There are still attractively valued tech stocks despite the market’s strong performance this year.

It’s been a strong year for the stock market and with the Federal Reserve beginning to cut rates as part of a normalization cycle, the good times are likely to continue. Tech stocks in particular have helped lead the way, as artificial intelligence (AI) is driving a lot of momentum in the market.

Despite the market’s strong run, there are still a number of attractively valued tech stocks that look like good investments. Let’s look at three tech stocks to invest $1,000 in right now.

1. Nvidia

The poster child of the AI infrastructure buildout, Nvidia (NVDA -0.01%), is the primary company that designs the graphics processing units (GPUs) that provide the computing power needed to train large language models (LLMs) and run AI inference. The chipmaker gained its dominant position in the market through its CUDA software platform, which long ago became the standard on which developers were trained to program GPUs, before AI was the next big thing.

While demand for its GPUs has been insatiable, there is no sign that this demand is going to wane anytime soon. A plethora of large tech companies and AI start-ups continue to pour money into AI infrastructure, while LLMs need more and more compute power to be trained on as they become more sophisticated. This recently led Citigroup to predict that the big four cloud computing companies will increase their data center capital expenditures (capex) by 40% to 50% next year. A nice percentage of that undoubtedly will be directed toward Nvidia’s GPUs.

Despite the huge opportunity still in front of it, Nvidia’s stock trades at a relatively attractive valuation given its growth. It currently trades at a forward price-to-earnings ratio (P/E) of about 33.5 based on next year’s analyst estimates, and a price/earnings-to-growth ratio (PEG) of 0.93. A PEG under 1 is usually typically considered undervalued, and growth stocks will often have PEGs well above 1.

Image source: Getty Images.

2. AppLovin

AppLovin (APP 1.49%) is another attractively valued stock that has been a big beneficiary of AI, but instead of hardware, it’s been through its advertising software platform.

While the company owns some mobile games, its primary business has been offering an adtech solution to mobile gaming companies to help them draw in new customers and better monetize their games. With the introduction of its Axon 2 AI-based advertising technology, AppLovin’s revenue has soared and the company has taken tremendous share in the space. This can be seen in its second-quarter (ended June 30) results, where platform revenue surged by 75% to $711 million. By comparison, rival Unity Software‘s mobile gaming ad business (called Grow Solutions) revenue sank 9% in the same quarter to $296 million.

Meanwhile, AppLovin has said that given Axon 2’s more predictive nature and increased use of automation, it is able to move beyond gaming customers and expand the number of advertisers with whom it works. The company is planning to move into the larger web-based marketing and e-commerce verticals, which should help continue to drive growth.

Trading at a forward P/E ratio of 25 based on next year’s analyst estimates and a PEG under 0.5, the stock is attractively priced despite the strong gains it has seen this year.

3. SentinelOne

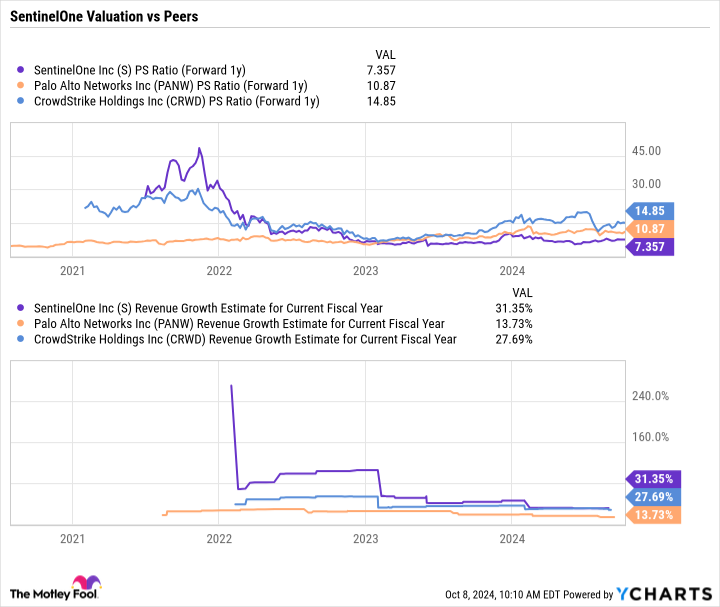

SentinelOne (S -0.54%) is a fast-growing cybersecurity company that trades at a nice price-to-sales (P/S) discount to its larger peers CrowdStrike and Palo Alto Networks, despite expected faster revenue growth this fiscal year.

S PS Ratio (Forward 1y) data by YCharts

In addition to its relatively attractive valuation, the company has a couple of nice growth opportunities in front of it. It competes directly with CrowdStrike in endpoint security through its Singularity Platform, which uses AI agents to monitor and eliminate threats. The company is well positioned to benefit from any fallout from the global IT outage that CrowdStrike’s failed software update caused. Given its much smaller size, any business that heads its way will only help drive growth.

In addition, the company recently signed a deal with enterprise personal computer (PC) vendor Lenovo to provide endpoint security to all its new PCs through its Singularity Platform. Lenovo PC owners will also be able to upgrade their security to the Singularity Platform. In addition, Lenovo plans to build a new managed detection and response (MDR) service based on the Singularity Platform. This should be a meaningful revenue driver for SentinelOne next year.

All in all, SentinelOne is an attractively valued stock with solid growth opportunities ahead.

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, Palo Alto Networks, and Unity Software. The Motley Fool has a disclosure policy.