The Morning Bull – US Market Morning Update Monday, Feb, 16 2026

US stock futures are pointing higher this morning, with key contracts on the S&P 500 and Nasdaq up around 0.3% to 0.4%, as investors react to cooler inflation and falling bond yields. Headline US inflation is at 2.4% and core inflation, which strips out food and energy, is at 2.5%, the lowest since March 2021, indicating that the cost of living is still rising but more slowly. The 10 year US Treasury yield is near 4.07%, which effectively makes borrowing a bit cheaper. The key question now is whether potential rate cuts help rate sensitive areas like real estate and smaller companies more than they squeeze income focused bond investments.

If falling inflation and lower yields have you rethinking your mix of stocks and bonds, our 83 resilient stocks with low risk scores can help you focus on quality ideas before markets move on.

Top Movers

- Rivian Automotive (RIVN) jumped 26.64% after multiple analyst upgrades and EV partnership headlines drew attention.

- Coinbase Global (COIN) climbed 16.46% as traders reacted to fresh earnings and a completed buyback tranche.

- Nebius Group (NBIS) gained 9.23% following its Q4 and full year earnings update.

Is Nebius Group still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

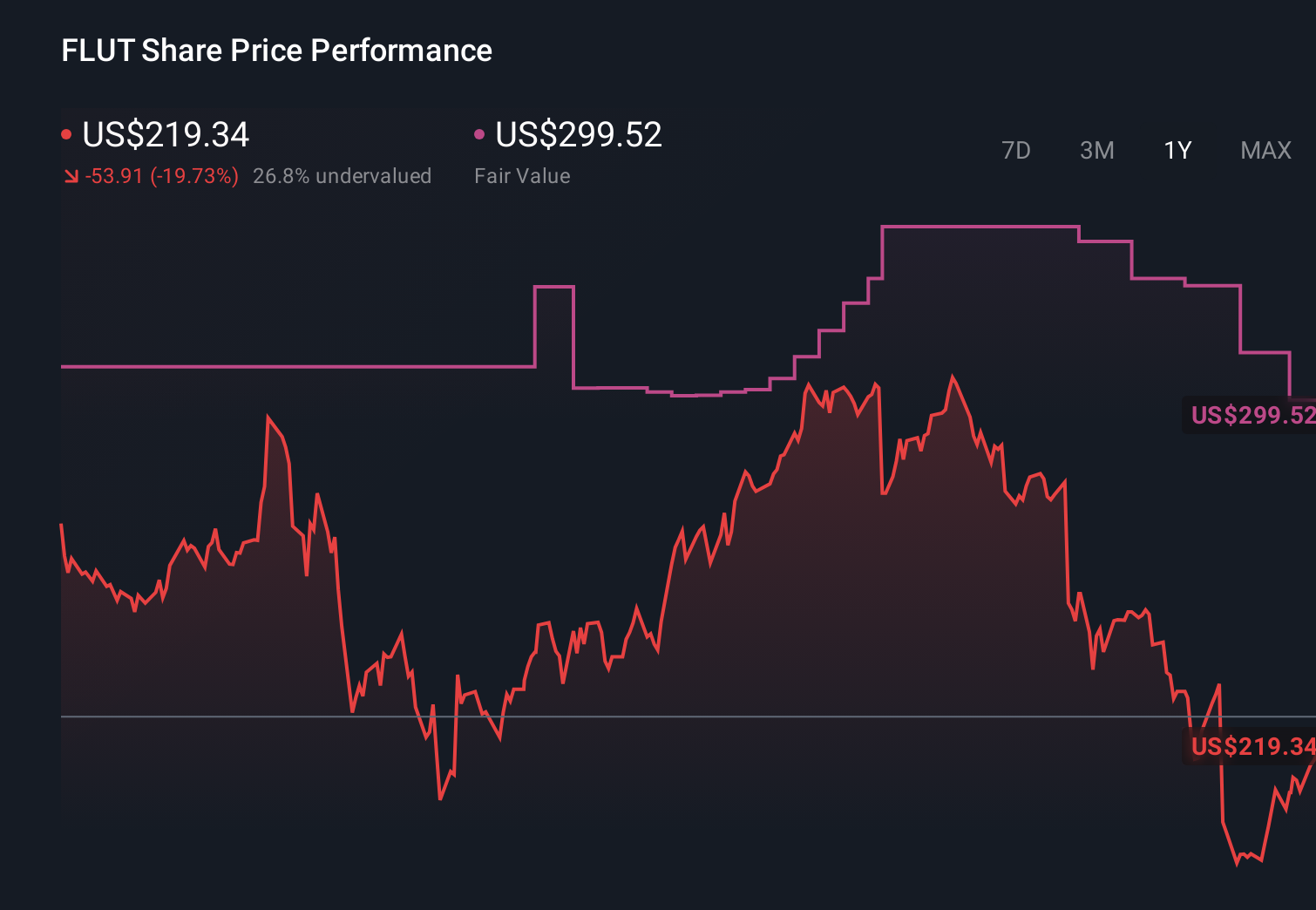

- Flutter Entertainment (FLUT) fell 11.46%.

- Constellation Brands (STZ) declined 8.04% after the company announced Nicholas Fink will become CEO in April 2026.

- NVR (NVR) slipped 7.27% following approval of a US$750 million share repurchase program.

Look past the noise – uncover the top narrative that explains what truly matters for NVR’s long-term success.

On The Radar

Earnings from tech, energy and financial names will share the spotlight with fresh signals from inflation and bond markets.

- Semis focus: Analog Devices (ADI) reports Q1 2026 results on Wednesday, highlighting demand trends across industrial and auto chips.

- Travel bellwether: Booking Holdings (BKNG) posts Q4 2025 numbers on Wednesday, giving a read on global travel spending.

- Security and software: Palo Alto Networks (PANW) reports Q2 2026 on Tuesday, updating views on cybersecurity budgets.

- Energy majors: Occidental Petroleum (OXY) and Devon Energy (DVN) report this week, outlining capital plans and cash return priorities.

- Rates backdrop: Softer US CPI and lower 10Y yields keep Fed policy expectations in focus for equity and bond positioning.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

How To Find Stocks That Fit Your Strategy

If you want ideas that go beyond the usual big names, take a few minutes now to scan our solid balance sheet and fundamentals stocks screener (44 results), built around companies with resilient fundamentals and disciplined balance sheets that can anchor a long term portfolio.

Ready to take control of your own ideas list? Use our stock screener to run custom searches that fit your style and set timely alerts so you never miss a potential opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com