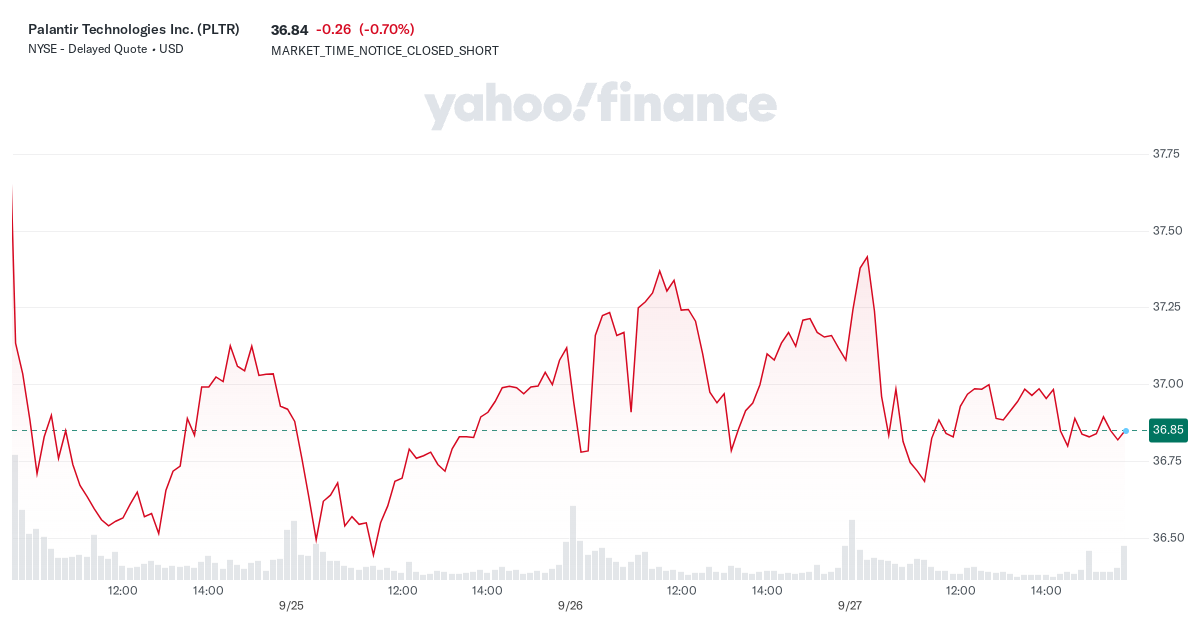

NYSE – Delayed Quote • USD

At close: September 27 at 4:00 PM EDT

After hours: September 27 at 8:00 PM EDT

- Previous Close

37.10 - Open

36.91 - Bid 36.83 x 1100

- Ask 36.86 x 1800

- Day’s Range

36.59 – 37.47 - 52 Week Range

14.48 – 38.19 - Volume

42,898,602 - Avg. Volume

58,732,338 - Market Cap (intraday)

82.501B - Beta (5Y Monthly) 2.71

- PE Ratio (TTM)

216.71 - EPS (TTM)

0.17 - Earnings Date Oct 31, 2024 – Nov 4, 2024

- Forward Dividend & Yield —

- Ex-Dividend Date —

- 1y Target Est

27.38

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally. The company provides Palantir Gotham, a software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. It also offers Palantir Foundry, a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place. In addition, it provides Palantir Apollo, a software that delivers software and updates across the business, as well as enables customers to deploy their software virtually in any environment; and Palantir Artificial Intelligence Platform (AIP) that provides unified access to open-source, self-hosted, and commercial large language models (LLM) that can transform structured and unstructured data into LLM-understandable objects and can turn organizations’ actions and processes into tools for humans and LLM-driven agents. The company was incorporated in 2003 and is headquartered in Denver, Colorado.

3,661

Full Time Employees

December 31

Fiscal Year Ends

Trailing total returns as of 9/27/2024, which may include dividends or other distributions. Benchmark is .

YTD Return

1-Year Return

3-Year Return

5-Year Return

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Valuation Measures

As of 9/27/2024

-

Market Cap

82.50B

-

Enterprise Value

78.76B

-

Trailing P/E

216.71

-

Forward P/E

87.72

-

PEG Ratio (5yr expected)

1.90

-

Price/Sales (ttm)

35.30

-

Price/Book (mrq)

20.37

-

Enterprise Value/Revenue

31.77

-

Enterprise Value/EBITDA

176.71

Financial Highlights

Profitability and Income Statement

-

Profit Margin

16.32%

-

Return on Assets (ttm)

3.98%

-

Return on Equity (ttm)

11.49%

-

Revenue (ttm)

2.48B

-

Net Income Avi to Common (ttm)

404.55M

-

Diluted EPS (ttm)

0.17

Balance Sheet and Cash Flow

-

Total Cash (mrq)

4B

-

Total Debt/Equity (mrq)

6.25%

-

Levered Free Cash Flow (ttm)

543.77M