Over the last 7 days, the United Kingdom market has remained flat, yet it has risen by 6.5% over the past 12 months with earnings forecasted to grow by 14% annually. In this context of steady growth and promising earnings potential, identifying strong dividend stocks like Livermore Investments Group can be an effective strategy for investors seeking reliable income streams amidst evolving market conditions.

Top 10 Dividend Stocks In The United Kingdom

|

Name |

Dividend Yield |

Dividend Rating |

|

James Latham (AIM:LTHM) |

5.71% |

★★★★★★ |

|

4imprint Group (LSE:FOUR) |

3.11% |

★★★★★☆ |

|

OSB Group (LSE:OSB) |

8.45% |

★★★★★☆ |

|

Impax Asset Management Group (AIM:IPX) |

6.72% |

★★★★★☆ |

|

Dunelm Group (LSE:DNLM) |

6.59% |

★★★★★☆ |

|

Man Group (LSE:EMG) |

6.04% |

★★★★★☆ |

|

Plus500 (LSE:PLUS) |

5.94% |

★★★★★☆ |

|

DCC (LSE:DCC) |

3.90% |

★★★★★☆ |

|

Big Yellow Group (LSE:BYG) |

3.70% |

★★★★★☆ |

|

Grafton Group (LSE:GFTU) |

3.53% |

★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Here’s a peek at a few of the choices from the screener.

Livermore Investments Group

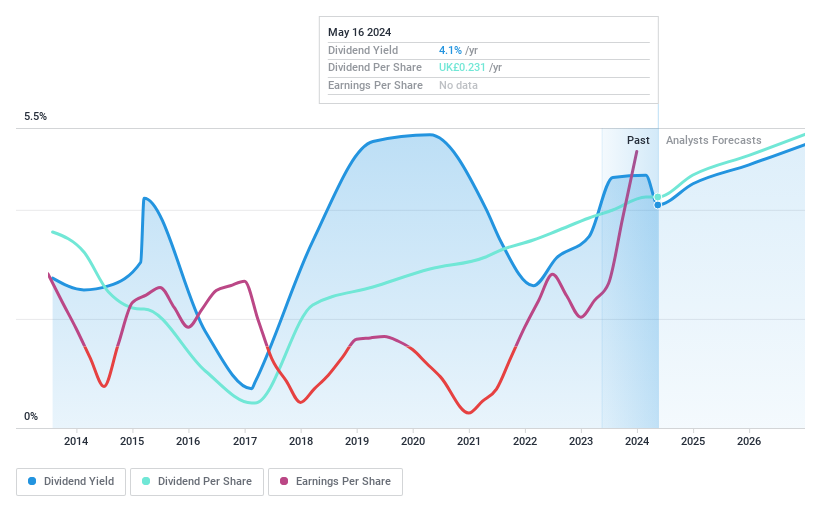

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £77.72 million.

Operations: Livermore Investments Group Limited generates revenue from its Equity and Debt Instruments Investment Activities, amounting to $23.75 million.

Dividend Yield: 7.0%

Livermore Investments Group recently declared an interim dividend of US$0.0423 per share, payable in November 2024, supported by a significant earnings increase to US$9.67 million for the half year ending June 30, 2024. Despite its attractive dividend yield of 7.04% and a low price-to-earnings ratio of 5.1x, Livermore’s dividends have been unreliable and volatile over the past decade, though they are currently well covered by earnings and cash flows with payout ratios of 25.3% and 33%, respectively.

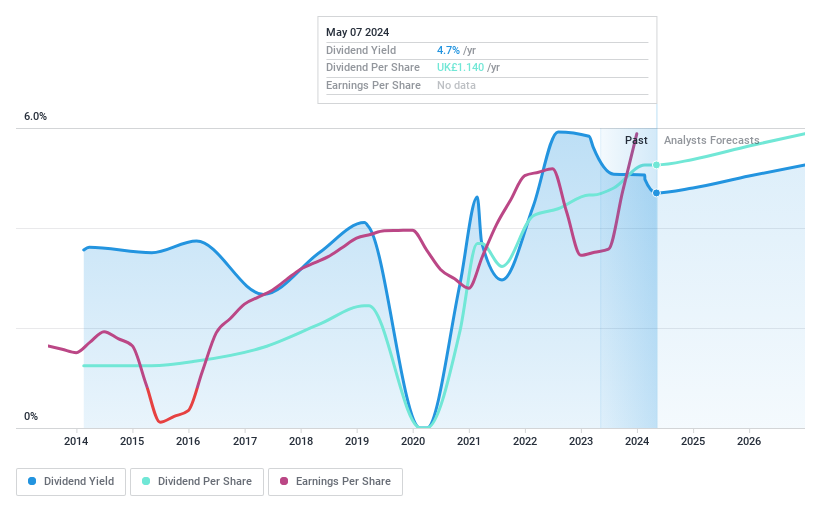

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.46 billion, operates in renewable power generation across the United Kingdom.

Operations: Drax Group’s revenue is primarily derived from its Generation segment (£5.99 billion), followed by Customers (£4.38 billion) and Pellet Production (£878.40 million).

Dividend Yield: 3.7%

Drax Group’s dividends are well-covered by earnings, with a low payout ratio of 14.4%, and cash flows, with a cash payout ratio of 23.1%. Despite this coverage, its dividend history is marked by volatility over the past decade. Recent strategic moves include refinancing £450 million in sustainability-linked credit and launching carbon offset initiatives with Karbon-X Corp., which may enhance long-term sustainability efforts. However, Drax’s dividend yield remains below top-tier UK payers at 3.75%.

Morgan Sindall Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market cap of £1.49 billion.

Operations: Morgan Sindall Group plc’s revenue segments include Fit Out (£1.24 billion), Construction (£1.02 billion), Infrastructure (£989.20 million), Property Services (£191.80 million), Urban Regeneration (£148.40 million), and Partnership Housing (£845.20 million).

Dividend Yield: 3.8%

Morgan Sindall Group’s dividend is well-supported by earnings and cash flows, with payout ratios of 44.7% and 33.4%, respectively. Despite a history of volatility, dividends have grown over the past decade, recently increasing by 15% to £0.415 per share. The yield remains lower than top UK payers at 3.76%. Recent executive changes include Mark Robson joining as a director, bringing strategic and financial expertise from his previous roles at Howden Joinery Group plc and Delta plc.

Taking Advantage

-

Investigate our full lineup of 60 Top UK Dividend Stocks right here.

-

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

-

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LIV LSE:DRX and LSE:MGNS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com