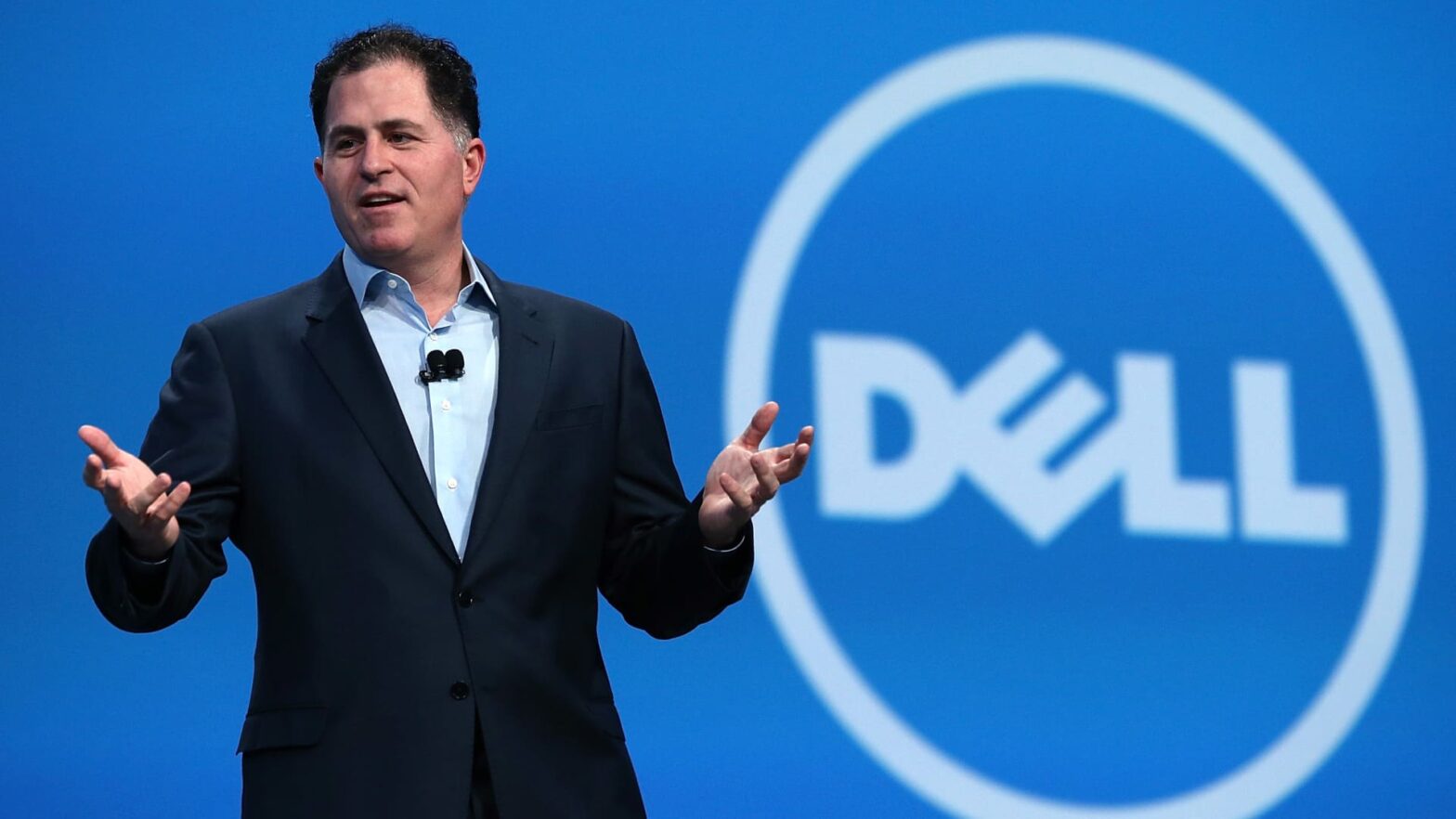

Dell CEO Michael Dell.

Getty Images

Dell is having its best day since founder Michael Dell brought the company back to the stock market in 2018.

Shares of the PC and server manufacturer surged 30% on Friday to $121.88, after the company posted fiscal fourth-quarter results that beat estimates. That tops the stock’s 21% gain from Sept. 1, which followed a better-than-expected earnings report.

For the latest quarter, Dell reported revenue of $22.32 billion, down 11% from the year-ago quarter but eclipsing the $22.16 billion analysts were expecting, according to LSEG, formerly known as Refinitiv. Adjusted earnings per share of $2.20 surpassed analysts’ estimate of $1.73. Dell’s net income of $1.16 billion marked an increase of 89% from its prior fourth quarter.

The company, demonstrating robust demand for its artificial intelligence servers, also said it’s increasing its annual dividend by 20% to $1.78 per share, and expects revenue between $21 billion and $22 billion for the first quarter.

Dell returned to public markets in 2018 after going private in 2013. Its market cap was about $16 billion when it first started trading more than five years ago. It’s now worth close to $86 billion.

Morgan Stanley analysts reinstated Dell as a top pick on Friday and raised their price target to $128 from $100, writing in an investor note that the company’s “AI server commentary stole the show.”

“The strength of AI server orders, backlog, pipeline, and expanding CSP/enterprise customer base show DELL’s AI story is early days and gaining momentum,” they wrote.

Wells Fargo, citing Dell’s AI strength and dividend increase, hiked its price target to $140 and maintained an overweight rating, while Citi increased its target price to $125 and reiterated a buy rating.

— CNBC’s Michael Bloom and Ashley Capoot contributed to this report.

WATCH: Friday’s rapid fire