On Feb. 9, the S&P 500 closed above 5,000 for the first time ever. Optimism around artificial intelligence (AI) has been a significant catalyst, with stocks like Nvidia leading the market higher. But Nvidia isn’t your only option. Here are three other AI stocks worth considering right now.

1. Microsoft

My first pick is the largest company in the world by market cap: Microsoft (NASDAQ: MSFT).

What makes Microsoft stand out in the AI crowd right now is how quickly the company is bringing AI advancements to market. Thanks to its long-standing partnership with OpenAI, the company integrated ChatGPT features into its Bing search engine and Edge internet browser more than a year ago.

And while some people might dismiss the company’s search and related ad business, that’s a mistake, because by any normal business measure, Microsoft’s search business is enormous.

For example, in its latest quarter (the three months ending Dec. 31), Microsoft generated $3.2 billion from search and its news feed’s advertising business. That’s about the same as the quarterly revenue of Domino’s Pizza, Pinterest, CrowdStrike Holdings (NASDAQ: CRWD), and DraftKings combined.

And search is just one area where Microsoft is incorporating new AI features. The company has also debuted its new AI-powered Copilot “everyday AI companion.” By purchasing a subscription, users can access generative AI features to help improve and streamline tasks like summarizing and replying to email and building charts and graphs.

In short, Microsoft is probably doing more than any other company to bring AI to the public, creating yet another competitive advantage for the world’s most valuable company.

2. CrowdStrike Holdings

Next up is CrowdStrike Holdings, the company behind one of the most popular AI-powered cybersecurity platforms.

CrowdStrike’s signature offering is the Falcon platform, a scalable, dynamic endpoint security solution. Organizations can purchase multiple security modules depending on their needs and budget.

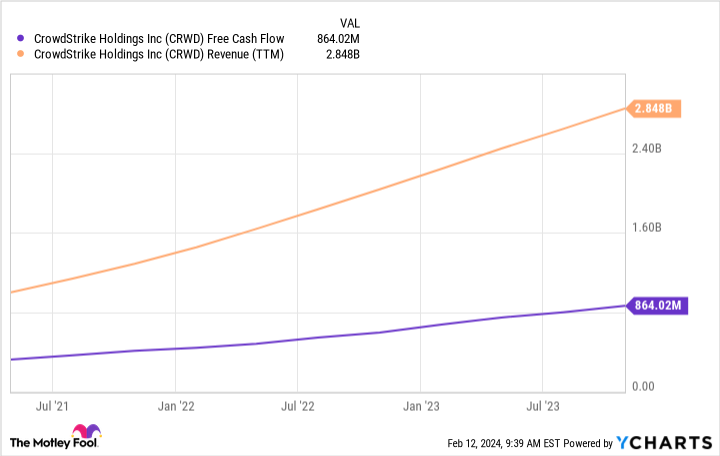

Financially, CrowdStrike is right where a young company early in its life cycle should be. It is growing fast and generating ample free cash flow.

Revenue in its most recent quarter (ending on Oct. 31, 2023), jumped 35% to $786 million. Free cash flow over the last 12 months has increased to $864 million. And the company’s customer count has grown 35% year over year.

Granted, CrowdStrike’s lofty price-to-sales multiple of 28 makes it an expensive stock. Yet for long-term, growth-oriented investors, it’s a name to remember.

3. Super Micro Computer

Lastly, let’s talk about one of the hottest stocks on Wall Street: Super Micro Computer (NASDAQ: SMCI).

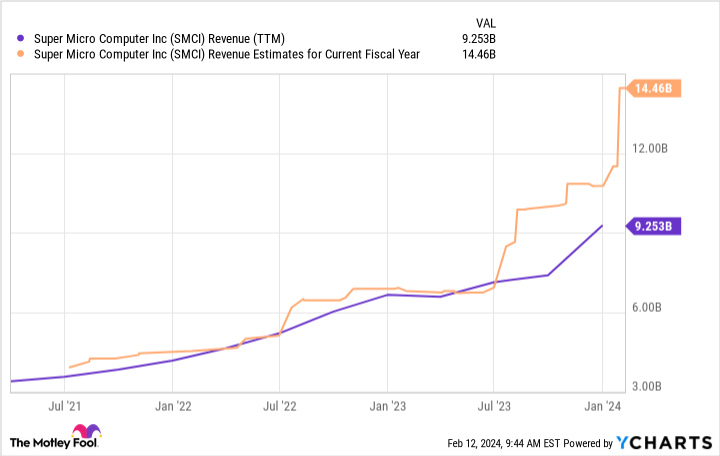

Up 171% year to date as of this writing, Super Micro Computer is firing on all cylinders thanks to the AI revolution.

The reason is that the company makes server racks, the physical hardware used in data centers to hold, cool, and store the cutting-edge AI chips made by Nvidia, AMD, and others.

Since cloud giants like Microsoft, Alphabet, and Amazon are buying AI chips at lightning speed, the demand for server racks is also through the roof. In fact, analysts estimate that the company’s sales will more than double in 2024 to $14.5 billion, with a 34% jump expected in 2025.

Nevertheless, this isn’t a stock for everyone. Given how quickly shares have skyrocketed, the stock’s valuation — a price-to-earnings multiple of 58 — puts it well out of consideration for value investors.

However, for those looking for a company that will benefit from the growth of physical AI infrastructure and data centers, Super Micro Computer is a stock to consider.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, CrowdStrike, Domino’s Pizza, Microsoft, Nvidia, and Pinterest. The Motley Fool recommends Super Micro Computer and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Top Artificial Intelligence Stocks to Buy Right Now was originally published by The Motley Fool