The Morning Bull – US Market Morning Update Tuesday, Feb, 17 2026

US stock futures are slightly weaker this morning, with E-mini S&P 500 contracts down about 0.25% and Nasdaq futures off around 0.6%, as investors weigh softer inflation against a cooling growth pulse. The US 10 year Treasury yield is sitting near a 2 and a half month low, which reflects hopes that the Federal Reserve may cut interest rates, something that could lower mortgage and borrowing costs. At the same time, recent payroll and unemployment figures suggest the job market is no longer running hot. The key question now is whether lower borrowing costs can arrive soon enough to support rate sensitive areas such as real estate and utilities, without squeezing economically sensitive sectors such as smaller companies and consumer focused businesses.

If rate swings have you second guessing your holdings, focus on our 82 resilient stocks with low risk scores today.

Top Movers

- Rivian Automotive (RIVN) jumped 26.64% after multiple analyst upgrades, as well as fresh attention on US joint venture talks.

- Coinbase Global (COIN) gained 16.46% following its earnings release and the completion of a US$1.7b buyback.

- Nebius Group (NBIS) rose 9.23% after reporting higher sales and a swing to full year net income.

Is Coinbase Global still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

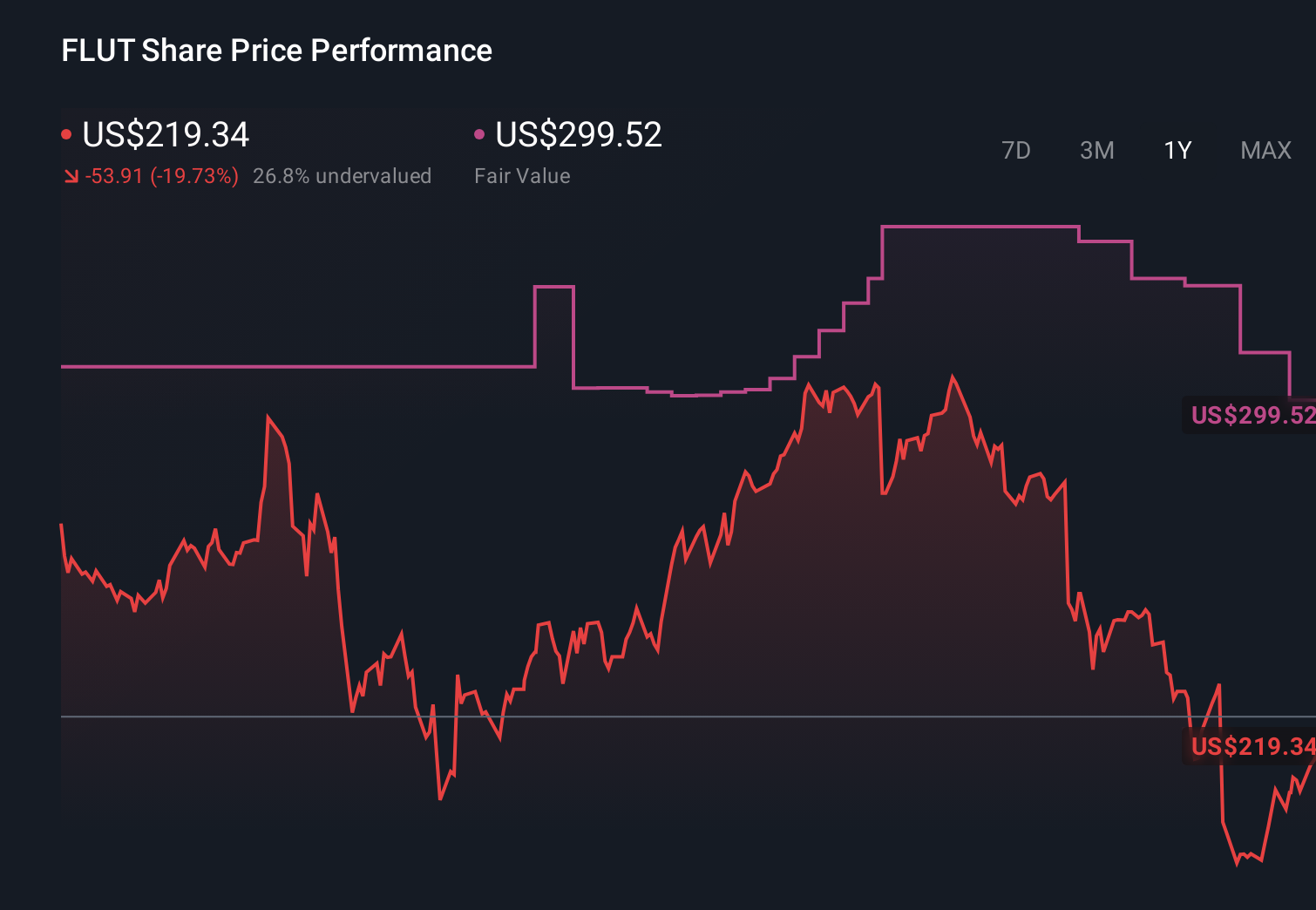

- Flutter Entertainment (FLUT) fell 11.46% after investors reacted to recent trading and liquidity conditions.

- Constellation Brands (STZ) declined 8.04% following announcements about upcoming leadership and governance changes.

- NVR (NVR) slipped 7.27% after UBS reduced its price target for the homebuilder.

Look past the noise – uncover the top narrative that explains what truly matters for Flutter Entertainment’s long-term success.

On The Radar

Earnings will drive the next few sessions, with a spotlight on big box retail, chipmakers, and energy names.

- Retail bellwether: Walmart (WMT) reports Q4 2026 on Thursday, giving a broad read on US consumer spending patterns.

- Semiconductors: Analog Devices (ADI) posts Q1 2026 on Wednesday, highlighting demand trends across industrial and communications customers.

- Online services: Booking Holdings (BKNG) reports Q4 2025 on Wednesday, updating on travel related booking volumes and profitability.

- US energy complex: Occidental Petroleum (OXY) and Devon Energy (DVN) report Q4 2025 today, with investors focused on capital discipline.

- Utilities focus: Southern (SO) and Consolidated Edison (ED) report on Thursday, important for income oriented, rate sensitive portfolios.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

Don’t Wait For The Winners, Find Them

When market moves feel noisy, zero in quickly with our screener containing 24 high quality undiscovered gems, available for a limited-time preview and highlighting companies with strong fundamentals that many investors still overlook.

Ready to take control of your next move? Our stock screener lets you set custom filters, zero in on stocks that fit your style, and set timely alerts so you do not miss fresh opportunities as they appear.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com