In the current global market, while most major stock indexes have seen declines, the technology-heavy Nasdaq Composite has managed to hit a record high, highlighting the resilience of growth stocks amidst broader economic challenges. With small-cap stocks underperforming and expectations rising for a Federal Reserve rate cut, identifying promising tech stocks requires careful consideration of their growth potential and adaptability in an evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1248 stocks from our High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Aerospace CH UAVLtd (SZSE:002389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aerospace CH UAV Co., Ltd focuses on the research, development, production, maintenance, and sale of aviation and spacecraft equipment with a market cap of CN¥18.70 billion.

Operations: Aerospace CH UAV Co., Ltd generates revenue primarily through the production and sale of aviation and spacecraft equipment. The company is involved in various stages of product development, including research, manufacturing, and maintenance.

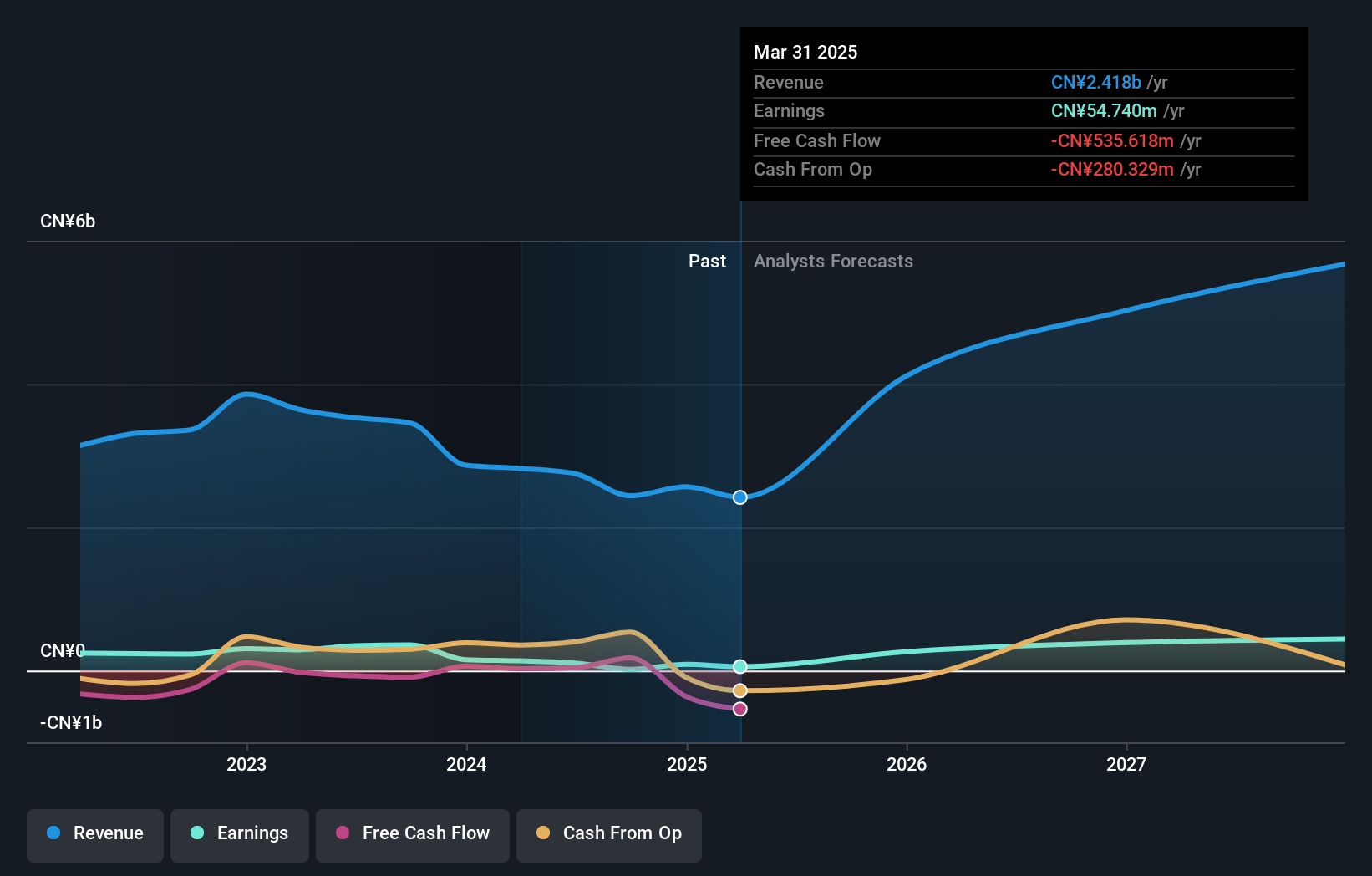

Aerospace CH UAVLtd, despite a challenging year with a significant one-off loss of CN¥44.9M impacting its financials, is poised for robust growth with expected annual revenue and earnings increases of 29.1% and 59.6%, respectively—outpacing the broader CN market averages. This growth trajectory is supported by substantial R&D investment, crucial for maintaining technological leadership in the competitive aerospace sector. Recent corporate governance enhancements, including new independent director appointments, signal a strengthened oversight framework which could enhance future operational effectiveness and market confidence.

- Click to explore a detailed breakdown of our findings in Aerospace CH UAVLtd’s health report.

-

Understand Aerospace CH UAVLtd’s track record by examining our Past report.

GNI Group (TSE:2160)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GNI Group Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical drugs both in Japan and internationally, with a market capitalization of ¥153.09 billion.

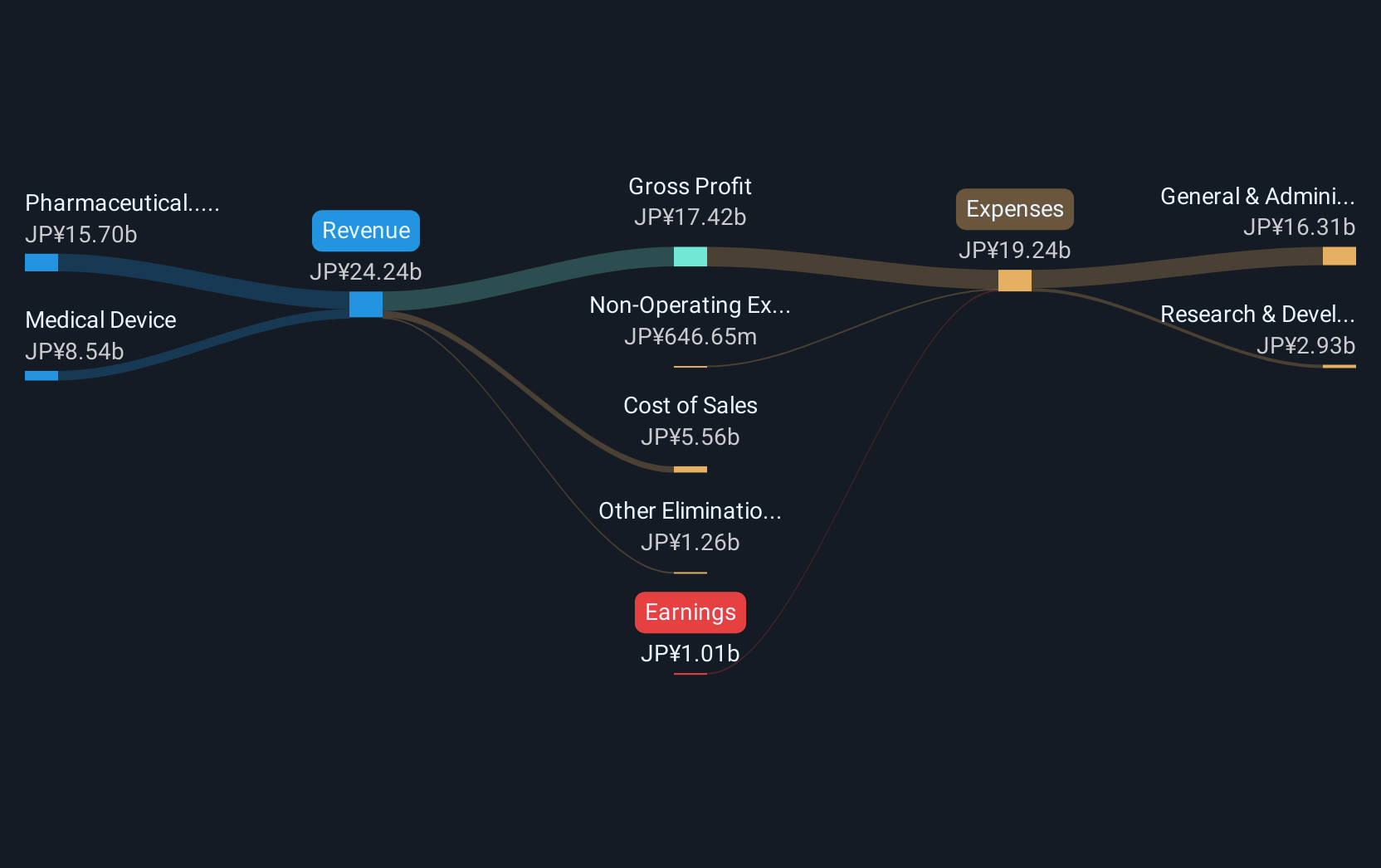

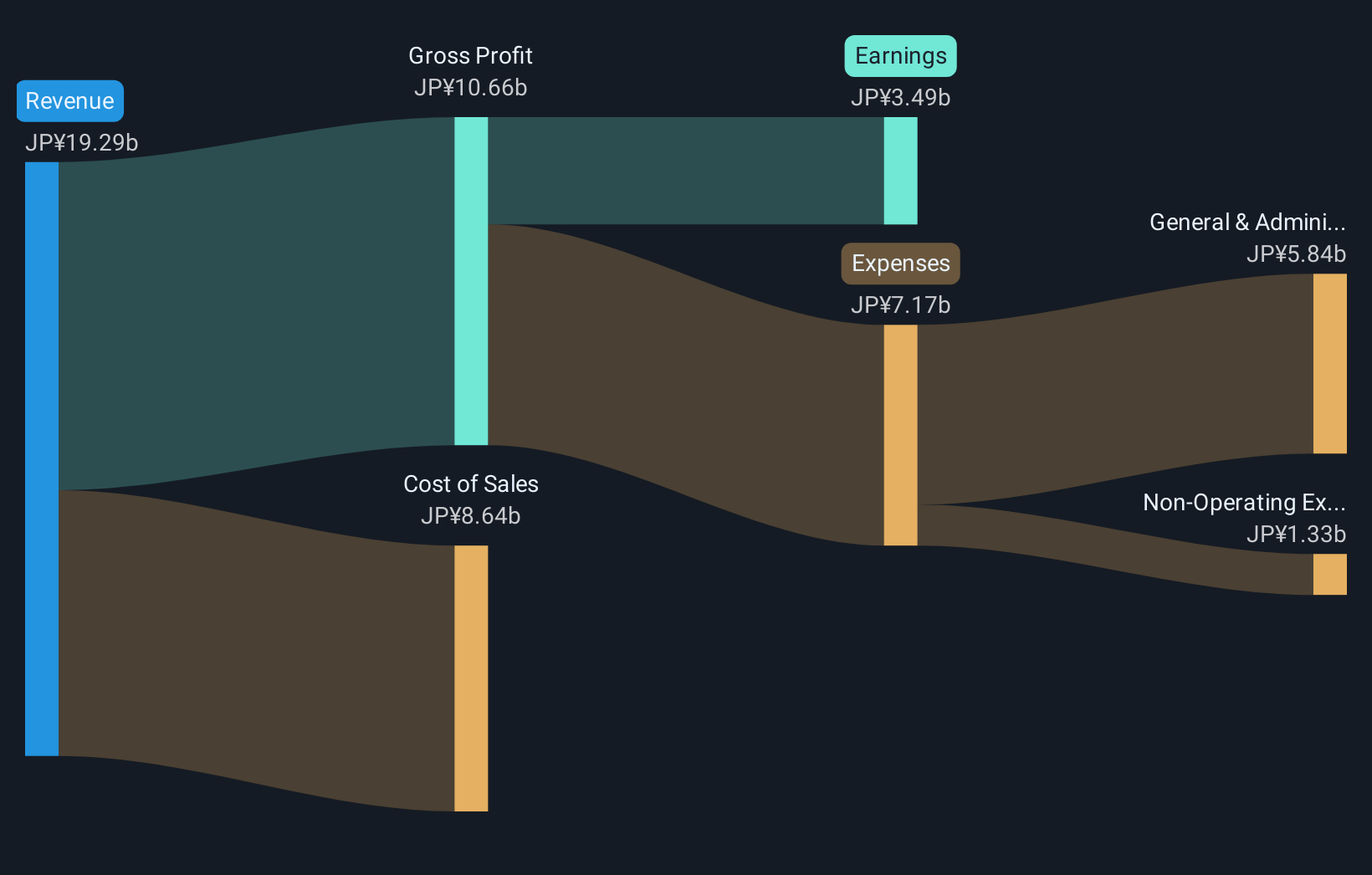

Operations: GNI Group Ltd. generates revenue primarily from its pharmaceutical segment, contributing ¥18.31 billion, while the medical device segment adds ¥4.34 billion to its earnings. The company’s operations are focused on both domestic and international markets in the pharmaceutical industry.

GNI Group has demonstrated robust performance with a remarkable earnings growth of 371.2% over the past year, significantly outstripping the Biotechs industry’s decline of 36.8%. This surge is underpinned by an aggressive R&D strategy, where they allocated substantial resources to innovation—crucial for maintaining competitive advantage in the rapidly evolving biotech landscape. Despite a highly volatile share price recently, GNI’s revenue is expected to grow at 25.7% annually, surpassing the Japanese market average growth of 4.1%. The company’s commitment to reinvesting in its core capabilities while expanding its market reach suggests promising prospects for sustained growth and industry leadership.

- Unlock comprehensive insights into our analysis of GNI Group stock in this health report.

-

Gain insights into GNI Group’s past trends and performance with our Past report.

I’LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I’LL Inc. is a Japanese company specializing in system solutions, with a market capitalization of ¥65.15 billion.

Operations: I’LL Inc. focuses on providing system solutions within Japan, generating revenue primarily through its specialized services in this sector. The company operates with a market capitalization of ¥65.15 billion.

I’LL has been carving out a strong position within the tech sector, evidenced by its impressive annual revenue growth of 9.4%. This performance is bolstered by strategic R&D investments, which have not only fueled innovations but also maintained a competitive edge in a rapidly advancing industry. With earnings expected to rise by 14.6% annually, the company’s focus on developing high-quality software solutions appears to be paying off. Additionally, I’LL’s commitment to reinvesting in core technologies and expanding market reach is reflected in its robust R&D spending, aligning with broader industry trends towards SaaS models and recurring revenue streams. As tech landscapes evolve, I’LL’s proactive approach in both financial health and innovative capacity positions it well for future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of I’LL.

-

Review our historical performance report to gain insights into I’LL’s’s past performance.

Make It Happen

- Gain an insight into the universe of 1248 High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com