Camtek (CAMT) is back on many radar screens after Morgan Stanley initiated coverage, alongside a wave of rating upgrades from other brokerages, a cluster of fresh opinions that often nudges sentiment and trading activity.

See our latest analysis for Camtek.

That growing analyst enthusiasm has arrived on the back of strong momentum, with the share price at $116.93 after a 5.44% 1 day share price return and a standout 48.48% 90 day share price return. The 5 year total shareholder return of 494.86% underlines how long term holders have already been rewarded.

If Camtek’s run has you wondering what else is gaining traction in semis and adjacent tech, it is worth exploring high growth tech and AI stocks for other fast moving ideas.

But with Camtek now trading just below consensus targets after a huge multi year run and rapid earnings growth, is there still meaningful upside ahead, or has the market already priced in the next leg of its expansion?

Most Popular Narrative Narrative: 6.9% Undervalued

With Camtek closing at $116.93 against a narrative fair value of $125.60, the story frames current pricing as leaving some upside on the table.

Successful integration and ramp of the MicroProf metrology offering, as evidenced by 30+ installations at a Tier 1 customer, demonstrates Camtek’s ability to expand its product portfolio and access new metrology-heavy workflows, enabling higher-margin revenue streams and operating income growth.

Curious how steady double digit growth, lofty margins, and a punchy future earnings multiple can still add up to underappreciated upside? Want the full playbook?

Result: Fair Value of $125.60 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, elevated exposure to Asian demand and intensifying competition in advanced packaging tools could quickly challenge today’s bullish earnings and valuation assumptions.

Find out about the key risks to this Camtek narrative.

Another Angle on Valuation

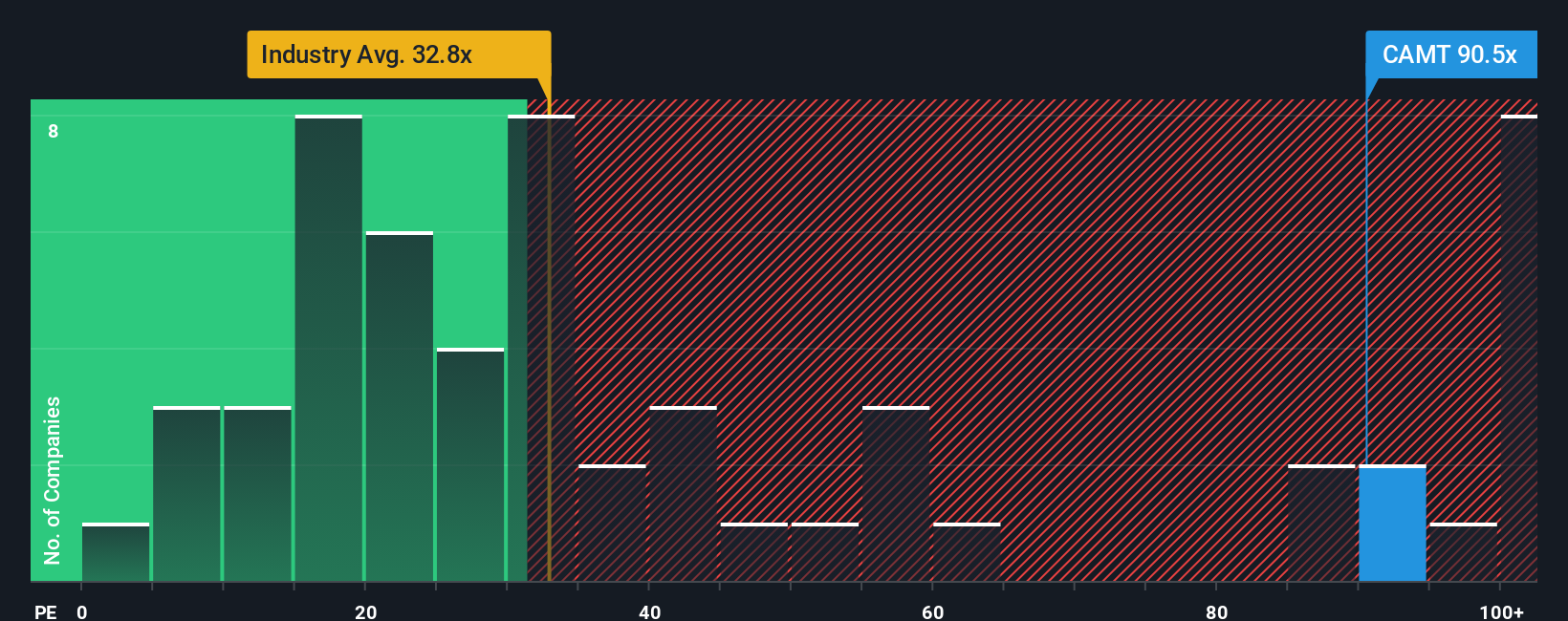

While the popular narrative suggests Camtek is about 7% undervalued, its price to earnings ratio of 111.9x tells a harsher story. That is far above the US semiconductor average of 36.2x, the peer average of 53.2x, and even its 73.8x fair ratio. This implies meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camtek Narrative

If you are not convinced by this framing or prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Camtek research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If Camtek impressed you, do not stop here, use the Simply Wall St Screener to uncover more targeted opportunities before the crowd rushes in.

- Capture early stage momentum by scanning these 3573 penny stocks with strong financials that already show solid fundamentals instead of fragile hype.

- Target structural growth by focusing on these 30 healthcare AI stocks shaping the future of diagnostics, drug discovery, and hospital efficiency.

- Lock in potential income streams by reviewing these 14 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com