As the European Central Bank’s recent interest rate cuts have sparked optimism for further monetary easing, the pan-European STOXX Europe 600 Index has seen a modest rise, reflecting a cautiously positive sentiment across major stock markets in Europe. In this context of evolving economic policies and market dynamics, dividend stocks on the Swedish exchange like Bahnhof offer potential stability and income generation, making them appealing options for investors looking to navigate these uncertain times.

Top 10 Dividend Stocks In Sweden

|

Name |

Dividend Yield |

Dividend Rating |

|

Bredband2 i Skandinavien (OM:BRE2) |

4.69% |

★★★★★★ |

|

Zinzino (OM:ZZ B) |

3.34% |

★★★★★☆ |

|

HEXPOL (OM:HPOL B) |

3.86% |

★★★★★☆ |

|

Axfood (OM:AXFO) |

3.12% |

★★★★★☆ |

|

Skandinaviska Enskilda Banken (OM:SEB A) |

5.46% |

★★★★★☆ |

|

Duni (OM:DUNI) |

4.99% |

★★★★★☆ |

|

Avanza Bank Holding (OM:AZA) |

5.03% |

★★★★★☆ |

|

Loomis (OM:LOOMIS) |

3.97% |

★★★★☆☆ |

|

Afry (OM:AFRY) |

3.09% |

★★★★☆☆ |

|

Bahnhof (OM:BAHN B) |

3.77% |

★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Let’s take a closer look at a couple of our picks from the screened companies.

Bahnhof

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market capitalization of SEK5.70 billion.

Operations: Bahnhof AB (publ) generates revenue through its Internet and telecommunications operations in Sweden and Europe.

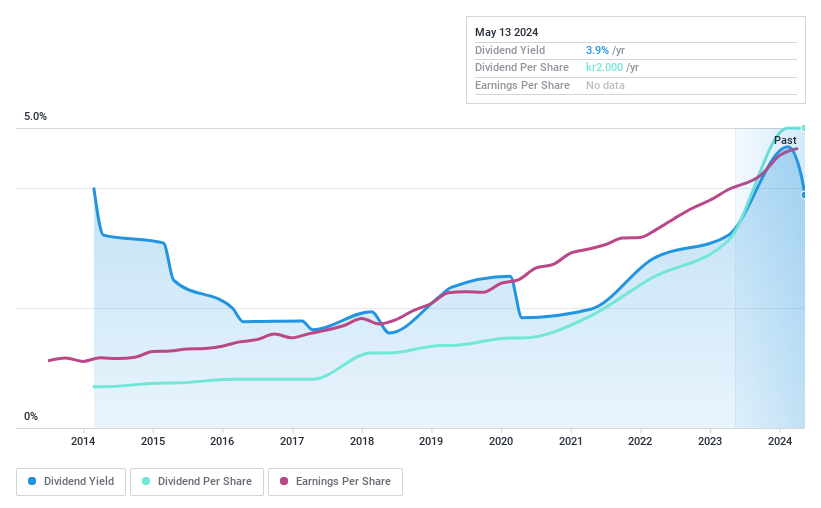

Dividend Yield: 3.8%

Bahnhof’s dividend yield of 3.77% is below the top 25% of Swedish dividend payers, and its high payout ratio of 94.4% suggests dividends are not well covered by earnings, though cash flows do cover them at an 85.3% ratio. Despite this, Bahnhof has maintained stable and reliable dividends over the past decade with growth in payments and recent inclusion in the S&P Global BMI Index potentially enhancing its visibility among investors.

-

Navigate through the intricacies of Bahnhof with our comprehensive dividend report here.

-

Our expertly prepared valuation report Bahnhof implies its share price may be too high.

Duni

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) develops, manufactures, and sells meal serving, take-away, and packaging products in Sweden and internationally, with a market cap of SEK4.71 billion.

Operations: Duni AB generates revenue from Dining solutions amounting to SEK4.52 billion and Food packaging solutions totaling SEK3.05 billion.

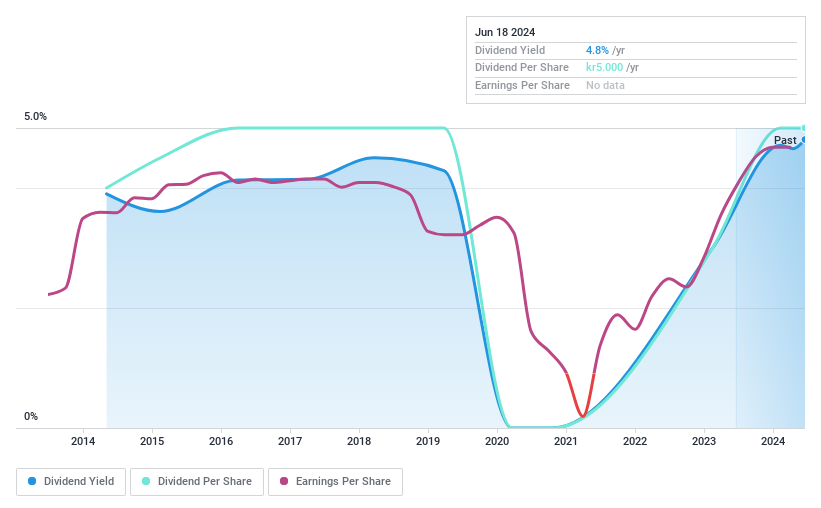

Dividend Yield: 5%

Duni’s dividend yield of 4.99% ranks in the top 25% of Swedish dividend payers, with dividends well covered by earnings and cash flows due to payout ratios of 63.9% and 42.9%, respectively. However, its dividend history is marked by volatility over the past decade. Recent plans for a new warehouse hub in Meppen, Germany aim to boost logistics efficiency, potentially impacting future financial stability but not affecting current production personnel significantly.

AB SKF

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services with a market cap of approximately SEK90.14 billion.

Operations: AB SKF’s revenue is primarily derived from its Automotive segment, which generated SEK29.44 billion, and its Industrial segment, which contributed SEK71.08 billion.

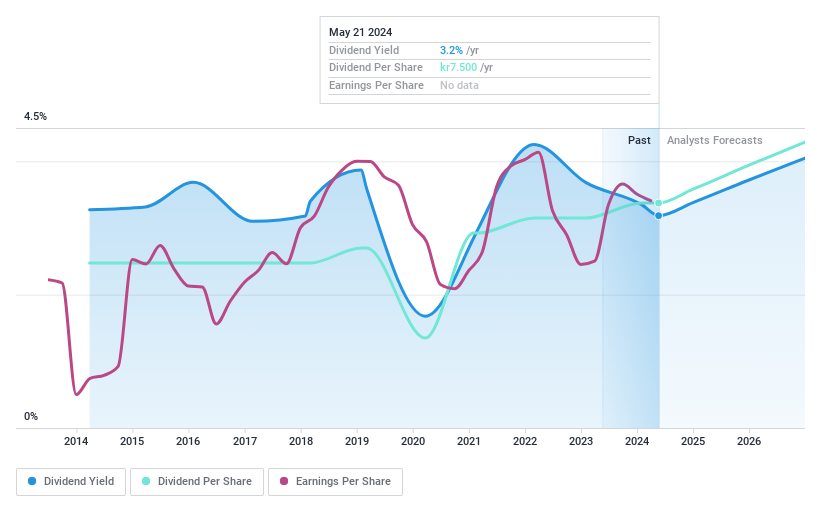

Dividend Yield: 3.8%

SKF’s dividend payments have been volatile over the past decade, with a yield of 3.79% falling below top-tier Swedish payers. Despite this, dividends are covered by earnings and cash flows with payout ratios of 59.9% and 53.6%, respectively. Trading at a significant discount to its estimated fair value, SKF plans to separate its Automotive business by 2026 to enhance focus and efficiency in its Industrial segment, potentially impacting future dividend stability.

Make It Happen

-

Gain an insight into the universe of 22 Top Swedish Dividend Stocks by clicking here.

-

Have you diversified into these companies? Leverage the power of Simply Wall St’s portfolio to keep a close eye on market movements affecting your investments.

-

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BAHN B OM:DUNI and OM:SKF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com