NXP Semiconductors (NXPI) is drawing fresh attention after a series of upbeat analyst opinions and investor comments, focusing on its role in automotive and industrial chips and its close integration with long term customers.

See our latest analysis for NXP Semiconductors.

The recent wave of analyst attention is landing on a stock that already has momentum, with a 1 day share price return of 4.62% and a 90 day share price return of 16.30%. The 5 year total shareholder return of 50.44% reflects the longer term payoff investors have seen so far.

If NXP’s recent move has you thinking about where else the market is rewarding chip makers, it could be a good moment to check out high growth tech and AI stocks.

With NXP posting solid recent returns, annual revenue of $12,045.0m and net income of $2,061.0m, the key question is simple: are you looking at an undervalued chip maker, or has the market already priced in future growth?

Most Popular Narrative: 7% Undervalued

At a last close of $240.03 versus a narrative fair value of $258.19, the current price sits below what this widely followed view implies.

A major catalyst is the normalization of automotive Tier 1 inventory levels in Western markets, which is ending after several quarters of being a growth headwind. As NXP can now ship directly to natural end demand, instead of customers burning through old inventory, this transition is expected to drive higher automotive revenues and better earnings visibility through the next several quarters.

Curious what kind of revenue path and margin profile need to hold for that valuation to add up? The narrative leans on steady growth, rising profitability and a richer earnings base a few years out. Want to see exactly how those moving parts fit together and what kind of earnings power is being penciled in?

Result: Fair Value of $258.19 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there is still a risk that modest end demand in automotive and intense China competition could pressure margins and challenge the earnings path analysts expect.

Find out about the key risks to this NXP Semiconductors narrative.

Another View: Cash Flows Paint A Tougher Picture

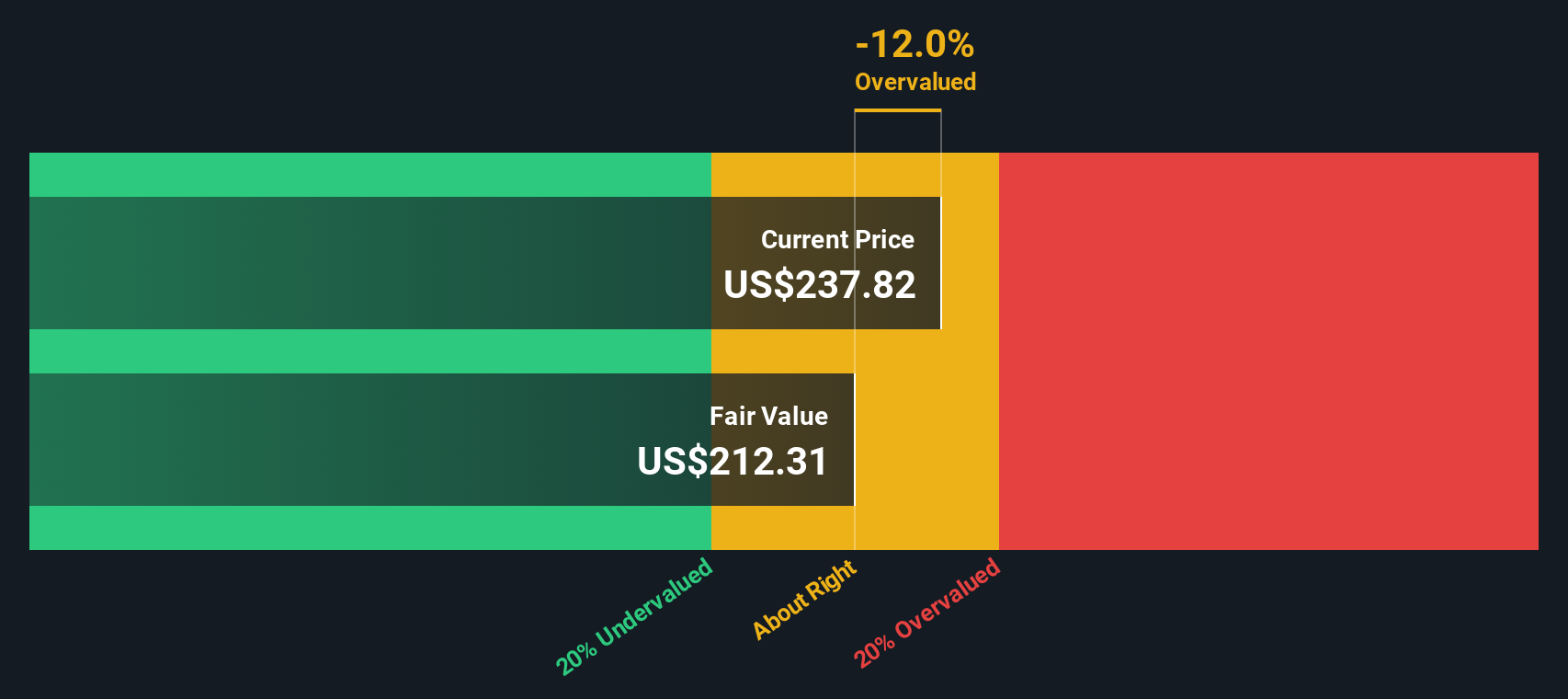

While the consensus narrative points to a fair value of $258.19 and labels NXP as 7% undervalued, our DCF model lands at $210.09, which is below the current $240.03 share price. On this view, the stock looks overvalued. Which perspective do you think fits your expectations better?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If the story here does not quite match your view, or you prefer testing the assumptions yourself, you can build your own data driven thesis in minutes: Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If NXP has sharpened your interest in where capital could work harder, do not stop here. Broaden your watchlist with a few targeted ideas today.

- Spot potential value gaps by scanning these 878 undervalued stocks based on cash flows that may offer prices below what their cash flows suggest.

- Zero in on future facing themes by tracking these 25 AI penny stocks tied to artificial intelligence and related technologies.

- Strengthen your income focus by checking out these 14 dividend stocks with yields > 3% that might align with a yield orientated approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com