News of the day for Dec. 3, 2024

Published December 03, 2024

07:59 AM EST

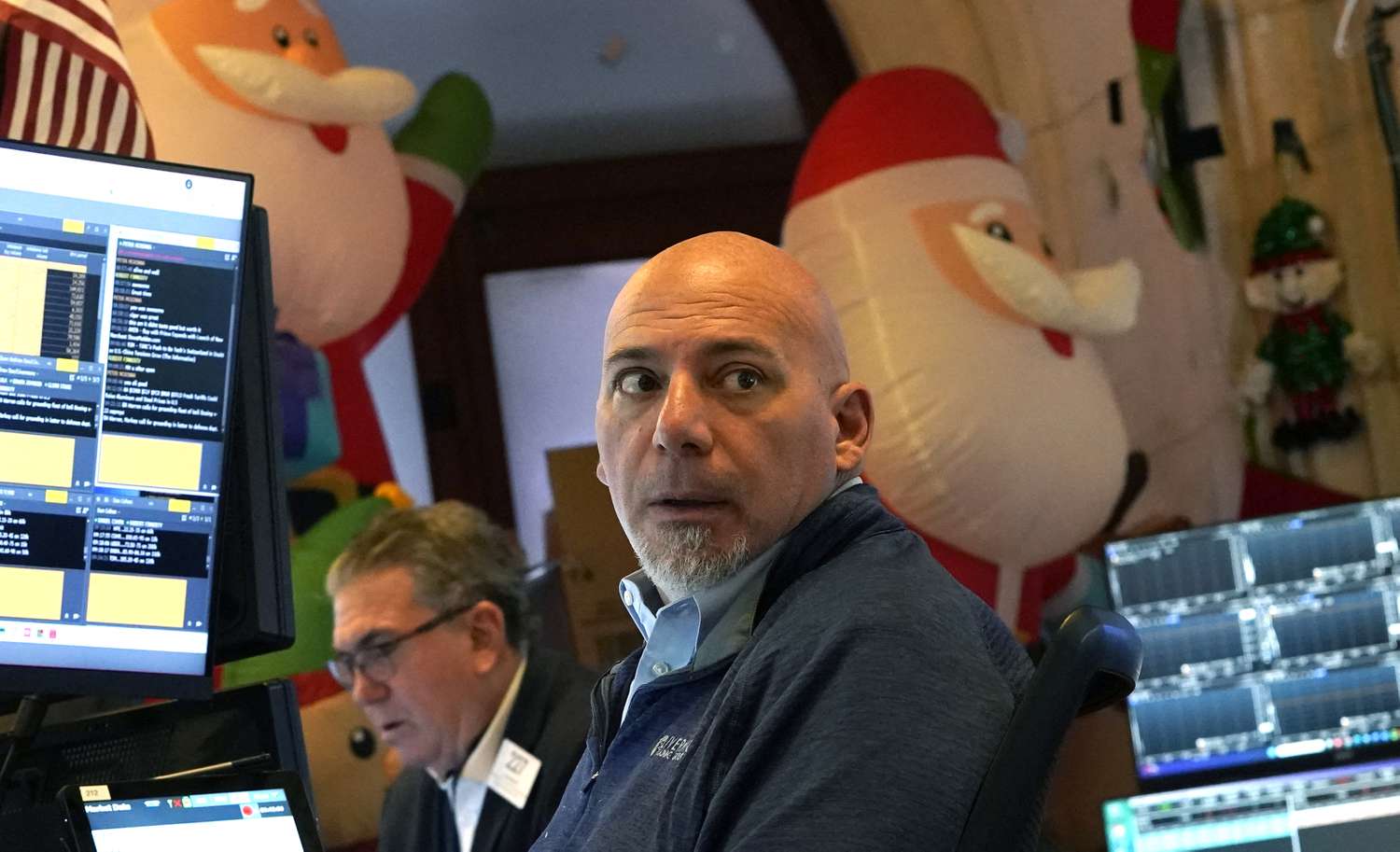

TIMOTHY A. CLARY / AFP via Getty Images

U.S. stock futures are little changed after indexes again hit record highs to kick off December; U.S. Steel (X) shares drop after President-elect Donald Trump reiterates his opposition to Nippon Steel’s takeover bid; BlackRock (BLK) buys HPS Investment Partners for $12 billion in stock; Salesforce (CRM) is expected to report earnings and revenue growth after markets close; and a judge again rules against the $50 billion pay package for Tesla (TSLA) CEO Elon Musk. Here’s what investors need to know today.

1. US Stock Futures Flat After S&P 500, Nasdaq Hit All-Time Highs

S&P 500 and Nasdaq futures are little changed after each index closed Monday trading at an all-time high. Dow Jones Industrial Average futures also are near flat after the index slipped 0.3% in the prior session. Investors will be watching today’s release of the October job openings report, which comes ahead of Friday’s closely watched U.S. employment report for November. Bitcoin (BTCUSD) is trading around $95,000, crude futures are up, gold futures are lower, and 10-year Treasury yields are slightly higher.

2. U.S. Steel Stock Stumbles After Trump Again Promises To Block Nippon Deal

U.S. Steel (X) stock is 7% lower in premarket trading as President-elect Donald Trump vowed to block Nippon Steel’s planned $14 billion acquisition of its American rival. In a post on Truth Social, Trump reiterated his previous opposition to the deal, which has also faced push back from President Joe Biden. U.S. Steel Chief Executive Officer (CEO) David Burritt has said that without the promised $3 billion promised by Nippon Steel if the deal passes, the company would have to close plants and move out of its headquarters in Pittsburgh.

3. BlackRock To Acquire HPS Investment Partners for $12 Billion in Stock

Global investment management firm BlackRock (BLK) said it would acquire HPS Investment Partners for about $12 billion in stock. BlackRock said the deal will help it “deliver integrated solutions across public and private markets,” pointing to the $148 billion in client assets that HPS Investment Partners has under management. BlackRock shares initially dropped in premarket trading but recently turned slightly higher.

4. Salesforce To Report Q3 Earnings After Bell

Salesforce (CRM) stock is little changed in premarket trading as investors await the software firm’s third-quarter earnings release after markets close today. Analysts surveyed by Visible Alpha expect Salesforce to deliver Q3 revenue of $9.35 billion, a 7% year-over-year increase, and profit of $1.41 billion or $1.45 per share, up from $1.22 billion or $1.25 per share. Of the 24 analysts covering the stock tracked by Visible Alpha, 19 have a “buy” rating, while five have “hold” ratings.

5. Judge Again Strikes Down Tesla CEO Musk’s Pay Package

A Delaware judge for a second time moved to strike down a multibillion-dollar pay package for Tesla (TSLA) CEO Elon Musk. The decision upholds an earlier ruling invalidating the package, which was valued above $50 billion. That decision was followed in June by a shareholder vote to approve the pay package. “The court’s decision is wrong, and we’re going to appeal,” Tesla said on X, the social platform owned by Musk. Tesla shares are down less than 1% in premarket trading.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.