One of the reasons Nvidia (NASDAQ: NVDA) has been so successful in the age of data centers and artificial intelligence (AI) involves the “picks and shovels” economic theory. This theory points out that, during a gold rush, the most successful participants are less likely to be the gold hunters and more likely to be the ones selling the tools the gold miners need for the hunt. Nvidia’s high-powered graphic processing units (GPU) and software are the picks and shovels of data centers and AI.

But Nvidia doesn’t act alone. It has several suppliers it depends on to provide technology and materials used to make its finished products. These would be the ax and shovel head suppliers and wooden handle makers of the “picks and shovels” theory. One of these suppliers to the supplier is Marvell Technology (NASDAQ: MRVL).

Marvell is not all that well known among retail investors. However, Citi analyst Atif Malik recently made the company his top specialty semiconductor stock, lifting it above Nvidia on his list of recommendations. One reason is probably that Nvidia’s stock has already gained 208% over the last year, while Marvell is up just 53%.

What does Marvell Technology do?

Today’s connected and increasingly cloud-based world requires immense amounts of data to be processed through massive data centers. Those data centers often are over 100,000 square feet in size, and cloud services providers (think Amazon Web Services and Microsoft Azure) plan on adding 50 to 100 annually.

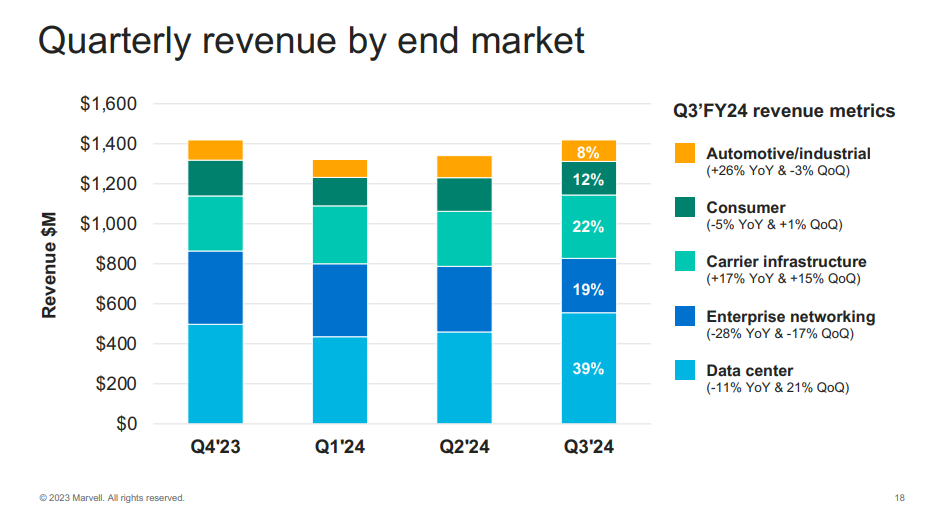

The rapid adoption of generative AI will increase bandwidth needs exponentially. Marvell’s technology, such as optical interconnects and cloud-optimized silicon, enables data centers to meet these needs. Optical interconnects transmit signals using light to support data center functions, and cloud-optimized silicon is critical to high-speed, low-power processing. Marvell also sells products for the automotive and consumer electronics industries, among others. However, nearly 40% of its revenue comes from the data center market.

Data center sales were the reason for Nvidia’s massive recent success. In its fiscal 2024 third quarter (which ended Oct. 29), Nvidia’s data center revenue rose 279% year over year to $14.5 billion. This incredible growth bodes well for Marvell as well.

Marvell will also benefit from advanced automotive technologies like driver assist features and even autonomous driving. Just like data centers, these systems need to move data incredibly rapidly, and Marvell’s products enable this level of performance. The secular opportunity for the company across multiple industries is impressive.

Is Marvell Technology stock a buy now?

While its long-term opportunities are terrific, the semiconductor industry is cyclical and tied to PC sales, and 2023 was a down year for most of the industry. For the first three quarters of Marvell’s fiscal 2024, (a period that ended Oct. 28), its sales fell 9% year over year to $4.1 billion. The company posted an operating loss of $543 million for that period compared to an operating profit of $214 million the year before. However, the picture gets brighter when digging deeper.

For instance, through Q3 of fiscal 2024, Marvell produced $824 million in operating cash flow despite the aforementioned losses. This is because over $1 billion of its expenses were for non-cash items like amortization of intangible assets, depreciation, and restructuring charges. These non-cash expenses make its results look poor but can be misleading. Marvell reported a non-GAAP operating profit of $1.1 billion on a 27% margin over the same period.

The stock is challenging to value because of all these moving parts. Marvell has a market cap of $60 billion. Analysts expect $6.1 billion in sales and non-GAAP earnings per share of $2.02 in the next fiscal year, giving it a price-to-earnings ratio of around 35. In addition, the average analyst price target of $72 per share is just 3% above the stock’s current price, suggesting that the stock is fairly valued.

It’s easy to see why there is growing buzz for Marvell. The company is knee-deep in two explosive industries, and it may be worth it for investors to pick up a small speculative position in the stock. Still, its fair valuation today means that interested investors don’t need to rush, and should consider a strategy like dollar-cost averaging or buying the dip.

Should you invest $1,000 in Marvell Technology right now?

Before you buy stock in Marvell Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Marvell Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Citigroup, and Nvidia. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.

Should You Buy This Mysterious Nvidia Partner Before Everyone Else Does? was originally published by The Motley Fool