The United Kingdom’s stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery and its impact on commodity-linked companies. In this environment, identifying high-growth tech stocks in the UK requires a focus on companies that can demonstrate resilience and innovation amidst broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

STV Group |

13.15% |

46.78% |

★★★★★☆ |

|

Gaming Realms |

11.57% |

22.07% |

★★★★★☆ |

|

YouGov |

14.29% |

29.79% |

★★★★★☆ |

|

Facilities by ADF |

52.00% |

144.70% |

★★★★★☆ |

|

Redcentric |

4.89% |

63.79% |

★★★★★☆ |

|

Windar Photonics |

63.60% |

126.92% |

★★★★★☆ |

|

LungLife AI |

100.61% |

100.97% |

★★★★★☆ |

|

Beeks Financial Cloud Group |

24.63% |

57.95% |

★★★★★☆ |

|

Oxford Biomedica |

20.98% |

106.13% |

★★★★★☆ |

|

Vinanz |

113.60% |

125.86% |

★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Keywords Studios

Simply Wall St Growth Rating: ★★★★☆☆

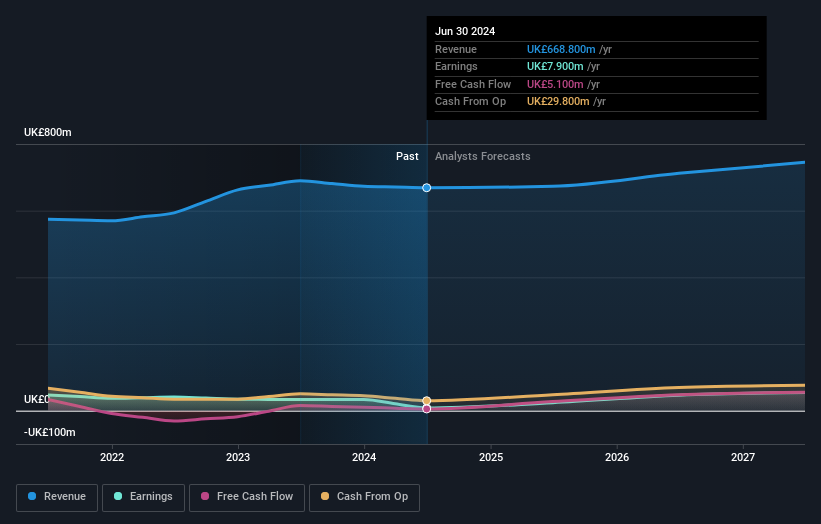

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market capitalization of £1.96 billion.

Operations: With a focus on the video game industry, Keywords Studios generates revenue through its three main segments: Create (€365.56 million), Engage (€180.43 million), and Globalize (€261.61 million).

Despite facing a net loss this year, Keywords Studios is showing promising signs of growth with its revenue expected to climb by 10.2% annually, outpacing the UK market’s average of 3.7%. This growth comes amidst significant R&D investments, which are crucial as the company aims to pivot more profoundly into high-value segments like player engagement solutions demonstrated at recent industry conferences. However, profitability remains a challenge with earnings projected to surge by 59.1% annually over the next three years, signaling potential for recovery and market adaptation. The firm’s engagement in extensive R&D (figures not specified) underlines its commitment to innovation and securing a competitive edge in the evolving tech landscape.

-

Take a closer look at Keywords Studios’ potential here in our health report.

-

Explore historical data to track Keywords Studios’ performance over time in our Past section.

Redcentric

Simply Wall St Growth Rating: ★★★★★☆

Overview: Redcentric plc is a UK-based company that delivers IT managed services to both public and private sectors, with a market capitalization of £208.28 million.

Operations: Redcentric plc generates revenue primarily through the provision of managed IT services, amounting to £163.15 million. The company focuses on serving both public and private sector clients within the UK.

Redcentric plc, amidst a challenging fiscal landscape with a net loss of GBP 3.44 million, still projects an encouraging revenue growth of 4.9% annually, outstripping the UK market average of 3.7%. This growth trajectory is bolstered by strategic R&D investments aimed at enhancing service offerings and efficiency; notably, its R&D expenses have surged to support these initiatives. The recent board changes, including appointing Richard McGuire as chairman, signal a fresh strategic direction which could further influence its market positioning and future profitability forecasts.

-

Unlock comprehensive insights into our analysis of Redcentric stock in this health report.

-

Understand Redcentric’s track record by examining our Past report.

Genus

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.35 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, with contributions of £314.90 million and £352.50 million, respectively.

Despite a challenging year with a substantial one-off loss of £47.4 million, Genus plc remains poised for significant growth, with earnings projected to surge by 39.4% annually. This optimistic outlook is underpinned by strategic R&D investments which have notably increased, reflecting the company’s commitment to innovation and market competitiveness. Moreover, Genus’s revenue growth forecast at 4.1% per year outpaces the UK market prediction of 3.7%, showcasing its potential resilience and adaptability in the high-growth tech sector of the UK economy.

-

Click here to discover the nuances of Genus with our detailed analytical health report.

-

Gain insights into Genus’ past trends and performance with our Past report.

Make It Happen

-

Gain an insight into the universe of 46 UK High Growth Tech and AI Stocks by clicking here.

-

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

-

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:KWS AIM:RCN and LSE:GNS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com