Adobe’s stock (ADBE) has seen a notable dip following its recent Q4 and full-year results for Fiscal 2024. This extends a trend of underwhelming performance over the past few years, with shares now trading at the same levels as in June 2020. Investor fears appear to center on concerns about increased competition, a slowdown in growth, and the potential for AI disruption to Adobe’s business model. And yet, Adobe’s recent earnings reveal that the creative software giant is still flourishing, with excellent earnings growth and noteworthy AI integrations improving its industry-leading tools. Given these factors, I remain bullish on the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What Is Fueling Investors’ Fears?

Investors appear increasingly cautious about Adobe’s prospects, likely due to mounting competition from fast-growing players like Canva and Figma. These smaller but serious contenders are gaining ground with their easy-to-use design tools. At the same time, Adobe’s failed attempt to acquire Figma two years ago—blocked by regulatory challenges—has only worsened concerns since then. These concerns definitely make sense. Canva’s simple drag-and-drop tools have made it a favorite for small businesses and non-professionals, chipping away at Adobe’s dominance. At the same time, Figma has become the top choice for collaborative interface design, slowly but surely stepping into Adobe’s space.

Further stoking fears is the rapid advancement of AI. Tools like SORA have showcased capabilities that threaten to disrupt traditional workflows by automating creative tasks, thus challenging the relevance of Adobe’s subscription model. If these worries weren’t enough, Adobe’s guidance for Fiscal 2025 fell short of Wall Street’s expectations, with revenue forecasted between $23.3 billion and $23.55 billion—below the $23.8 billion consensus. Thus, you can see how this mix of competitive pressure and tempered guidance has kept shares under pressure.

Robust Results Challenge the Narrative

Now, despite this rather disappointing narrative, Adobe’s actual performance tells a different story, which supports my bullish outlook on the stock. The company posted excellent Q4 results, achieving a record $5.61 billion in revenue, an 11% year-over-year increase. Each segment contributed significantly to growth. Creative Cloud revenue rose to $3.30 billion, up 10%, while Document Cloud delivered 17% growth, hitting $843 million. The company also saw solid progress in the Digital Experience segment, whose revenues reached $1.4 billion, a 10% uptick.

Interestingly, Adobe’s embrace of AI has been a key driver of this momentum, defying the notion that AI poses a threat to its own business model. The company integrated its Firefly generative AI models across flagship tools, resulting in over 16 billion content generations in Fiscal 2024. For instance, Firefly’s video model, integrated into Premiere Pro, has drawn notable interest, showing Adobe’s capability to innovate within its creative suite.

Further, according to management, tools like the AI Assistant in Acrobat and Reader boosted productivity, allowing users to complete tasks four times faster. With these advancements helping boost the top line and margins remaining elevated, Adobe also ended Fiscal 2024 on a high note regarding its profitability. In particular, the company achieved a record adjusted EPS of $18.42, marking a 14.6% increase year-over-year.

Are Slowdown Fears Overdone?

Let’s turn to concerns over Adobe’s growth deceleration, which, in my view, while understandable, seem overstated. Essentially, management’s Fiscal 2025 revenue outlook implies a year-over-year growth of 8.4% at the midpoint, slower than the 10.8% growth recorded in Fiscal 2024. This could mark the first time in over a decade that Adobe’s growth slips into the single digits. However, there are some notable factors worth considering.

For one, Adobe’s guidance likely reflects a conservative stance in light of the somewhat uncertain industry environment and foreign exchange (FX) headwinds. The latter alone accounted for a $117 million decline in Digital Media ARR. Excluding FX impacts, growth would likely remain in the double digits. Furthermore, while revenue growth may indeed moderate, EPS is still anticipated to grow by more than 11% to $20.43, according to consensus estimates, maintaining double-digit expansion. In the meantime, Wall Street sees continued EPS growth in the double digits for years to come.

In my view, such a strong EPS growth outlook forms a compelling investment case for Adobe stock. Since it is trading at a forward P/E of just over 22, the stock is priced at one of its lowest multiples in a decade. I think this makes it an attractive opportunity for long-term investors who believe in the company’s ability to successfully traverse the AI revolution. So far, it certainly seems like the case.

Is Adobe Stock a Buy or Sell?

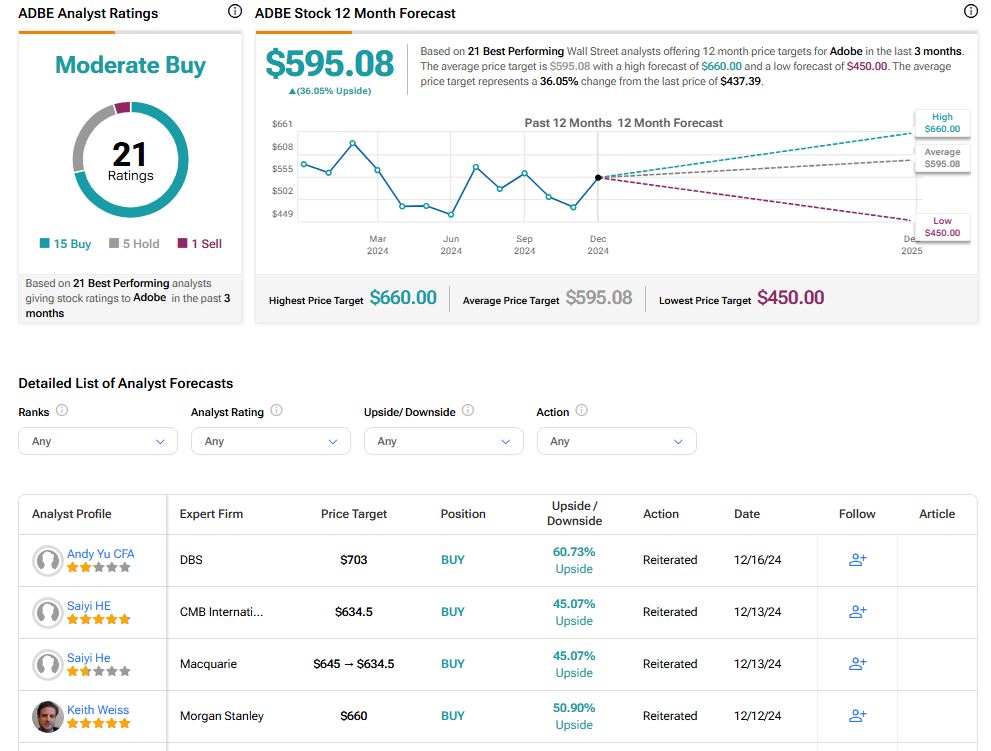

Wall Street analysts appear more optimistic for Adobe from today’s price levels. Specifically, ADBE stock now has a Moderate Buy rating among 26 Wall Street analysts who cover the company. This is based on 20 Buy, five Hold, and one Sell recommendations assigned in the past three months. The average price target for ADBE stock of $595.08 suggests an upside potential of 36.1%.

If you’re unsure which analyst to follow concerning ADBE stock, the most accurate and most profitable analyst (on a one-year timeframe) is Alex Zukin from Wolfe Research, with an average return of 19.60% per rating and a 61% success rate.

Conclusion

Adobe’s recent performance truly reflects its ability to navigate the significant transformations shaping its industry. Despite the challenges of such rapid evolution, the company has achieved impressive growth in key areas while thoughtfully integrating AI into its tools. While investor concerns about competition and slowing growth persist, I believe that Adobe’s sustained profitability and double-digit EPS outlook over the medium term suggest these worries may be overblown.

In the meantime, at today’s valuation, Adobe presents a compelling opportunity for long-term investors who trust its ability to continue navigating and leveraging the AI-driven evolution of creative and productivity tools for its benefit.