Two of the most closely followed investors on Wall Street are Warren Buffett and Cathie Wood. But the two don’t share much in common.

Buffett has made billions sticking to a relatively simple investing strategy — seeking companies that generate strong, consistent cash flow and build best-in-breed brands. Much of the portfolio of Buffett’s Berkshire Hathaway is concentrated in sectors like consumer goods, financial services, telecommunications, and energy. On the other hand, Wood’s Ark Invest portfolio is comprised of growth stocks in emerging areas such as artificial intelligence (AI), genomics, and crypto.

Despite very different approaches to investing, Wood and Buffett both own “Magnificent Seven” stock Amazon (NASDAQ: AMZN). While the company is best-known for its online store, Amazon is also home to a leading cloud computing operation, and is even beginning to make inroads in streaming, entertainment, and advertising.

With the stock up over 70% in the last year, one analyst on Wall Street sees much more room for growth. Mark Mahaney of Evercore ISI has a price target of $220 for Amazon stock, representing about 26% upside from Thursday’s closing price.

Let’s dig into Amazon’s business and get an understanding of how the company has been able to attract two of the most prominent investors on Wall Street, and why there could be a lot more room for it to run.

How much Amazon stock do Wood and Buffett own?

While Wood’s and Buffett’s portfolios both hold Amazon stock, it’s important for investors to understand that it is a relatively small position for both investors.

Buffett owns about $1.5 billion of Amazon stock, which represents only about 0.44% of Berkshire’s total portfolio. Similarly, Wood’s position in Amazon is in only one of her exchange-traded funds, and the company represents just 0.06% of the fund.

I wouldn’t get caught up in the details of Amazon’s weighting relative to other holdings for either investor. Wood likely views Amazon as a hedge to some of her other technology investments in smaller businesses. Meanwhile, the Oracle of Omaha has long avoided the technology sector in general and so it’s not entirely surprising to see only a small allocation in a business like Amazon.

AI could boost Amazon’s entire business

One thing that makes Amazon so unique is that the company operates across a wide spectrum of end markets. E-commerce and cloud computing are the company’s primary growth drivers. However, its Amazon Prime subscription service provides customers with access to media such as movies and television shows, and its $47 billion advertising business is quickly becoming a major force in the company’s ecosystem.

Providing investors with a deep level of diversification is only part of the value proposition for Amazon. On a deeper level, advancements in AI have the ability to fuel growth across Amazon’s entire business. The company’s multibillion-dollar investment in OpenAI competitor Anthropic back in September could be the key to unlocking new synergies in Amazon Web Services (AWS). Moreover, use cases surrounding generative AI are exploding, and have the potential to bring Amazon’s e-commerce and advertising segments to a new level.

Amazon stock has room to run

Mahaney’s bullish stance on Amazon does not hinge just on the company’s ability to generate strong revenue. Rather, the investments that Amazon is making across its platform should lead to significant margin expansion in the long run. As such, the company should be able to generate robust, sustained cash flow that it can use to reinvest in other growth areas.

As AI becomes a pillar for the next phase of evolution for Amazon, I agree with Mahaney’s take that a return to revenue and cash flow acceleration looks achievable.

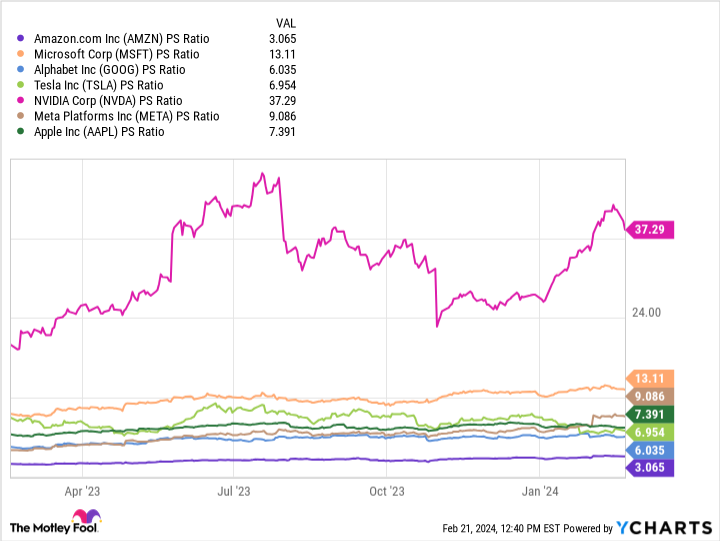

It seems that investors may be underappreciating Amazon’s potential to emerge as a leader in AI. At a price-to-sales multiple of just 3.1, Amazon stock trades at the biggest discount based on this measure among the Magnificent Seven. Investors have an opportunity to scoop up shares at a steep discount relative to Amazon’s megacap peers.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Cathie Wood and Warren Buffett Each Own This Artificial Intelligence (AI) Stock. 1 Wall Street Analyst Thinks It Could Surge by 26%. was originally published by The Motley Fool