My top 10 things to watch Friday, Feb. 2

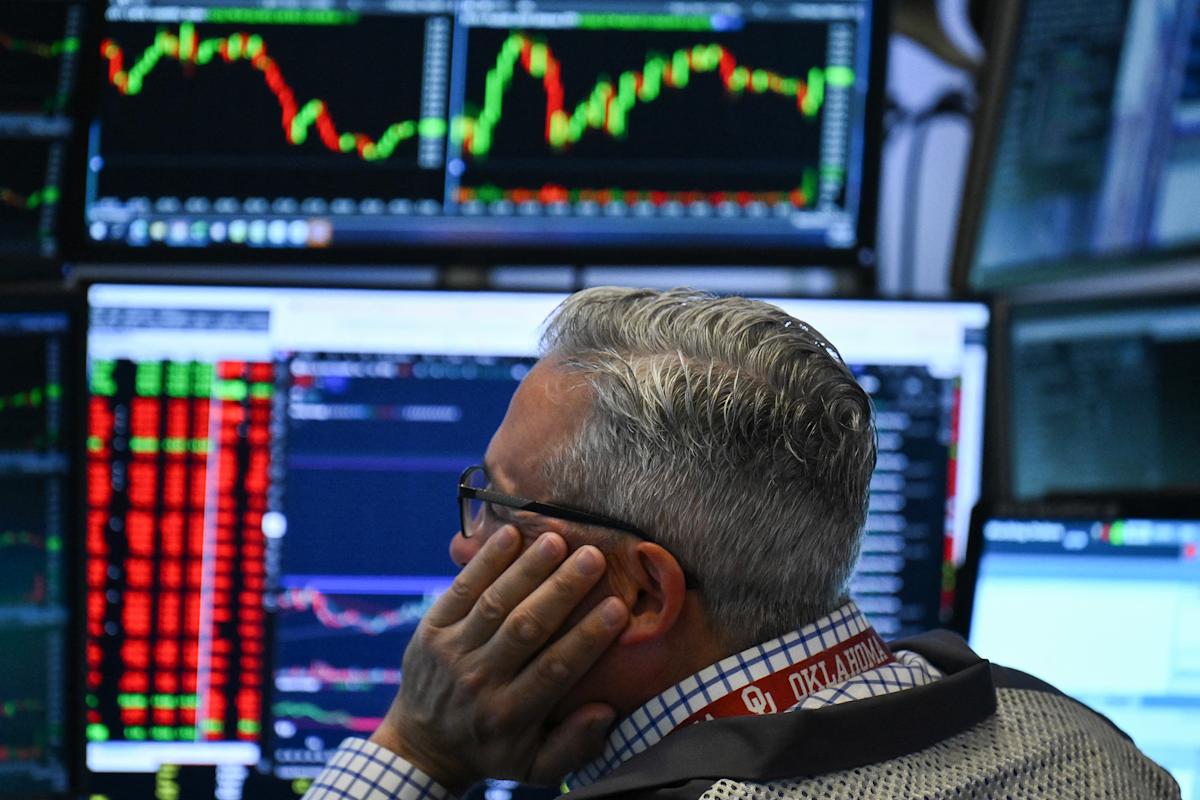

- Jobs blowout: 353,000 nonfarm jobs created by the U.S. economy in January versus 185,000 expected. Wage inflation was double the monthly estimate. These numbers must certainly remove lingering odds for a Fed interest rate cut in March. The employment data show economy strong and inflation, perhaps, not fully vanquished. The 10-year Treasury yield jumps back up over 4%.

- Wall Street shows little reaction as Fed chief Jerome Powell told us that on Wednesday. Rate cut odds are still favoring May or June. The Dow, the S&P 500 and the Nasdaq roared back Thursday after the prior session’s Fed Day rout. Ahead of Friday trading, the Dow and S&P 500 are in the green for the week. The Nasdaq, however, is still working a weekly loss.

- Long knives are out for Apple. Shares down 3.5% after year over year quarterly drop in China revenue, which accounts for one-fifth of sales. China decline is palpable and political. Vision Pro goes on sale Friday after robust presale. But the $3,500-plus headset still viewed as boutique consumer instead of large business-to-business and large consumer. Multiple price target cuts. We held our Club PT at $205 per share. As we told you repeatedly ahead of the print, the guide would be lower and it would take stock lower, and that is what happened. Still “own, don’t trade” Apple stock.

- Meta Platforms quarter was the star of the Thursday evening tech earnings. Shares up 15%. It looks like the $1 billion sales mark from Reality Labs, the metaverse and VR headset unit, plus the 350,000 artificial intelligence H100 chips from Nvidia for Reels and advertising has made it so TikTok could be on its heels soon. Instagram is accelerating as is WhatsApp in America. Connected Ray-Ban sunglasses are a surprise hit. Lots of price target increases, including our own Club PT to $500 per share from $350.

- The cloud was back in the fourth quarter at Amazon. Shares up more than 6.5%. Amazon checked the boxes of exactly what the bulls wanted to see. Amazon reduced its cost-to-serve on a per-unit basis globally for the first time since 2018. Boosts e-commerce. Advertising also strong. Multiple price target hikes. The Club takes our PT to $190 per share from $160.

- Five of our Super Six stocks have now issued their most recently completed quarters. Nvidia always reports last, Feb. 21 is the date. But Nvidia was the big winner as all of these companies can’t get enough of the AI chips that CEO Jensen Huang can’t make fast enough. Meta, Amazon and Microsoft, which reported strong results earlier this week, are heavy users. Alphabet is also a buyer of Nvidia chips.

- Club name Eaton was a big earnings winner outside tech. The industrial power specialist issued much better than expected results and saw lots of price target boosts from analysts. Eaton keeps hitting all-time highs. We raised our Club PT to $290 per share from $255.

- Both Exxon and Chevron beat. The latter returned a huge amount to shareholders including 8% dividend increase. Exxon declared a dividend for the first quarter of 95 cents per share. Exxon bought former Club name Pioneer Natural Resources. Chevron bought Hess. We own the much smaller Coterra Energy. 50/50 oil and natural gas exploration and production company.

- Bristol-Myers beats on sales and earnings. Hasn’t done that in a while. Chris Boerner new CEO. The Club owns a bunch of health- and drug-related stocks, including the outperforming Eli Lilly, which owns the GLP-1 market for diabetes and weight loss alongside Novo Nordisk.

- Cardinal Health multiple price target increases on better-than-expected quarter. Along with Cencora and McKesson, these companies never miss, which is highly unusual. What is their value add? I’ll ask Cardinal Health CEO Jason Hollar on Mad Money this Friday evening.

Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free

(See here for a full list of the stocks at Jim Cramer’s Charitable Trust.)

What Investing Club members are reading right now

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.