Tom Lee says the S&P 500 (a benchmark for the U.S. stock market) can hit 15,000 by 2030.

The S&P 500 (^GSPC +1.97%) is considered the single best gauge for the overall U.S. stock market. Tom Lee at Fundstrat Global Advisors thinks the benchmark index will reach 15,000 by 2030. That implies 120% upside from its current level of 6,830.

Investors can position themselves to benefit by owning shares of the Vanguard S&P 500 ETF (VOO +1.95%). Here are the important details.

Image source: Getty Images.

The Vanguard S&P 500 ETF provides exposure to many of the most influential stocks

The Vanguard S&P 500 ETF measures the performance of the S&P 500, an index comprising 500 large U.S. companies. The fund includes stocks from every market sector, though it is most heavily weighted toward technology stocks.

The Vanguard S&P 500 ETF includes about 80% of domestic equities and 50% of global equities by market value, meaning it offers exposure to many of the most influential stocks in the world. The top 10 positions are listed by weight below:

- Nvidia: 7.7%

- Apple: 6.8%

- Microsoft: 6.1%

- Alphabet: 5.6%

- Amazon: 3.8%

- Broadcom: 2.7%

- Meta Platforms: 2.4%

- Tesla: 2.1%

- Berkshire Hathaway: 1.5%

- Eli Lilly: 1.4%

The S&P 500 advanced 439% during the last two decades, compounding at 8.7% annually. If dividends are included, the index achieved a total return of 700% over the same period, compounding at 10.9% annually. At that pace, $500 invested monthly over the last 20 years would now be worth more than $380,000.

Additionally, while the U.S. economy has suffered 10 recessions since the S&P 500 was created in 1957, the index has generated a positive return over every rolling 15-year period during that time. That means you would have made money by holding an S&P 500 index fund for at least 15 years no matter when you bought the fund.

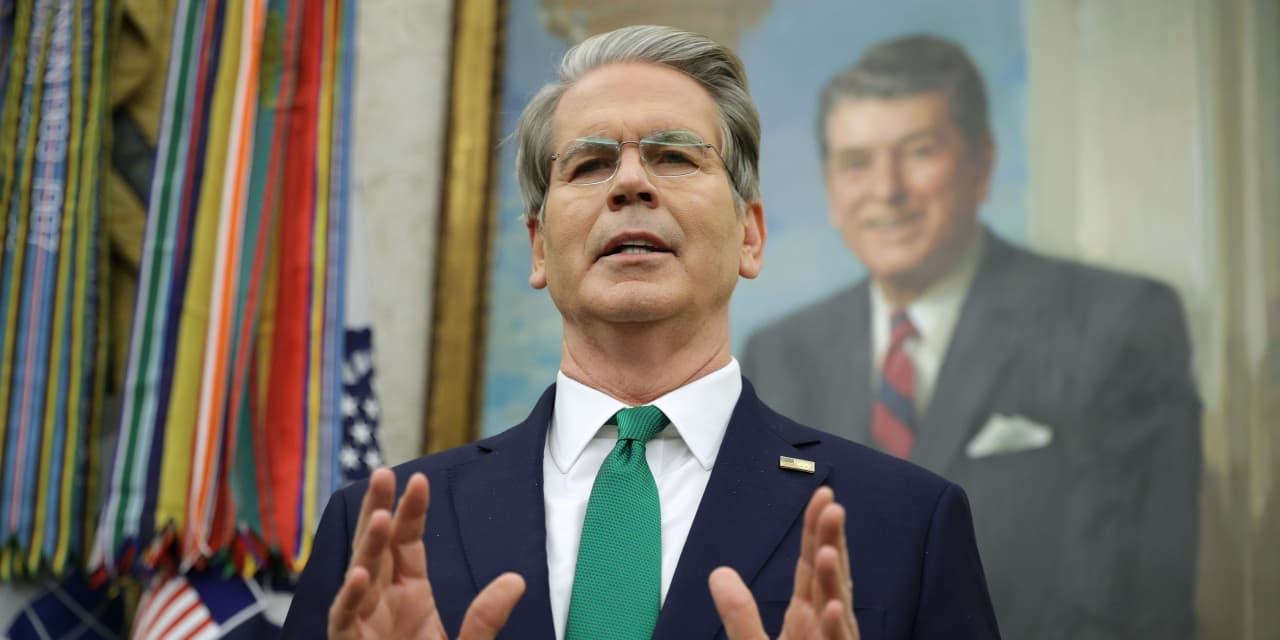

Tom Lee thinks millennials and AI will drive the S&P 500 to 15,000 by 2030

Tom Lee is the head of research at Fundstrat Global Advisors. He manages the Fundstrat Granny Shots U.S. Large Cap ETF, an exchange-traded fund that holds about 40 stocks. The holdings are selected based on secular trends that Lee believes will drive the broader market higher in the years ahead. The Granny Shots ETF has outperformed the S&P 500 by 4 percentage points since its inception in November 2024.

Lee believes those same secular trends will drive the S&P 500 to 15,000 by the end of the decade:

- Millennials, the largest living generation, are reshaping the economy as they enter their peak earning years. They are also set to inherit $80 trillion, the largest generational wealth transfer in history.

- The global labor shortage is predicted to reach 80 million workers by 2030, which should create demand for artificial intelligence (AI) as companies look to increase productivity and automate workflows.

In particular, Lee anticipates a parabolic move in the technology sector, which accounts for 33% of the S&P 500. He argues, “Between 1948 and 1967 there was a global labor shortage and technology stocks went parabolic. And between 1991 and 1999 there was global labor shortage and technology stocks went parabolic. This is what’s happening today.”

Here’s the bottom line: Whether Lee is correct or not in predicting the S&P 500 will reach 15,000 by 2030, the index has consistently created wealth over long holding periods. That makes an S&P 500 index fund a wise choice for patient investors. And the Vanguard S&P 500 ETF stands out due to its cheap expense ratio of 0.03%. The average expense ratio on similar funds from other issuers is 0.75%, according to Vanguard.

Trevor Jennewine has positions in Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.