Simply Wall St

4 min read

As global markets grapple with volatility, driven by concerns over artificial intelligence and geopolitical tensions, investors are increasingly turning their attention to value-oriented segments that may offer more stability. In this context, identifying undervalued stocks in the Asian markets can present unique opportunities for those seeking to capitalize on potential discrepancies between a stock’s market price and its estimated intrinsic value.

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

TLB (KOSDAQ:A356860) |

₩60000.00 |

₩118404.93 |

49.3% |

|

Sino Medical Sciences Technology (SHSE:688108) |

CN¥22.82 |

CN¥44.84 |

49.1% |

|

Ningxia Building Materials GroupLtd (SHSE:600449) |

CN¥13.41 |

CN¥26.70 |

49.8% |

|

Hyundai Rotem (KOSE:A064350) |

₩212500.00 |

₩424059.73 |

49.9% |

|

Fuji Media Holdings (TSE:4676) |

¥3628.00 |

¥7106.09 |

48.9% |

|

EMRO (KOSDAQ:A058970) |

₩40850.00 |

₩80317.40 |

49.1% |

|

CURVES HOLDINGS (TSE:7085) |

¥763.00 |

¥1517.50 |

49.7% |

|

CSPC Innovation Pharmaceutical (SZSE:300765) |

CN¥34.95 |

CN¥69.46 |

49.7% |

|

Comvita (NZSE:CVT) |

NZ$0.69 |

NZ$1.38 |

50% |

|

BEAUTY GARAGE (TSE:3180) |

¥1416.00 |

¥2830.45 |

50% |

We’ll examine a selection from our screener results.

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products across China, the United States, and internationally, with a market cap of HK$148.18 billion.

Operations: The company generates revenue from its biotechnology segment, which amounts to CN¥11.42 billion.

Estimated Discount To Fair Value: 43.8%

Innovent Biologics is trading at HK$85.4, significantly below its estimated future cash flow value of HK$151.85, highlighting potential undervaluation based on cash flows. The company recently announced a strategic collaboration with Eli Lilly, securing a US$350 million upfront payment and potential milestone payments up to US$8.5 billion, enhancing its financial position. Innovent’s robust revenue growth and high earnings forecast further support its attractiveness as an undervalued investment opportunity in Asia.

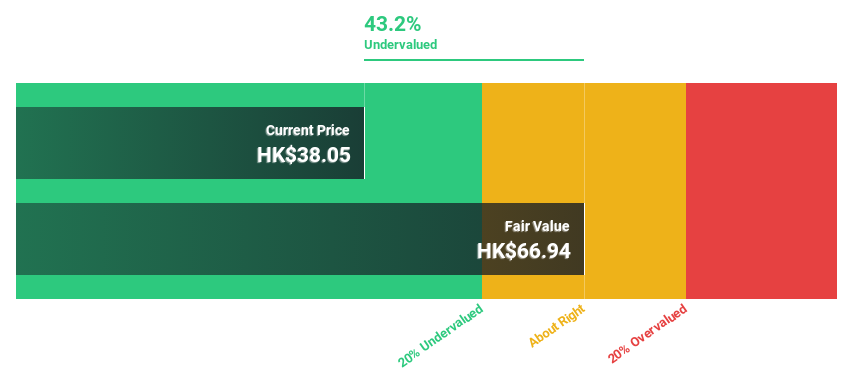

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and other metallic products both in China and internationally, with a market cap of approximately HK$122.64 billion.