Over lengthy periods, Wall Street has a knack for making patient investors richer. But over shorter timelines, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth stock-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) are no more predictable than a coin flip.

Despite the uncertainties that accompany stocks over short periods, it doesn’t stop investors from trying to gain a competitive edge in knowing which direction the Dow, S&P 500, and Nasdaq Composite will head next.

Even though no perfect economic data point or predictive indicator exists that can, with 100% accuracy, forecast what’s next for the major stock indexes, there are a small number of these tools that have a historically strong track record of foreshadowing directional moves in the Dow, S&P 500, and Nasdaq. One such recession indicator, which is nearing uncharted territory, has a potentially grim warning to offer Wall Street and investors.

Trouble appears to be on the horizon for the U.S. economy

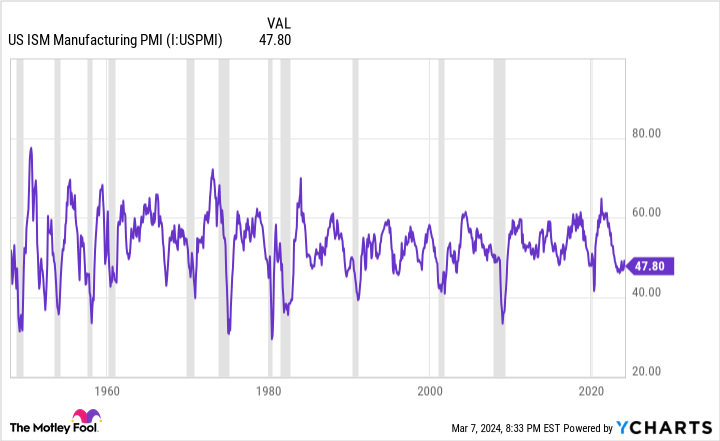

Every month for more than 76 years, the Institute of Supply Management (ISM) updates one of the most widely followed economic indicators in the U.S.: the ISM Manufacturing Index, which is also known as the Purchasing Managers’ Index (PMI).

The monthly ISM Manufacturing Index report surveys purchasing and supply executives at more than 300 manufacturing firms across the country to gauge changes in economic activity. The categories used to make this determination include manufacturing, new orders, production, employment, inventory, prices, order backlogs, and imports.

The PMI is reported on a scale of 0 to 100, with 50 representing a baseline that signals neither expansion nor contraction of the U.S. manufacturing industry. A reading above 50 suggests manufacturing expansion, while a reading below 50 alludes to contraction.

For February 2024, the ISM Manufacturing Index came in with a reading of 47.8, which implies modest contraction. Although prices and imports suggest manufacturing growth, ISM New Orders dipped back into contraction territory.

However, it’s not just the PMI reading from February that’s concerning. The ISM Manufacturing Index peaked during the last round of COVID-19 stimulus checks and has been wavering ever since. February marked the ISM Manufacturing Index’s 16th consecutive month of contraction (i.e., a reading below 50). This represents the third-longest period of contraction for the PMI, with only the 19-month contraction from July 1981 to January 1983 and the 18-month decline from August 2000 to January 2002, lasting longer.

Dating back to 1948, there has never been a lengthy contraction that didn’t result in the U.S. economy dipping into a recession. Typically, persistent contraction of the PMI leads to downward revisions in corporate earnings — and when businesses are generating weaker profits, stock valuations often decline.

If history were to rhyme, once more, the ISM Manufacturing Index portends a downturn in the U.S. economy and stock market by perhaps the second-half of this year.

Following the money is worrisome, too

The worry for Wall Street and investors is that the PMI represents just one of a couple of economic indicators and data points that portend trouble. This is especially true if you focus on money-based metrics.

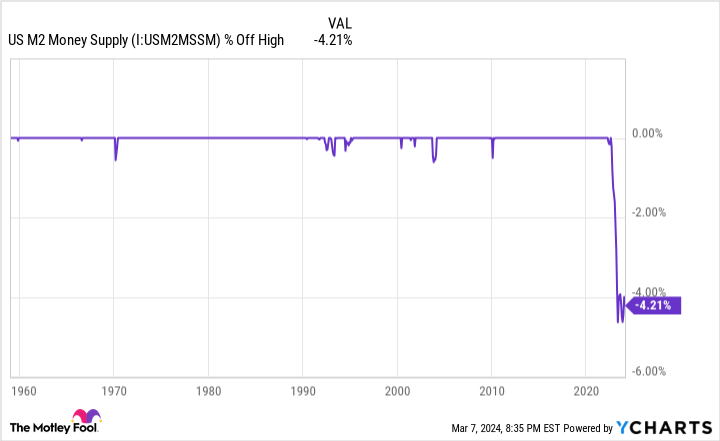

For example, we’re currently witnessing historic movements in the U.S. money supply. The two best-known money supply metrics are M1 and M2. The former factors in cash and coins in circulation, as well as demand deposits in a checking account. Meanwhile, M2 is comprised of everything in M1 and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000. In other words, M2 is money that is still relatively easy to get to, but it often requires a bit more work than hitting an ATM. It’s M2 that’s making history at the moment.

As of January 2024, U.S. M2 money supply was $20.78 trillion. That’s down 1.44% on a year-over-year basis, and 4.21% from a peak of $21.7 trillion in July 2022.

On a nominal-dollar basis, neither of these percentages represents a big move. However, the last time money supply contracted by at least 2% was the Great Depression between 1931 and 1933. The four other times M2 retraced by at least 2%, when back-tested to 1870, were all correlated with deflationary depressions for the U.S. economy and high levels of unemployment.

While a depression is highly unlikely today given the tools the nation’s central bank and the federal government have to work with, a decline in money supply with inflation running at or above historical norms is often a precursor to a recession.

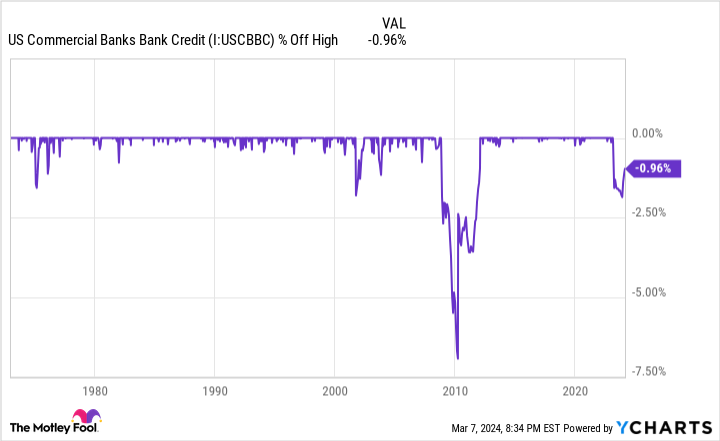

Additionally, commercial bank credit has headed in the wrong direction.

“Commercial bank credit” accounts for all the loans, leases, and securities held by U.S. commercial banks. Since banks are encouraged to lend to cover the costs of taking in deposits (e.g., paying interest on deposits), commercial bank credit has steadily risen over long periods.

However, there have been three instances dating back to the start of 1973 where commercial bank credit declined by at least 2% from its then-all-time high. We witnessed this occur during the dot-com bubble, shortly after the Great Recession, and late last year. The previous two instances where commercial bank credit declined by at least 2% correlated with the S&P 500 losing around half of its value.

What the decline in commercial bank credit is telling us is that banks have tightened their lending standards and are being pickier about how they lend their money. Historically, that’s bad news for the U.S. economy and innovation as a whole.

Ignore the noise: Patience and perspective are your greatest allies

There’s no question the U.S. economy and stock market are facing hurdles that have, historically, spelled trouble. However, none of these aforementioned indicators can hold a candle to the power that patience and perspective bring to the table for investors.

If indicators like the PMI, M2 money supply, and commercial bank credit are correct, a U.S. recession is unavoidable in the not-too-distant future. But did you know that recessions tend to resolve very quickly? Out of the 12 recessions since the end of World War II, only three reached the 12-month mark, and none surpassed 18 months in length.

For the sake of comparison, two periods of economic expansion since the end of World War II topped 10 years in length. If investors simply allow time to work its magic, they’d enjoy disproportionately long periods of expansion.

This disparity between economic expansions and recessions can be seen in the length of bull and bear markets on Wall Street, as well. Even though the Dow, S&P 500, and Nasdaq aren’t tied at the hip to the U.S. economy, corporate earnings do ebb and flow with the health of the economy.

Last June, the analysts at Bespoke Investment Group examined the average length of bull and bear markets in the S&P 500 dating back to the start of the Great Depression in September 1929. What Bespoke’s research uncovered was that the average S&P 500 bear market lasted just 286 calendar days, or roughly 9.5 months. On the other hand, the typical bull market endured 1,011 calendar days, or 3.5 times as long as the average bear market.

What’s more, 13 of the 27 bull markets — Bespoke defines a “bull market” as a rally of 20% or greater following a decline of 20% or greater — in the S&P 500 since September 1929 were lengthier than the longest bear market.

Investors are never going to be able to perfectly and consistently time when stock market downturns will occur, know how long they’ll last ahead of time, or accurately predict where the bottom will be. But history conclusively shows that all downturns in the major stock indexes are eventually (key word!) erased by bull market rallies. If you have a lengthy investment horizon and can ignore the white noise raised by select economic indicators and data points, you’re ideally positioned to generate wealth on Wall Street.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of March 8, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

A Key Recession Indicator Is Nearing Uncharted Territory, and It Offers an Ominous Warning for Wall Street was originally published by The Motley Fool