Fresh analyst commentary on Sportradar Group (SRAD) has brought the stock back into focus, as firms highlight its recurring revenue model and broad product set tied to the expanding online sports betting industry.

See our latest analysis for Sportradar Group.

Despite the recent positive analyst commentary, Sportradar Group’s share price, which last closed at US$18.12, has seen a 30 day share price return of 22.30% and a year to date share price return of 22.30%. The 1 year total shareholder return of 14.89% contrasts with a 3 year total shareholder return of 38.64%, suggesting longer term holders have seen stronger overall gains than more recent buyers.

If Sportradar’s recent moves have your attention, this could be a useful moment to scan other high growth tech and AI names using our screen for high growth tech and AI stocks.

Analysts see plenty of potential upside relative to their price targets, while the recent 1 year share price decline suggests sentiment has cooled. So is SRAD quietly undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 44.4% Undervalued

With Sportradar Group last closing at $18.12 against a widely followed fair value estimate of about $32.61, the current price sits well below that narrative view, which leans heavily on growth and profitability assumptions.

Increasing demand for advanced, real-time sports data, in-play betting, and micro markets is driving greater adoption of premium, higher-margin products like MTS and 4Sight, supporting both revenue acceleration and EBITDA margin expansion.

Curious what kind of revenue mix and margin profile could support that fair value gap? The narrative leans on faster earnings growth and a richer profit structure than today. Want to see exactly how those assumptions stack up over time, and what discount rate is used to pull them back to a present value?

Result: Fair Value of $32.61 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on Sportradar holding onto key data rights and managing rising competition and regulatory scrutiny around betting and prediction markets, which could pressure revenue and margins.

Find out about the key risks to this Sportradar Group narrative.

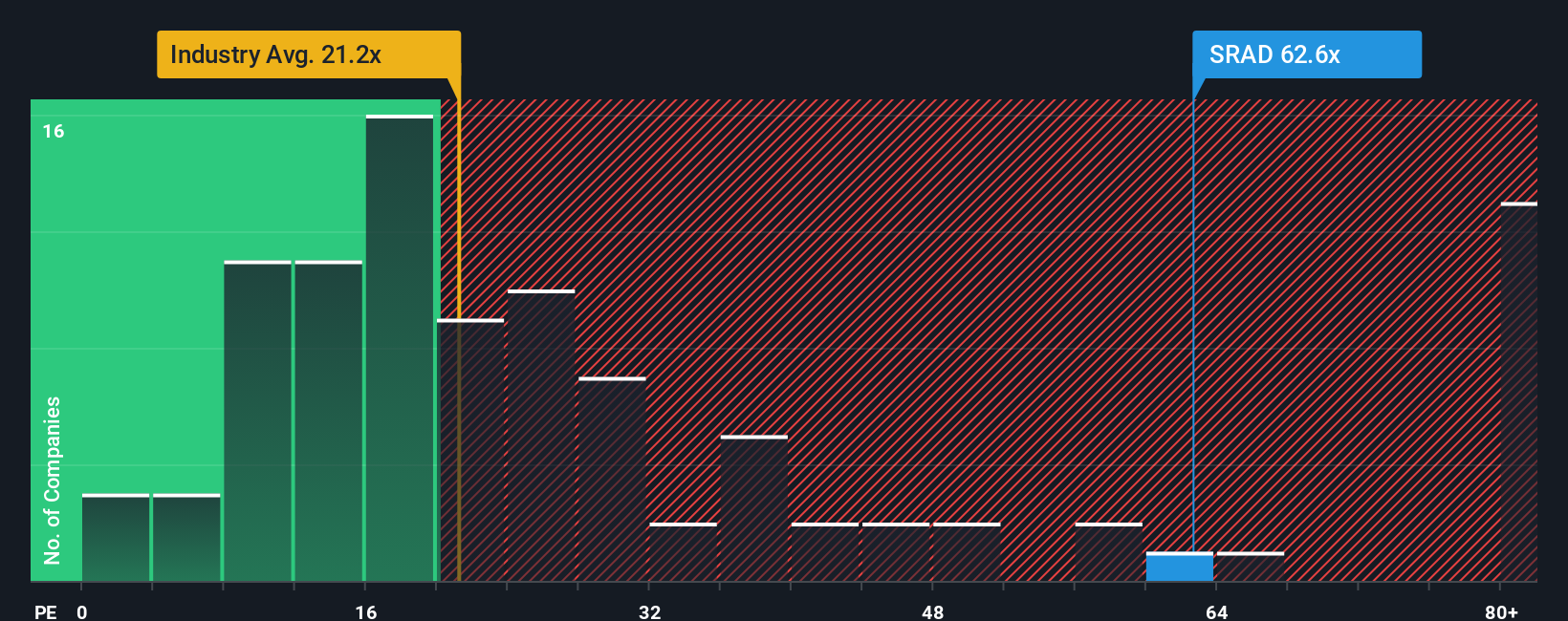

Another Angle: Earnings Multiple Sends A Different Signal

The fair value narrative points to undervaluation, but the P/E ratio tells a tougher story. At about 48.3x earnings, Sportradar trades well above the US Hospitality industry average of 21.3x and above its own fair ratio of 32.2x. This suggests meaningful valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sportradar Group Narrative

If you are not fully on board with this view or prefer to lean on your own analysis, you can build a personalised thesis in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sportradar Group.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one stock. Use the Screener to quickly surface fresh ideas that fit what you care about.

- Spot potential growth stories early by scanning these 3531 penny stocks with strong financials that already show stronger financial underpinnings than many expect at this size.

- Focus your time on AI names that match your interests by filtering for these 25 AI penny stocks positioned around artificial intelligence themes.

- Hunt for mispriced opportunities by checking these 873 undervalued stocks based on cash flows that screen as attractively valued based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com