Meta Platforms’ impressive surge on the stock market could encourage management to split the stock.

Shares of Meta Platforms (META 1.39%) have enjoyed a remarkable run on the market in the past year, surging 85% on the back of impressive growth in its revenue and earnings. There is a good chance that this technology giant’s stock could continue running higher thanks to the strength in the digital ad market where it appears to be gaining a bigger share.

For investors interested in the stock who don’t have access to fractional share purchases, this Meta price runup has created an issue. Each share is now trading just a shade under $585. To address higher share prices, all of Meta’s Magnificent Seven peers executed stock splits in the recent past.

Will the social media giant join this bandwagon to help out interested retail investors? Let’s find out.

Is a stock split going to matter?

Meta Platforms is the only company among the Magnificent Seven that has never executed a splitting of its stock. The company went public at just over $38 per share back in May 2012, and it has delivered outsized gains to investors since then.

It is worth noting that a stock split is nothing more than a cosmetic move that doesn’t alter the fundamental value of a company. It simply increases the number of outstanding shares by reducing the price of each share. The market cap doesn’t change. Of course, companies executing a stock split point out that the reduced price of each share following this move will allow a bigger pool of investors to buy the stock, thereby helping the demand for their shares. Smaller share prices also give Meta employees greater control over how they manage their stock compensation options.

If you are an investor with access to fractional shares, a split doesn’t mean all that much and you can still invest in the company with whatever available funds you have. More importantly, now would be a good time to buy Meta Platforms stock irrespective of a split. Let’s look at the reasons why.

Meta Platforms looks like an enticing buy right now

Even though Meta stock has gained impressively in the past year, it is trading at 29.8 times earnings. That’s a slight discount to the Nasdaq-100 index’s earnings multiple of 31.7 (using the index as a proxy for tech stocks). Meta’s forward earnings multiple of 27.4 points toward a nice jump in the company’s earnings and is a solid discount to the Nasdaq-100 index’s forward earnings multiple of 30.

Investors who are looking to add a tech stock to their portfolios will get a good deal on Meta Platforms stock right now. That’s because Meta’s market-share growth in digital advertising is driving robust financial growth.

The company reported $75.5 billion in revenue in the first six months of 2024, an increase of 25% from the same period last year. Its earnings increased at a much stronger pace of 90% during the same period to $9.86 per share. Analysts expect Meta to exit 2024 with almost $162 billion in revenue, which would be a 20% increase over last year. Earnings, meanwhile, are expected to jump by 43% to $21.29 per share.

The good part is that Meta is forecast to clock double-digit growth over the next couple of years as well.

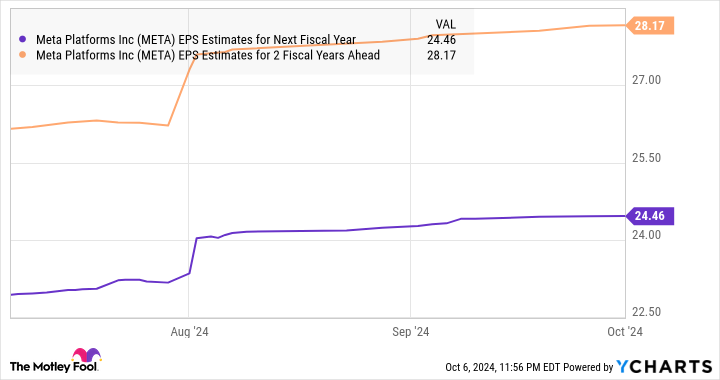

META EPS Estimates for Next Fiscal Year data by YCharts

To put things in perspective, the global digital ad market is set to grow by 12.2% this year, 11.4% in 2025, and 10.4% in 2026, according to eMarketer. Meta’s estimated growth for all three years means that it is set to outperform the market in which it operates. The company has been using artificial intelligence (AI) tools to recommend more relevant content to users to improve engagement and ad performance.

CFO Susan Li remarked on the company’s recent earnings conference call that its AI tools “continue to unlock performance gains, with a study conducted this year demonstrating 22% higher return on ad spend for U.S. advertisers after they adopted Advantage+ Shopping campaigns.”

The improved returns that Meta delivers to advertisers explain why it was able to enact a 10% year-over-year jump in average price per ad in the second quarter. The company also reported a 10% increase in the number of ads delivered. Moreover, a strong daily active user base of 3.27 billion means Meta has a wide reach, and it is able to command more money from advertisers by offering them AI tools to capitalize on its huge user base.

Meta Platforms stock seems set for more upside even after the impressive gains of the past year. Assuming its earnings do hit $28.17 per share in 2026, and it trades at 30 times forward earnings at that time (in line with the Nasdaq-100 index’s forward earnings multiple), its stock price could jump to $845. That would be a 44% increase from current levels.

So, investors are getting a good deal on this tech stock, and they may not want to miss it considering Meta’s growing share of the digital ad space and its application of AI to make a bigger dent in this market.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.