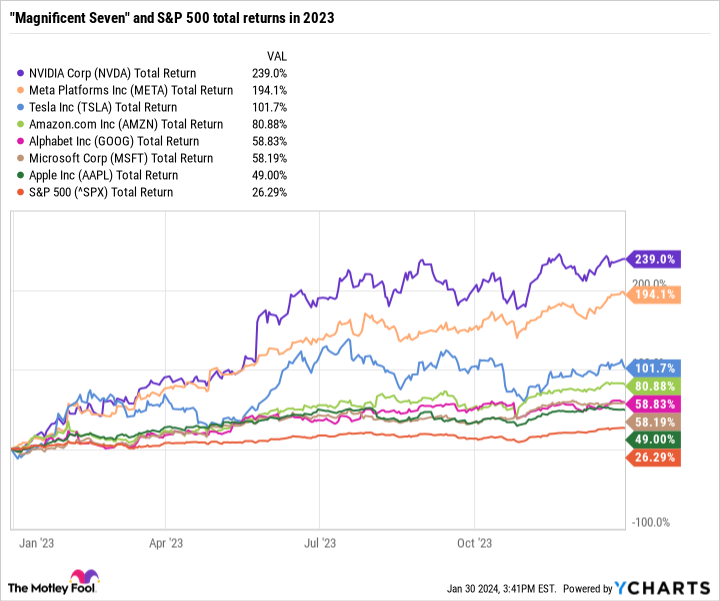

The “Magnificent Seven” is an elite club: Apple, Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia.

And last year, the group dominated the stock market, with all of them up by a minimum of 49%, leaving the benchmark S&P 500 index in the dust.

NVDA Total Return Level data by YCharts

Yet, I think there is one company that stands out in this illustrious list: Nvidia. Here’s why.

Nvidia’s sales are soaring

If I were to distill my bullish thesis on Nvidia down to one sentence, it would be this: Nvidia is the stock that has benefited the most from the artificial intelligence (AI) revolution so far, and there’s every reason to think it will continue to do so for a long time to come.

The speed and scale of AI adoption can be challenging to grasp, so let’s review a couple of graphics that may help. Let’s start with a tweet from Visual Capitalist that shows where we are when it comes to AI’s innovation cycle:

In short, experts think AI is just getting off the ground — perhaps only 10% to 25% of the way to its full potential. That would put it in a similar position to where the internet stood in 1995 or where smartphone adoption was in 2007 — understood by most people, but still a long way from where it will end up.

Crucially for investors, there remains time to find the companies that will benefit from the AI revolution and add them to portfolios. Whenever there is a new technological innovation, it takes time to determine how big the wave will be, and which companies will benefit the most.

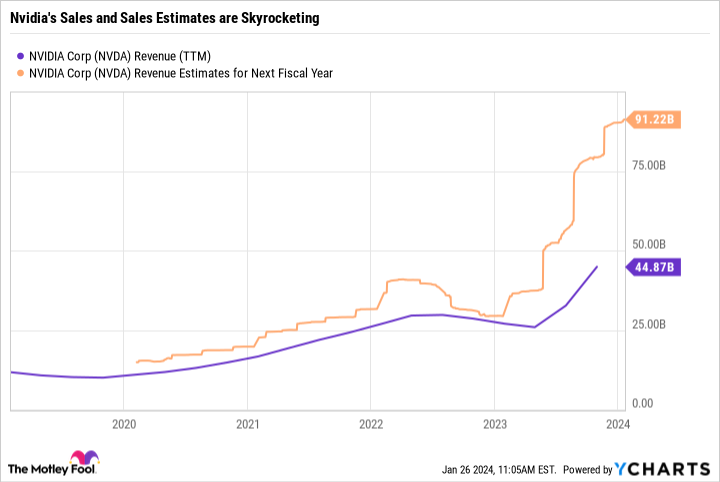

Clearly, Nvidia is one of the companies that will massively benefit from the AI revolution. Want to know why? Look at this chart:

This chart shows Nvidia’s trailing 12-month revenue (blue line) and Wall Street’s revenue estimates for its next fiscal year (yellow line). Note how sharply the yellow line is rising. That’s because analysts can’t seem to boost their predictions for Nvidia fast enough. Each time it delivered a quarterly report in 2023, management’s revenue guidance figures came in far above what analysts had expected, and the analysts had to race to keep up.

Meanwhile, reported revenue is soaring, too. Nvidia’s trailing 12-month revenue nearly doubled in 2023, from a low of $25.9 billion to $44.9 billion.

Clearly, the company’s sales are on fire, and it’s all down to AI. Nvidia makes graphics processing units (GPUs) — and this type of hardware is key to making AI possible. GPUs provide the fast parallel-processing computing power that allows developers to train large language models and other AI systems on vast amounts of data. That’s what gives AI the ability to “know” things. Without massive numbers of the GPUs that Nvidia produces, AI algorithms would learn more slowly and be far less “smart.”

Many of the world’s largest companies are racing to add hundreds of thousands of Nvidia’s AI chips to their tech infrastructure. Magnificent Seven peers such as Microsoft, Meta Platforms, and Tesla are buying its chips at a blistering pace.

Nevertheless, just because the AI revolution is here to stay doesn’t mean there won’t be bumps in the road. Because of that, Nvidia isn’t a stock to trade — it’s a stock to buy and hold for at least a decade.

Nvidia investors should remember at least one thing moving forward: A relatively modest investment — made at the start of a key innovation cycle — can help set up an individual investor for life … if they’re willing to buy and hold.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

1 “Magnificent Seven” Stock That Could Help Set You Up for Life was originally published by The Motley Fool