Utilities are conservative income stocks with a reputation for being safe enough to be appropriate for widows and orphans. That’s true for some utilities, but NextEra Energy (NYSE: NEE) bucks the trend (in a good way). While NextEra operates a boring utility, it also owns a rapidly growing renewable power business.

For both growth and income and dividend growth investors, it’s a great stock to consider. And now is a unique opportunity to buy it. Here’s what you need to know.

NextEra is down but not out

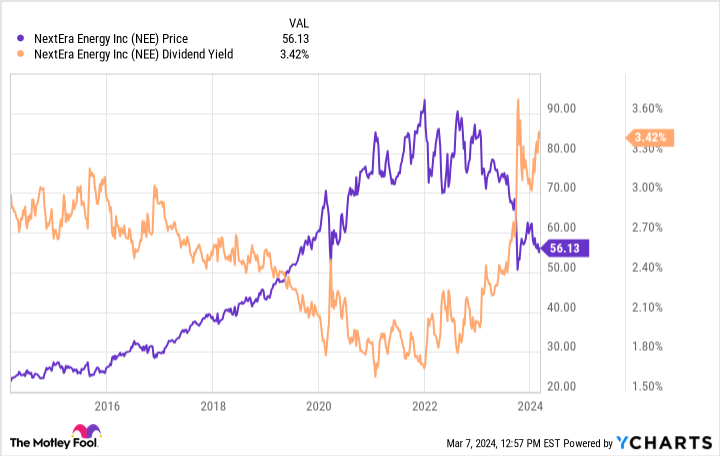

NextEra Energy’s dividend yield is around 3.5%. That’s basically in line with the utility average, using Vanguard Utilities Index ETF as an industry proxy. While income-focused investors might see NextEra’s yield as modest, it’s important to note that the 3.5% yield is near the highest levels of the past decade. So in this way, the stock looks historically cheap right now.

That said, management expects to increase the dividend by roughly 10% in 2024, which is both attractive on an absolute level and extremely high for a utility. But that’s right in line with the rate of dividend growth over the past decade. The dividend has been increased annually for 29 years, so an increase in 2024 would bring that record up to a cool three decades. NextEra Energy is a dividend growth machine, and there’s no reason to think that the growth is going to come to a halt anytime soon.

Notably, management projects earnings growth of between 6% and 8% a year through 2026. There’s a chance that dividend growth will slow down and simply track along with earnings growth, but even that would suggest an attractive dividend growth rate. This is particularly true of a utility stock.

That’s notable because dividend growth investors and growth and income investors looking to create a diversified portfolio will probably find it hard to add utility exposure. Most stocks in the sector are simply slow-growing on the earnings and dividend fronts. NextEra Energy’s historically high yield and robust growth outlook make the stock an ideal diversification pick for investors looking for something with a little more growth.

Why is NextEra’s yield historically high?

The really big reason for NextEra’s high yield is that interest rates have risen. There are two issues for investors to consider here. First, other income options are now more competitive, like certificates of deposit. Second, and more importantly, higher interest rates will make it more expensive for NextEra to grow its business. The utility sector is capital-intensive and makes heavy use of leverage. Don’t get too worried about this.

There are two distinct businesses here to consider. First, NextEra owns Florida Power & Light, which is the largest regulated utility in Florida and about 70% of the utility’s business. The Sunshine State has benefited from population growth for years. More customers mean more revenue and more opportunity to invest in regulated assets. This is a very stable and reliable business, because NextEra has been granted a monopoly in exchange for accepting government oversight of the rates it charges and its capital investment plans. Regulators generally adjust so that utilities can earn a reliable return. Thus, it’s highly likely that the rates NextEra can charge will eventually be updated to account for higher interest rates.

The rest of NextEra is NextEra Energy Resources, one of the largest renewable power generators in the world. This is a fast-growing business with a very long runway for growth as carbon-heavy power sources get replaced by renewable sources like solar and wind. NextEra currently operates around 34 gigawatts of clean energy. It has plans to add as much as 41.8 gigawatts to that total by 2026. This side of the business is not regulated, so higher interest rates will have to be dealt with on a contract-by-contract basis. Market forces are likely to ensure NextEra can profitably grow this side of its business even if there’s some near-term disruption to deal with.

In all, higher interest rates are a headwind. But they’re highly unlikely to change the long-term growth trajectory of NextEra and its dividend.

Don’t miss out on the opportunity

There’s no such thing as a perfect investment, but the current concerns about NextEra’s growth seem likely to be temporary and, perhaps, a little overblown. That’s an opportunity for investors that think in decades. Growth-and-income and dividend growth-focused investors have the chance to add a reliable utility stock to their portfolios with a historically attractive yield. That’s not something you should pass up without giving NextEra a deep dive.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Dividend Growth Stock to Buy Now was originally published by The Motley Fool