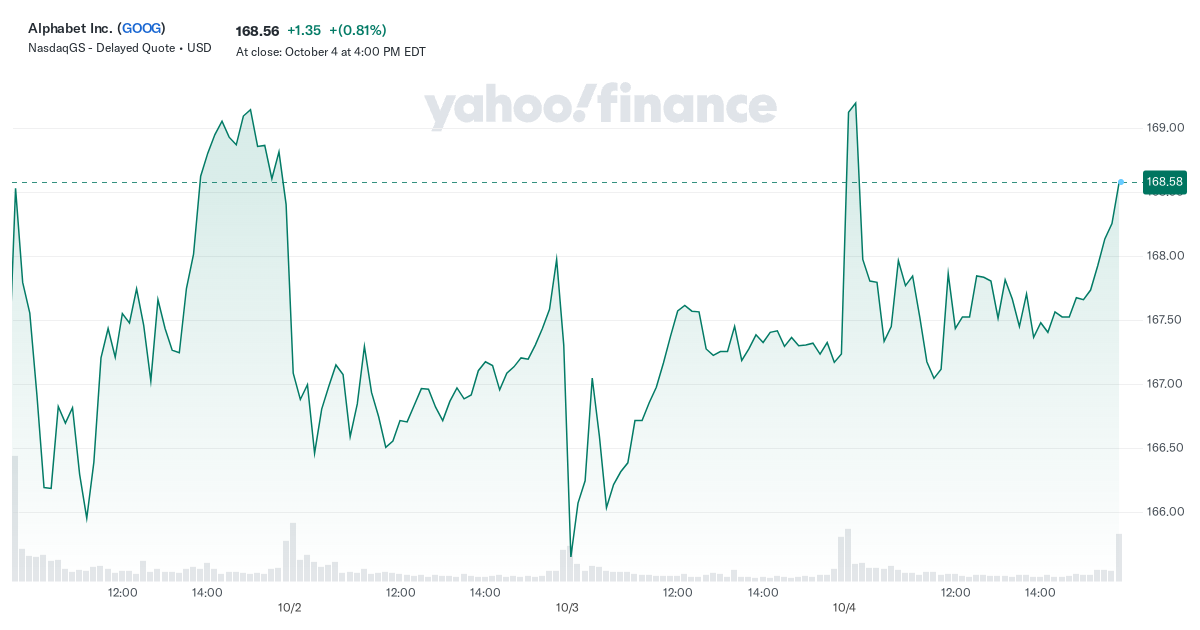

NasdaqGS – Nasdaq Real Time Price USD

At close: October 4 at 4:00 PM EDT

After hours: October 4 at 7:59 PM EDT

- Previous Close

167.21 - Open

169.20 - Bid 160.63 x 100

- Ask 177.66 x 100

- Day’s Range

166.96 – 169.55 - 52 Week Range

121.46 – 193.31 - Volume

11,435,318 - Avg. Volume

17,828,470 - Market Cap (intraday)

2.065T - Beta (5Y Monthly) 1.04

- PE Ratio (TTM)

24.15 - EPS (TTM)

6.98 - Earnings Date Oct 22, 2024 – Oct 28, 2024

- Forward Dividend & Yield 0.80 (0.47%)

- Ex-Dividend Date Sep 9, 2024

- 1y Target Est

200.15

Alphabet Inc. offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. It is also involved in the sale of apps and in-app purchases and digital content in the Google Play and YouTube; and devices, as well as in the provision of YouTube consumer subscription services. The Google Cloud segment offers infrastructure, cybersecurity, databases, analytics, AI, and other services; Google Workspace that include cloud-based communication and collaboration tools for enterprises, such as Gmail, Docs, Drive, Calendar, and Meet; and other services for enterprise customers. The Other Bets segment sells healthcare-related and internet services. The company was incorporated in 1998 and is headquartered in Mountain View, California.

179,582

Full Time Employees

December 31

Fiscal Year Ends

Trailing total returns as of 10/4/2024, which may include dividends or other distributions. Benchmark is .

YTD Return

1-Year Return

3-Year Return

5-Year Return

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Valuation Measures

As of 10/4/2024

-

Market Cap

2.06T

-

Enterprise Value

1.99T

-

Trailing P/E

24.18

-

Forward P/E

19.23

-

PEG Ratio (5yr expected)

1.14

-

Price/Sales (ttm)

6.46

-

Price/Book (mrq)

6.90

-

Enterprise Value/Revenue

6.07

-

Enterprise Value/EBITDA

17.26

Financial Highlights

Profitability and Income Statement

-

Profit Margin

26.70%

-

Return on Assets (ttm)

15.96%

-

Return on Equity (ttm)

30.87%

-

Revenue (ttm)

328.28B

-

Net Income Avi to Common (ttm)

87.66B

-

Diluted EPS (ttm)

6.98

Balance Sheet and Cash Flow

-

Total Cash (mrq)

100.72B

-

Total Debt/Equity (mrq)

9.55%

-

Levered Free Cash Flow (ttm)

43.99B