Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is a legend in the investing world. Since taking over the failing textile business in 1965, Buffett has given investors nearly 20% returns annually. Put differently, a $100 investment in the company back then would be worth nearly $4.4 million today.

Berkshire’s long track record of success has drawn much attention, which is why investors eagerly track the company’s investment portfolio like a hawk. However, because of the popularity of Berkshire’s investments, the conglomerate occasionally requests confidential treatment when building an equity position so it doesn’t tip off the markets until it’s finished buying.

In the last two quarters of last year, Berkshire Hathway accumulated an estimated $5.3 billion stock position, with investors speculating about what it could be. One company on my short list has earned high praise from Buffett and his longtime partner Charlie Munger and has other connections to Berkshire.

Berkshire bought around $5 billion in one company’s stock last year

In the second quarter, Berkshire reported $23.5 billion in investments in “banks, insurance, and finance.” This amount increased to $27.1 billion by the end of the year, or a $3.6 billion increase. Berkshire also eliminated equity positions in Globe Life and Markel, so the investment is around $5.3 billion.

Another thing we know is that if Berkshire’s ownership stake exceeded 5% of shares outstanding, it would be required to report this to the Securities and Exchange Commission. With this in mind, Berkshire likely invested in a company with a large market capitalization of $100 billion or more, significantly narrowing down the list of potential candidates.

Progressive has earned high praise for Berkshire Hathway’s leaders

One company that could fit the Berkshire Hathaway criteria is Progressive (NYSE: PGR), the second-largest automotive insurer in the U.S. behind State Farm. GEICO, wholly owned by Berkshire Hathaway, rounds out the top three.

When it comes to the automotive insurance industry, Buffett sees it as a two-horse race between Progressive and GEICO. He has said:

I have always thought for a very long time [that] Progressive has been very well run. They have an appetite for growth. Sometimes they copy us. Sometimes we copy them. And I think that will be true five years from now, ten years for now.

Buffett’s right-hand man, the late Charlie Munger, also praised Progressive, saying, “In the nature of things, every once in a while, somebody is a little better at something than we are.”

Progressive’s underwriting advantage

Thanks to its stellar underwriting ability, Progressive has gotten Buffett’s and Munger’s attention over the years. The company has committed to underwriting profitable insurance policies since 1971, when it went public. At the time, it was common to think that insurers should break even on their policies and make their actual returns from their investment portfolios.

CEO Peter Lewis bucked the trend then and prioritized achieving a combined ratio of 96, meaning the company would earn $4 of profit for every $100 in premiums written. This goal has been core to Progressive’s disciplined underwriting and is a big reason for the stock’s long-term outperformance.

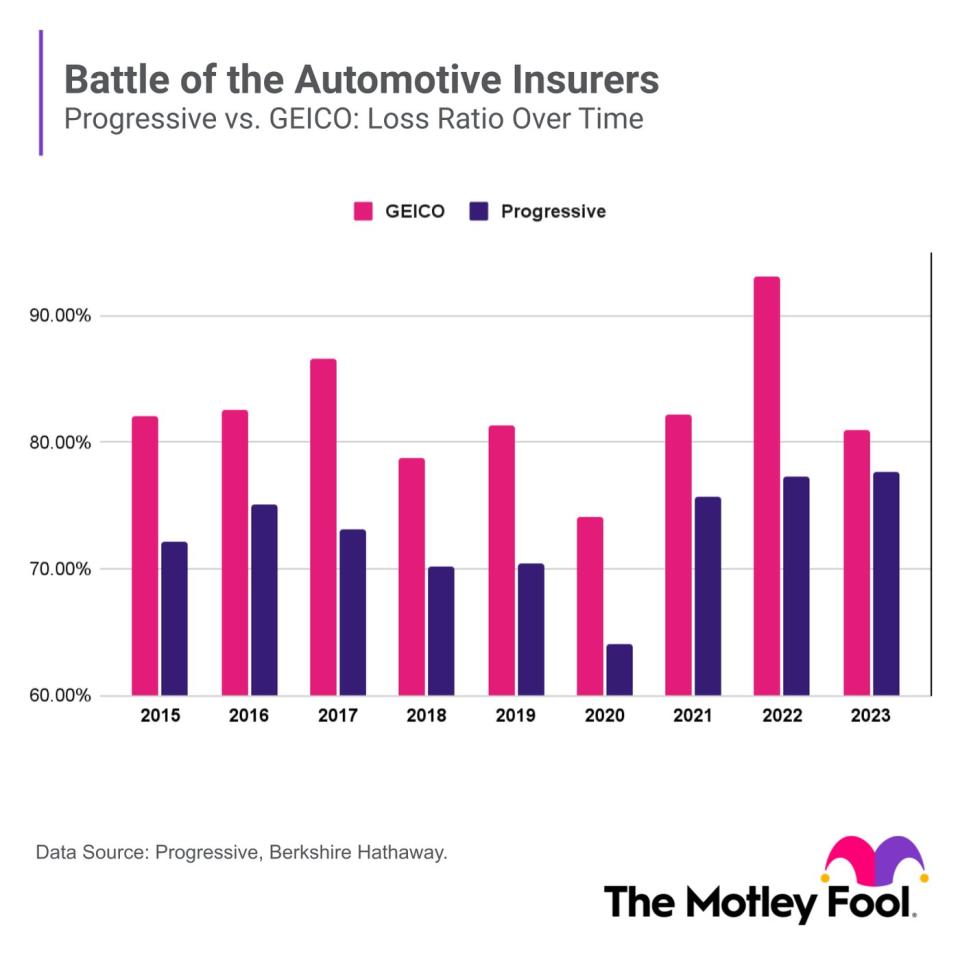

One way to assess Progressive’s stellar performance is to examine its loss ratio. This is one component of the combined ratio and the ratio of losses to premiums earned. Over the last nine years, Progressive’s loss ratio has averaged 73%, an excellent number in the highly competitive auto insurance industry. GEICO, also a solid underwriter, averaged 82% over that period.

Berkshire’s other connection to Progressive

Progressive could also be a candidate for Berkshire Hathaway because of Todd Combs’s connection to the insurer. Combs works alongside Ted Weschler to help manage Berkshire’s investment portfolio with Buffett. Combs worked at Progressive as a pricing analyst in the late ’90s and is quite familiar with the company.

During an interview on the “Art of Investing” podcast, Combs recounted talking to Buffett in 2010 before being offered a job at Berkshire Hathaway. Buffett asked Combs his opinion on Progressive vs. GEICO, and Combs told him that GEICO excelled at marketing and branding, but Progressive’s focus on data would drive its long-term success. Combs was right about Progressive’s data advantage — the stock has crushed it over the past few decades.

A quality company for long-term investors

Berkshire Hathaway has long had its eye on Progressive as a competitor, and the conglomerate may have seen an excellent opportunity to scoop up the insurer at the end of last year. Progressive continued its profitable underwriting streak, maintaining an annual combined ratio below 96 for the 23rd consecutive year. The stock has climbed 28% since the start of the year.

We won’t know if Berkshire is buying Progressive until its 13-F filing for the first quarter is made available in mid-May, assuming it’s not marked as confidential again. Regardless, Progressive has been an excellent stock for long-term investors. Even if Berkshire isn’t buying it, it can make a solid addition to your portfolio today.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Berkshire Hathaway and Markel Group. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

Could This Be The Mystery Stock Billionaire Warren Buffett Has Been Adding to Berkshire Hathaway’s Portfolio? was originally published by The Motley Fool