Today, semiconductor giant Nvidia (NASDAQ: NVDA) is a tremendous company worth over $1.7 trillion. Those who bought and held shares many years back are very wealthy today.

But thinking that you’ve missed the boat because you were late can be a costly mistake. You could have invested $10,000 in Nvidia just five years ago and still be sitting on $195,000 in gains today.

Nobody knew five years ago that artificial intelligence (AI) would impact Nvidia as it has, but that’s the thing with great companies — fortune tends to find them. The cycle repeats. There are investors right now thinking they’ve missed out on Nvidia. But as you’ll see below, that’s not necessarily true.

Here is why.

Nvidia is cornering the AI chip market

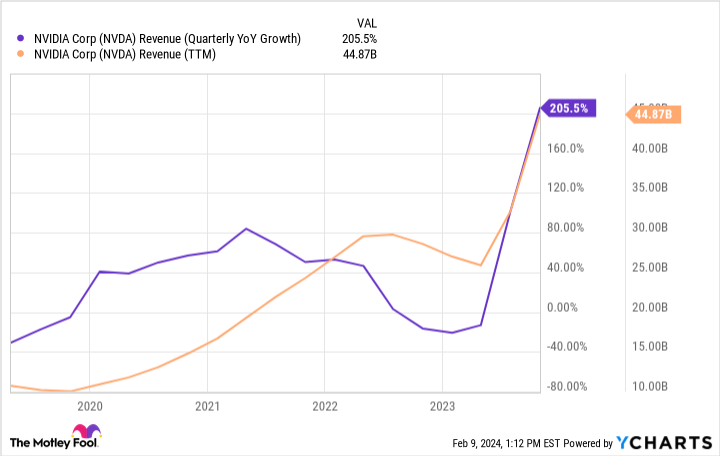

It’s becoming increasingly clear that Nvidia is dominating the AI chip market. It’s become widely known how the company jumped out to a quick lead, illustrated by exploding growth that began several quarters ago. Industry analysts estimate that Nvidia’s early market share is between 80% and 95%. The technology sector’s most prominent companies, including Amazon, Microsoft, Tesla, and Meta Platforms, flocked to the company’s flagship H100 and H200 series AI chips.

Naturally, these companies, which are buying tens and hundreds of thousands of chips, may try to develop their own chips to save money and optimize their hardware for their own use. It looks like Nvidia is staying proactive here, which should be music to investors’ ears.

According to a report by Reuters, Nvidia will establish a new business unit for custom AI chips. As companies look for alternatives to Nvidia’s standardized AI chips, it potentially opens the door for competitors that can help create these custom chip designs. Nvidia’s custom chip unit will try to prevent market share leakage by working with customers looking for alternatives to Nvidia’s standardized chip products. Custom chips are predicted to be a $30 billion niche in the AI chip space.

Could Nvidia still be cheap?

Things can move fast in the stock market. Nvidia, which trades at over $720 per share, was only $200 a year ago. As you saw in the graph above, the company’s growth spurt justified Nvidia’s meteoric rise. However, investors must carefully weigh Nvidia stock’s future potential versus its price tag.

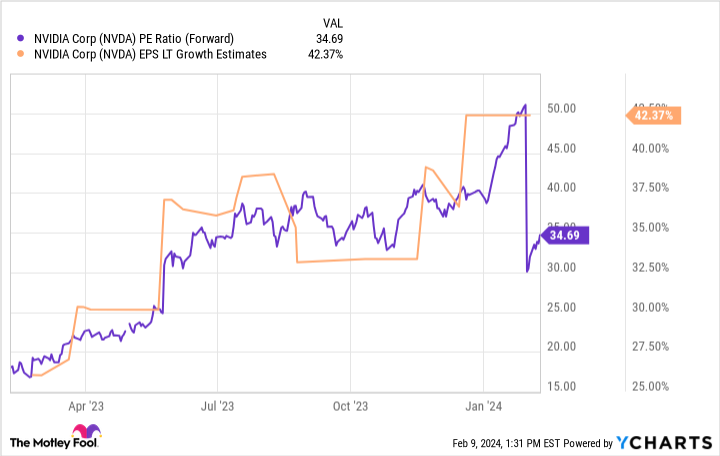

As the calendar turns over, Nvidia’s stock is pricing in the next fiscal year’s earnings. Shares trade roughly 35 times its estimated earnings for the year ending January 2025. Remarkably, analysts’ long-term growth estimates signal the stock is still arguably cheap on a forward-looking basis. That’s a price/earnings-to-growth (PEG) ratio under 1.

On the other hand, analysts have set a very high bar, and coming up short could cause a painful contraction in the stock price. In other words, the stock is a riskier investment today than a year ago because expectations are higher.

How investors should approach Nvidia stock

Time is a superpower for individual investors who don’t need to meet quarterly performance quotas for their clients like hedge fund managers do. Naturally, a stock that has risen as much as Nvidia could easily see a pullback. But given the overwhelming evidence of Nvidia’s AI dominance, now and moving forward, it may be unwise to avoid the stock altogether, holding out for a price that may never come.

That’s why investors should dollar-cost average into Nvidia stock. Buying a little at a time will help investors build a position at various price points, automatically averaging down if the stock does take a fall. Plus, holding Nvidia with a multiyear time frame in mind will increase the odds that investors realize the company’s long-term growth as investment returns.

It’s much easier to imagine Nvidia being a much bigger company 10 years from now than to guess Nvidia’s quarterly results and the market’s reaction to them. Playing the long game will help investors get more out of the stock, especially as Nvidia’s new-found growth opens up potential share repurchases and dividend growth over the coming years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

If You Invested $10,000 in Nvidia in 2019, This Is How Much You Would Have Today was originally published by The Motley Fool