These two retail giants are both market beaters.

Amazon (AMZN 1.59%) and Costco Wholesale (COST 0.87%) are two of the best retail stocks on the market. They’re both surefire winners that have beaten the market by a large margin over decades. But if you could only buy one today, which is the better buy?

The case for Amazon: Unlocking new opportunities

Amazon is the second-largest company in the U.S. by sales and the fourth-largest by market capitalization. It has almost 38% of the market share for e-commerce in the U.S. and 31% of the market share for cloud services globally. It’s a major player in streaming, it has a fast-growing advertising business, and it has plenty of other new ideas in the cooker.

If that wasn’t enough, it still sees massive opportunities ahead — especially in generative artificial intelligence (AI). The average person thinks of or uses generative AI for fun, to find out information easily, or to generate content that fulfills obligations. Workers use generative AI to generate all sorts of consumable content.

But developers, such as those who code for websites, can use generative AI to handle non-creative work efficiently and free up their time for tasks that require human analysis. Amazon is targeting all kinds of work-use tasks through its generative AI solutions for Amazon Web Services (AWS).

CEO Andy Jassy keeps saying that 90% of company information technology (IT) spending is still on the premises, meaning not on the cloud. That’s a wide-open opportunity in an area where Amazon has a clear lead, and it’s not letting up in innovation to keep its lead and benefit from the opportunity. Its AWS-AI business already has a run rate of $105 billion, and management sees this as early days.

Until now, migrating to the cloud has been a lot of work for clients, but AI makes it a lot easier, and migration plus new infrastructure built on the cloud should lead to faster growth.

Amazon is still refining its e-commerce business, lowering costs and making it the platform of choice for its 200 million Prime members at even higher rates. It’s also leveraging its unmatched e-commerce platform to drive a large advertising business. There are many levers for Amazon to push to reach higher sales and profits for the foreseeable future.

The case for Costco: The reliable and lucrative fee model

Costco sells a lot of the same things as Amazon, but retail is its only business. You could say, though, that what Costco really sells is warehouse memberships, because that’s how it makes most of its money. It’s a model that works beautifully, with customers getting cheap prices, driving high volume and sales, and feeding into a cycle of renewals. There are other retailers that use this model, but none are as big or popular as Costco.

As of the end of the fiscal third quarter (ended May 12), Costco had 133.9 million cardholders worldwide, a 7.4% year-over-year increase. Membership fee income grew 7.6% to $1.1 billion. Net income totaled $1.7 billion, and since membership fee income goes straight to the bottom line, it’s clear that this represents a large portion of net income.

The U.S. and Canada renewal rate was an impressive 93%, and the global rate was 90.5%. Costco does well at any time, but it’s more resilient than other retailers when there’s inflation, since each dollar counts a little more. Shoppers looking for better deals are more likely to keep their memberships and shop at Costco more than other stores, even if they’re buying lower-priced items.

Costco stock is reliable for market-beating gains, and it also pays a growing dividend. The dividend yield isn’t typically very attractive, yielding 0.61% at the current price. But it pays an occasional special dividend that’s quite attractive. It’s paid one every two to three years or so since 2012, and the most recent one, issued in December, was its highest ever at $15.

Costco received a lot of attention this year for its most recent special dividend and the news of a fee hike, its first in seven years. There’s little chance that this will negatively affect its renewal rates and card-member signups. Not only will most members easily make up the extra $5 (or $10 for executive members) through savings by shopping at Costco’s stores, but management uses the extra money to drive higher value for shoppers.

One of these stocks works for you

This is a tough contest because these are each fabulous stocks, and I recommend them both. They can both be part of a diversified portfolio since they each offer something different, with Amazon’s opportunities and Costco’s passive income and reliability. If you can only buy one, the growth investor might choose Amazon, while the retiree or dividend investor might choose Costco.

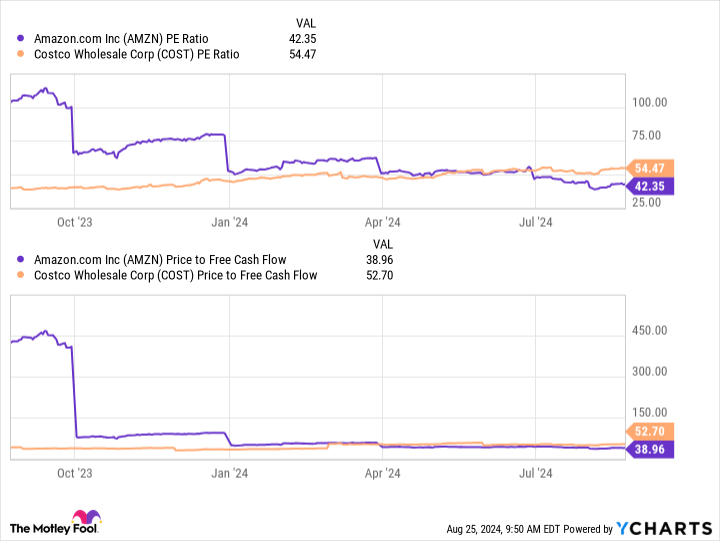

AMZN PE Ratio data by YCharts.

But I won’t duck the question. If I had to choose one stock today, I would go with Amazon. It has incredible long-term opportunities, and its track record is strong and steady enough even for the value investor. Plus, it’s trading at a cheaper valuation today than Costco, making now an excellent time to buy.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Costco Wholesale. The Motley Fool has a disclosure policy.