3 min read 02 Mar 2024, 08:28 AM IST Join us ![]()

Indian stock market: Gift Nifty was trading at a premium of 0.27% around 60.50 points at 22,511.00 level, indicating a positive start for the Indian stock market indices.

Premium

PremiumIndian stock market: The domestic equity indices, Sensex and Nifty 50, are expected to open higher on Saturday tracking positive global market cues.

The Indian equity market will remain open on Saturday, March 2, as the stock exchanges will conduct a special live trading session in the equity and derivatives segments through their disaster recovery site to check the preparedness in case of an emergency.

On Friday, the Indian stock market indices hit their record highs and ended with strong gains buoyed by strong domestic GDP data.

The Sensex jumped 1,245.05 points, or 1.72%, to close at 73,745.35, while the Nifty 50 settled 355.95 points, or 1.62%, higher at 22,338.75.

“We expect ongoing momentum to continue while taking cues from a fresh set of economic data next week. For the next week, sectors to be in focus include auto, on the back of better-than-expected monthly sales numbers. Cement and Metals are also expected to be in focus on the back of stronger economic growth, while defence and solar sector on account of improved order visibility,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd.

Here are key domestic and global market cues for Sensex today:

Gift Nifty Today

Gift Nifty was trading at a premium of 0.27% around 60.50 points at 22,511.00 level, indicating a positive start for the Indian stock market indices.

Foreign institutional investors (FIIs)

FIIs were net buyers in Indian markets as outflows reduced significantly this week amid strong market sentiments with domestic equity benchmarks Nifty 50 touching record highs buoyed by robust macroeconomic indicators.

Even though FIIs were buyers for three out of five sessions this week, yet the net investment value stands at ₹23.51 crore.

Wall Street

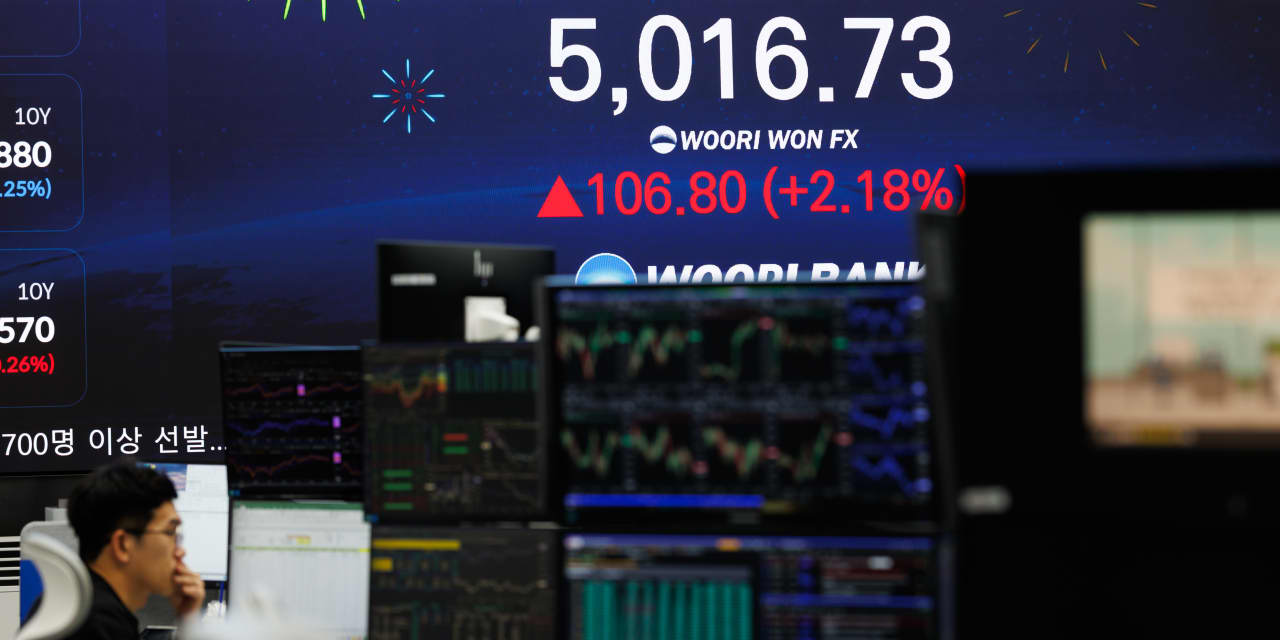

US equities reached all-time highs on Friday as Wall Street concluded another successful week. A fresh surge in technology firms drove the stock market higher as investors went through the statements made by a number of Federal Reserve speakers in search of hints about the direction of interest rates.

One day after reaching a record high, the S&P 500 increased 40.81 points, or 0.8%, to 5,137.08. A rise of 90.99 points, or 0.2%, brought the Dow Jones Industrial Average to 39,087.38. Leading the market were technology companies, while the Nasdaq composite broke its previous high set in 2021 by a day, rising 183.02, or 1.1%, to 16,274.94.

Crude Oil

As traders evaluated new economic data from the US, Europe, and China and anticipated an OPEC+ decision on supply agreements for the second quarter, oil prices increased by 2% on Friday and recorded weekly gains, according to a report by Reuters.

At $83.55 a barrel, Brent futures for May ended the day 1.64 higher, or 2%, higher. At $83.62 a barrel on February 29, the April Brent futures contract came to an end.

A barrel of US West Texas Intermediate (WTI) for April increased by $1.71, or 2.19%, to $79.97.

Dollar Index

Friday saw a -0.25% decline in the dollar index. Friday saw the dollar retreat from a one and a half-week high and record modest losses due to less positive than anticipated U.S. economic data on February ISM manufacturing, January construction spending, and February consumer confidence from the University of Michigan in the US. Tradingview.com reports that the dollar was also negatively impacted by a drop in T-note rates on Friday.

Also Read: Nifty 50, Sensex today: What to expect from Indian stock market in trade on March 2

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint. Check all the latest action on Budget 2024 here. Download The Mint News App to get Daily Market Updates.

Published: 02 Mar 2024, 08:28 AM IST

Next Story ![]()