If you’re looking for an ultra-high yield on Wall Street, one great place to start your search is the real estate investment trust (REIT) sector. These companies are, literally, built to pass income on to shareholders. For conservative investors, Realty Income (NYSE: O) and its 5.8% yield is a good choice. For more aggressive sorts, EPR Properties (NYSE: EPR) could be attractive, given its even higher 7.7% yield. But be careful not to overreach and buy Annaly Capital (NYSE: NLY) and its 13.7% yield.

Here’s what you need to know.

Realty Income is boring and reliable

Realty Income has increased its dividend annually for 29 consecutive years. Although dividend growth has been modest over time, at roughly 4.3% a year, it has clearly been a highly reliable dividend stock. As for the financial foundation, the company’s balance sheet is investment grade-rated.

Adding to the allure here is the REIT’s business model. It invests in single tenant net lease properties, which means that its tenants are responsible for most property level costs. Although any individual property is high risk, Realty Income owns over 15,000 properties — mostly retail, with some industrial and other assets in the mix. So the risk is fairly muted while the company’s operating costs are protected from the impact of inflation. Regular rent bumps and acquisitions have driven and should continue to drive slow and steady growth over time. In all, Realty Income is the kind of high-yield stock you can sleep well owning, which will make the lofty 5.8% dividend yield attractive to even the most conservative of investors.

EPR is progressing well on its turnaround

That said, if you’re willing to take on more risk for a higher yield, then EPR Properties might be the choice for you. The company also uses the net lease approach, but its portfolio is much more focused. That’s true in two ways. First, EPR owns only around 350 properties. Second, almost all of the REIT’s assets are experiential properties, including things like movie theaters, amusement parks, and ski resorts.

This focus was a major problem during the early days of the coronavirus pandemic, when social distancing was used to slow the spread of the illness. EPR ended up suspending its dividend for a few quarters. It has since started to pay a dividend again. And while most of its tenants are in better shape today than they were back then, there’s still some lingering pain in the movie theater business (about 40% of rents) that has to be dealt with. This is why conservative investors might want to err on the side of caution and not buy EPR. But the company’s adjusted funds from operations (FFO) payout ratio in the third quarter of 2023 was a very modest 55% or so. That means there’s a huge amount of leeway for EPR to deal with the ongoing headwinds facing the movie business.

If you can stomach a little adversity, EPR looks to be navigating its turnaround extremely well. The lofty 7.7% dividend yield could be well worth the extra effort that will be needed to keep track of the progress from here.

Annaly’s dividend track record is terrible

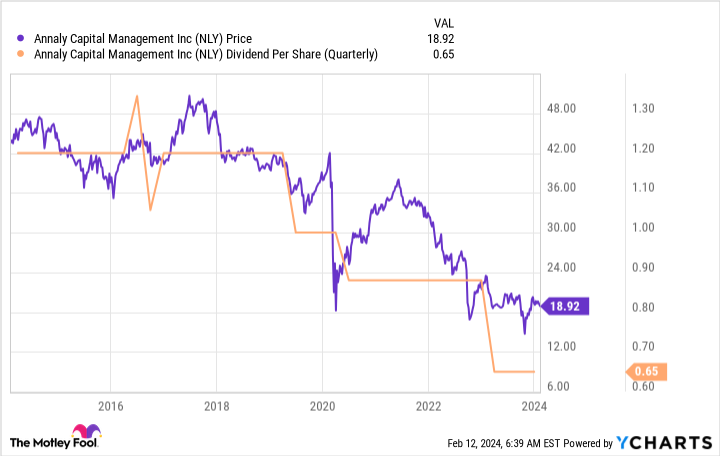

That said, the risk/reward profile of Annaly Capital probably isn’t worth it. Yes, it has a huge 13%-plus dividend yield, but the mortgage REIT has also cut its dividend multiple times over the past 10 years or so. And each time the stock price has followed the dividend lower. That has left investors who reached for this stock’s heady yield with less income and less capital.

To be fair, Annaly isn’t really designed for small investors looking to live off the income their portfolios generate. It’s meant for large institutional investors who use an asset allocation approach and look at total return — which assumes dividends get reinvested. Mortgage REITs are fairly complex entities that can be affected by interest-rate fluctuations and housing market dynamics, among other things. Annaly isn’t inherently a bad company, but that doesn’t mean it’s a good choice for investors looking to maximize the income their portfolios generate. In fact, history suggests that it’s a less than desirable option if that’s your goal.

Two high yield REITs to buy and one to stay away from

The S&P 500 Index is offering a miserly 1.4% or so yield today, and the average REIT, using Vanguard Real Estate ETF as a proxy, is yielding around 4.1%. So both Realty Income and EPR are offering compelling yields, the difference being the risk profile of the two stocks. However, the risk profile of Annaly, despite its massive yield, probably won’t be a good choice for most investors.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income and Vanguard Specialized Funds-Vanguard Real Estate ETF. The Motley Fool recommends EPR Properties. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield REIT Stocks to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool