Volatility on Wall Street has been inescapable since this decade began. Although the CBOE Volatility Index is currently at a multiyear low, investors have watched as the three major stock indexes have vacillated between bear and bull markets in successive years since the start of 2020.

When the going gets tough on Wall Street, investors have historically turned their attention to time-tested businesses with a history of outperformance. Though the FAANG stocks are one example of a group of consistent outperformers, it’s stocks enacting splits that have been the preferred choice by investors over the past two-plus years.

A “stock split” is an event that allows a publicly traded company to alter both its share price and outstanding share count without having any impact on its market cap or operating performance. It’s nothing more than a cosmetic change that can make a company’s share price more nominally affordable for everyday investors via a forward-stock split, or can help a company remain listed on a major stock exchange by increasing its share price, as with a reverse-stock split.

Investors have flocked to industry-leading companies enacting forward splits

Although there have been a couple of instances of publicly traded companies making investors richer years after a reverse-stock split, most investors tend to flock to companies enacting forward splits.

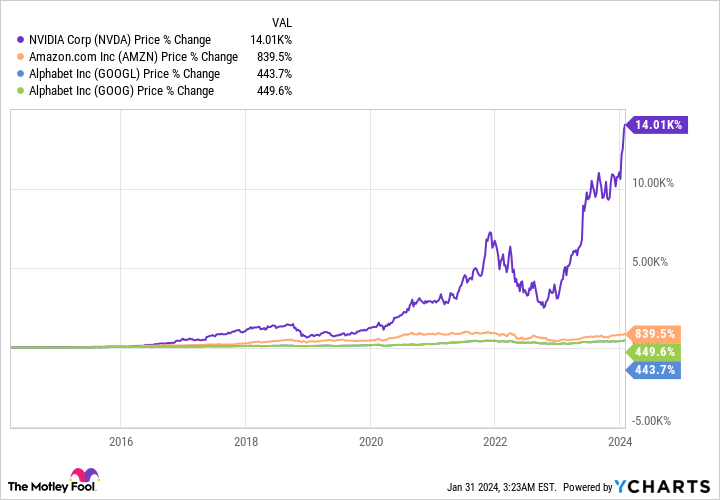

Since mid-2021, nine high-profile companies have completed forward splits, including megacap superstar Nvidia (NASDAQ: NVDA), e-commerce company Amazon (NASDAQ: AMZN), and internet search behemoth Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), to name a few. Nvidia completed a 4-for-1 split in 2021, while Amazon and Alphabet enacted respective 20-for-1 splits in 2022.

What these former stock-split stocks all share is seemingly impenetrable moats.

-

Nvidia has developed into the infrastructure backbone of the artificial intelligence (AI) movement. The company’s A100 and H100 graphics processing units (GPUs) might account for an up-to 90% share of the GPUs deployed in AI-accelerated data centers this year. Even with new competitors entering the space, Nvidia isn’t going to be relinquishing its AI-GPU dominance anytime soon.

-

Amazon’s online marketplace accounted for 39.5% of online retail sales in the U.S. in 2022, according to Insider Intelligence. That’s over eight percentage points higher than its 14 closest competitors, combined! What’s more, Amazon Web Services (AWS) is the world’s leading provider of cloud-infrastructure services.

-

Alphabet’s Google was responsible for nearly 92% of worldwide internet search share in December 2023 and has tallied at least a 90% share of monthly internet search dating back over eight years. Meanwhile, YouTube (which Alphabet owns) is the second most-visited social site on the planet, and Google Cloud has become the third-biggest global cloud-infrastructure service provider, by market share.

Impenetrable moats, exceptional execution, and top-tier innovation is why former stock-split stocks have succeeded.

Earlier this week, a new “member” announced its introduction to this exclusive group.

Say hello to Wall Street’s newest stock-split stock

Following the closing bell on Jan. 30, retail giant Walmart (NYSE: WMT) announced plans to conduct a 3-for-1 stock split in the weeks to come.

According to Doug McMillon, the CEO and president of Walmart, the intent of its stock split is to ensure that its employees can purchase whole shares rather than fractional shares of the company’s stock. Said McMillon, “Given our growth and our plans for the future, we felt it was a good time to split the stock and encourage our associates to participate in the years to come.”

Interestingly, this stock split is going to de-emphasize Walmart’s influence in the ageless Dow Jones Industrial Average. The Dow is a share price-weighted index, and Walmart’s share price is about to decline from about $165 to roughly $55 by the time the market opens for trading on Feb. 26, 2024. Whereas Walmart is currently the 17th most influential stock in the Dow, it could be in the bottom five following its split.

However, this is a minor price to pay to reflect Walmart’s decades of outperformance.

One reason Walmart has been virtually unstoppable is the company’s sheer size. Having deep pockets and virtually unparalleled product variety means it can undercut smaller/local stores on price. Furthermore, its selection and lower price points make it a logical choice for cost-conscious consumers. If above-average inflation rates persist, Walmart would be a clear beneficiary.

Innovation and adaptation are additional ingredients to Walmart’s decades-long outperformance. Just last year, Walmart outlined plans to increase automation and data reliance in its supply chain to improve inventory accuracy, bolster its omnichannel sales platform, and ultimately make the company nimbler when it comes to adapting to changing consumer demands. By the end of fiscal year 2026 (Jan. 31, 2026), Walmart anticipates that roughly 55% of its fulfillment-center volume will be handled by automated facilities.

The company’s aggressive investments in technology will further enhance its competitive edge. Average unit cost should decline, which will allow the company to pay higher wages to workers who are making a difference on the front lines.

Nevertheless, Walmart is on track to end January with a forward price-to-earnings (P/E) ratio north of 25. That’s the priciest this stock has been in at least a decade. Even with its top-notch competitive advantages, Walmart will likely need more than short-lived, stock-split euphoria to push its valuation higher.

This high-flying stock may be next to split its shares

With Walmart officially breaking the seal on brand-name, forward-stock splits in 2024, it’s just a matter of time until another high-flying stock follows in its footsteps. While there’s no way to concretely know which widely owned company will join the ranks of the elite stock-split stocks next, I’d be betting on semiconductor company Broadcom (NASDAQ: AVGO) to be the next in line.

Prior to being acquired by Avago in 2016, Broadcom had conducted a couple of forward-stock splits. On the other hand, Avago (which kept the Broadcom name following the buyout) has never enacted a stock split. But with shares of the company climbing more than 2,100% over the trailing decade to north of $1,200 per share, now looks like as good a time as any to make its stock more nominally affordable for everyday investors.

Broadcom’s bread and butter has long been its wireless-focused operations. This is a company that makes wireless chips and accessories used in next-generation smartphones. The 5G revolution has encouraged consumers and businesses to upgrade their wireless devices to take advantage of faster download speeds. This ongoing replacement cycle has steadily lifted Broadcom’s operating cash flow.

I’d be remiss if I didn’t also mention Broadcom’s backlog. Although CEO Hock Tan wasn’t as forthcoming with his company’s backlog in 2023 as he was in the previous year, he did note that Broadcom had a whopping $31 billion in orders in its backlog as of September 2022. An extensive backlog minimizes recessionary fears and all but ensures predictable cash flow for the company.

However, the fuel that’s helped Broadcom’s stock effectively double over the past eight months is AI. Last year, Broadcom unveiled its Jericho3-AI chip, which can connect up to 32,000 GPUs at once in high-compute data centers. Broadcom’s AI solution is at the heart of the split-second decision-making needed by AI-driven software and systems.

Broadcom is expected to report is fiscal first-quarter operating results in about a month. Don’t be surprised if it follows in Walmart’s footsteps and becomes the second brand-name stock-split stock of 2024.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, and Walmart. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Meet Wall Street’s Newest Stock-Split Stock, Along With the Company Likeliest to Follow in Its Footsteps was originally published by The Motley Fool