The United Kingdom’s stock market has recently been under pressure, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns over global economic recovery. In such a challenging environment, identifying undervalued stocks can be crucial for investors seeking potential opportunities at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

GlobalData (AIM:DATA) |

£2.005 |

£3.72 |

46.1% |

|

Franchise Brands (AIM:FRAN) |

£1.44 |

£2.63 |

45.2% |

|

Informa (LSE:INF) |

£8.16 |

£16.18 |

49.6% |

|

CAB Payments Holdings (LSE:CABP) |

£1.15 |

£2.23 |

48.4% |

|

Redcentric (AIM:RCN) |

£1.2875 |

£2.42 |

46.8% |

|

Mpac Group (AIM:MPAC) |

£4.70 |

£9.05 |

48% |

|

Videndum (LSE:VID) |

£2.475 |

£4.55 |

45.6% |

|

Foxtons Group (LSE:FOXT) |

£0.632 |

£1.20 |

47.4% |

|

SysGroup (AIM:SYS) |

£0.325 |

£0.65 |

49.9% |

|

Genel Energy (LSE:GENL) |

£0.776 |

£1.51 |

48.4% |

Let’s uncover some gems from our specialized screener.

CAB Payments Holdings

Overview: CAB Payments Holdings Limited, with a market cap of £292.26 million, offers foreign exchange and cross-border payment services to banks, fintech companies, development organizations, and governments in the UK and internationally through its subsidiaries.

Operations: CAB Payments Holdings Limited generates revenue by providing FX and cross-border payment services to a diverse clientele, including banks, fintech firms, development organizations, and governments both domestically and globally.

Estimated Discount To Fair Value: 48.4%

CAB Payments Holdings appears significantly undervalued, trading at £1.15 compared to an estimated fair value of £2.23, suggesting a 48.4% discount. Despite recent revenue and net income declines, the company’s forecasted annual earnings growth of 27.45% and revenue growth of 21.4% outpace the UK market averages. However, profit margins have decreased substantially from last year, and share price volatility remains high due to large one-off items impacting financial results.

Informa

Overview: Informa plc is an international company specializing in events, digital services, and academic research, with operations in the UK, Continental Europe, the US, China, and beyond; it has a market cap of approximately £10.78 billion.

Operations: The company generates revenue through its segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million).

Estimated Discount To Fair Value: 49.6%

Informa trades at £8.16, significantly below its estimated fair value of £16.18, indicating a substantial discount. Despite a recent decline in net income to £147.3 million, the company’s earnings are projected to grow at 21.6% annually, surpassing UK market averages. Revenue growth is expected at 6.8% per year but remains below high-growth benchmarks. The stock’s undervaluation is tempered by an unstable dividend track record and low forecasted return on equity of 11.8%.

Trainline

Overview: Trainline Plc operates an independent rail and coach travel platform, selling tickets in the United Kingdom and internationally, with a market cap of £1.46 billion.

Operations: The company’s revenue segments include Trainline Solutions at £134.76 million, International Consumer at £53.16 million, and United Kingdom Consumer at £208.80 million.

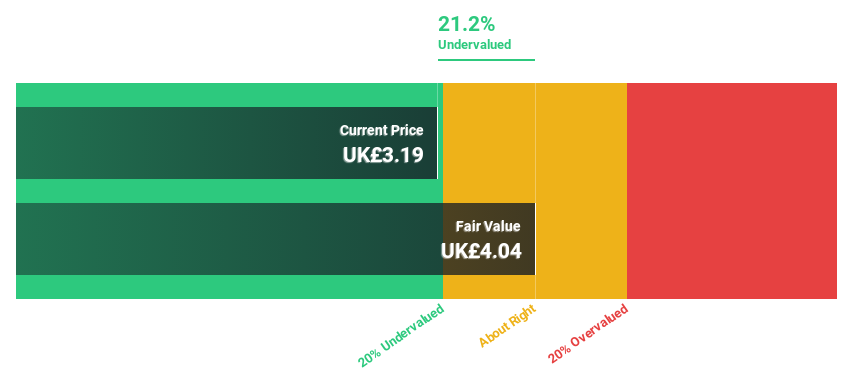

Estimated Discount To Fair Value: 38.4%

Trainline is trading at £3.28, notably below its estimated fair value of £5.33, highlighting a significant undervaluation based on discounted cash flow analysis. Earnings are projected to grow 22.5% annually, outpacing the UK market average of 14.1%, with revenue growth expected at 5.8% per year, above the market’s 3.6%. Analysts anticipate a potential stock price increase of 28.4%, although revenue growth remains modest compared to high-growth standards.

Turning Ideas Into Actions

-

Click here to access our complete index of 61 Undervalued UK Stocks Based On Cash Flows.

-

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

-

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CABP LSE:INF and LSE:TRN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com