When things seem too perfect on Wall Street, they often are.

From a statistical standpoint, the stock market has thrived with Donald Trump in the Oval Office. During his first term (Jan. 20, 2017 – Jan. 20, 2021), the widely followed Dow Jones Industrial Average (^DJI +0.10%), broad-based S&P 500 (^GSPC +0.05%), and innovation-inspired Nasdaq Composite (^IXIC 0.22%) gained 57%, 70%, and 142%, respectively.

Since Donald Trump was inaugurated for his second, non-consecutive term on Jan. 20, 2025, it’s been more of the same. Through the closing bell on Feb. 11, the Dow, S&P 500, and Nasdaq Composite have respectively risen by 15%, 16%, and 18%.

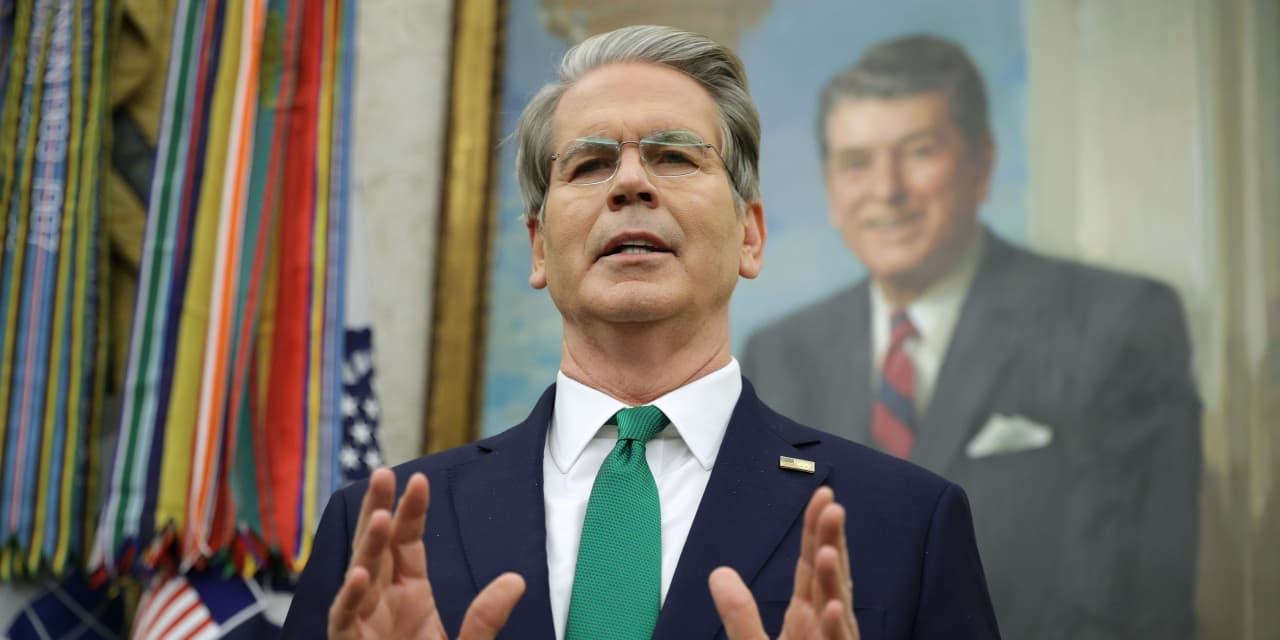

President Trump delivering remarks. Image source: Official White House Photo by Shealah Craighead, courtesy of the National Archives.

Although stock market volatility has been off the charts at times with Trump in the White House, his policies, including the permanent lowering of the peak marginal corporate income tax rate from 35% to 21%, have lit a fire under Wall Street and driven record share buybacks.

But when things seem too perfect on Wall Street, they often are. Rumblings of a potential stock market crash in year two of President Trump’s second term are mounting. Thankfully, several historically correlated events offer clear insight into the likelihood of a stock market crash taking shape.

History often rhymes on Wall Street

Before going any further, it’s important to note that history can’t guarantee that something is going to happen on Wall Street. Although history does tend to rhyme on Wall Street, and certain correlated events have flawless track records of foreshadowing the future, nothing should be taken as a concrete guarantee.

Nevertheless, the following three data-backed correlations provide a historic glimpse of what to expect in year two of Donald Trump’s presidency.

The second-priciest stock market in 155 years

The first historical marker deserving of attention is the time-tested Shiller Price-to-Earnings (P/E) Ratio, which is also known as the Cyclically Adjusted P/E Ratio, or CAPE Ratio. The S&P 500’s Shiller P/E is based on average inflation-adjusted earnings over the previous 10 years and has been back-tested to January 1871.

This valuation yardstick is particularly useful in determining the relative cheapness or priciness of Wall Street’s benchmark index, the S&P 500. Whereas the Shiller P/E has averaged 17.34 over the last 155 years, it ended the Feb. 11 trading session at 40.35. This is the second-priciest stock market in history, trailing only the dot-com era.

S&P 500 Shiller PE Ratio hits 2nd highest level in history 🚨 The highest was the Dot Com Bubble 🤯 pic.twitter.com/Lx634H7xKa

— Barchart (@Barchart) December 28, 2025

History tells us that CAPE Ratios above 30 signal trouble for stocks. The previous five times the Shiller P/E has topped 30 during a continuous bull market, the Dow Jones Industrial Average, S&P 500, and/or Nasdaq Composite eventually shed 20% or more of their value. While the timing of this downturn is anyone’s guess, the Shiller P/E has made clear that extended valuations aren’t well-tolerated on Wall Street.

Next-big-thing innovations have a checkered past

A second historically correlated event that builds on the Shiller P/E discussion has to do with the nature of next-big-thing technologies. For more than three decades, every game-changing technological innovation has endured a bubble-bursting event.

The reason bubbles form is that investors overestimate the early stage adoption and/or optimization of next-big-thing innovations. For example, artificial intelligence (AI) is the hottest thing since sliced bread. There are no signs of an adoption problem, with the “Magnificent Seven” spending tens, if not hundreds, of billions of dollars on AI data center infrastructure.

However, there are optimization concerns. Just because businesses are spending aggressively on AI infrastructure, it doesn’t mean AI solutions will be optimized to maximize corporate sales and profits. It took businesses more than half a decade to optimize the internet to bolster their bottom lines, and it’ll likely take years for AI to mature and evolve as a technology. If and when the AI bubble bursts, the same companies that led Wall Street higher will likely be the first to drag it down.

Midterm elections lead to larger stock market corrections

The third correlated event that offers insight is the historical performance of the benchmark S&P 500 during midterm election years. Wall Street and investors love certainty above all else, and elections can quickly strip that away.

Get ready to hear a lot about this, but midterm years tend to see their ultimate low later in the year and have some of the largest intra-year corrections.

The good news? Since 1950, off those lows stocks have never been lower a year later and up more than 30% on average. pic.twitter.com/WuWr8vWCJN

— Ryan Detrick, CMT (@RyanDetrick) November 16, 2025

Entering the 2026 midterm elections in November, Republicans hold a very slim majority in the House of Representatives. Given that history shows the sitting president’s party typically loses seats in Congress in midterm elections, it wouldn’t take much of a shift from voters to lead to a divided Congress come January 2027.

According to Carson Group’s Chief Market Strategist, Ryan Detrick, the average peak-to-trough downturn for the S&P 500 during midterm years is 17.5% since 1950 — a larger average correction than in other years of a president’s term. In Trump’s first term, the S&P 500 fell nearly 20% during the midterm elections.

While all three of these historically correlated events make clear that double-digit percentage downside is expected in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, none point to a heightened likelihood of an emotion-driven stock market crash. Although this doesn’t rule out an elevator-down crash, investors shouldn’t be overly concerned.

Image source: Getty Images.

Historical correlations work in favor of optimistic long-term investors

While several historically flawless correlations paint a rather grim picture for the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite over the short term, this outlook completely reverses for investors willing to broaden their perspective.

On the one hand, stocks can and will go down. No amount of well-wishing or policy maneuvering can stop emotion-driven stock market corrections, bear markets, or the occasional crash from taking shape.

But what corrections, bear markets, and especially crashes have in common is their propensity to be short-lived. The last two crashes investors observed were resolved in 33 calendar days (the February-March 2020 COVID-19 crash) and four days (April 2, 2025 – April 8, 2025). While investors commonly have their heartstrings pulled during periods of heightened volatility, elevator-down moves are historically unsustainable beyond a few weeks.

Meanwhile, bull markets tend to stick around significantly longer.

The current bull market — the “AI Bull” — has eclipsed the 1,200-day mark. This is the 10th bull market to last 1,000+ days based on the 20% rally/decline threshold.

Bear markets, on average, are much shorter, at just 286 days, with the longest being 630 days back in… pic.twitter.com/ds7lqWWHFh

— Bespoke (@bespokeinvest) February 10, 2026

Recently, analysts at Bespoke Investment Group updated a data set published on X (formerly Twitter) that examined the calendar-day length of every S&P 500 bull and bear market since the beginning of the Great Depression in September 1929. What this data set shows is a night-and-day difference between bull and bear markets.

Whereas the longest S&P 500 bear market over the last 96 years endured for 630 calendar days, 14 out of 27 S&P 500 bull markets have persisted longer. If the current bull market is still ongoing by late March 2026, 10 of 27 S&P 500 bull markets will have lasted twice as long as the lengthiest bear market.

What’s more, the average bear market has lasted just 286 calendar days, or approximately 9.5 months. Compared with the typical bear market, the average bull market has persisted 1,011 calendar days, or roughly 3.5 times as long.

This data demonstrates the power of investor optimism and the value of time in the market.