Why Brunswick’s latest earnings matter for investors

Brunswick (BC) is back in the spotlight after fourth quarter results showed a return to profit compared with a loss a year earlier, alongside an updated share buyback tally and a shift in analyst sentiment.

See our latest analysis for Brunswick.

Brunswick’s recent earnings return to profit and confirmation of sizeable buybacks appear to have supported a strong run in the shares, with a 30 day share price return of 13.06% and a 1 year total shareholder return of 31.46% suggesting that momentum has been building rather than fading.

If Brunswick’s move has caught your eye, it could be a good moment to see what else is making waves among marine and leisure names through auto manufacturers.

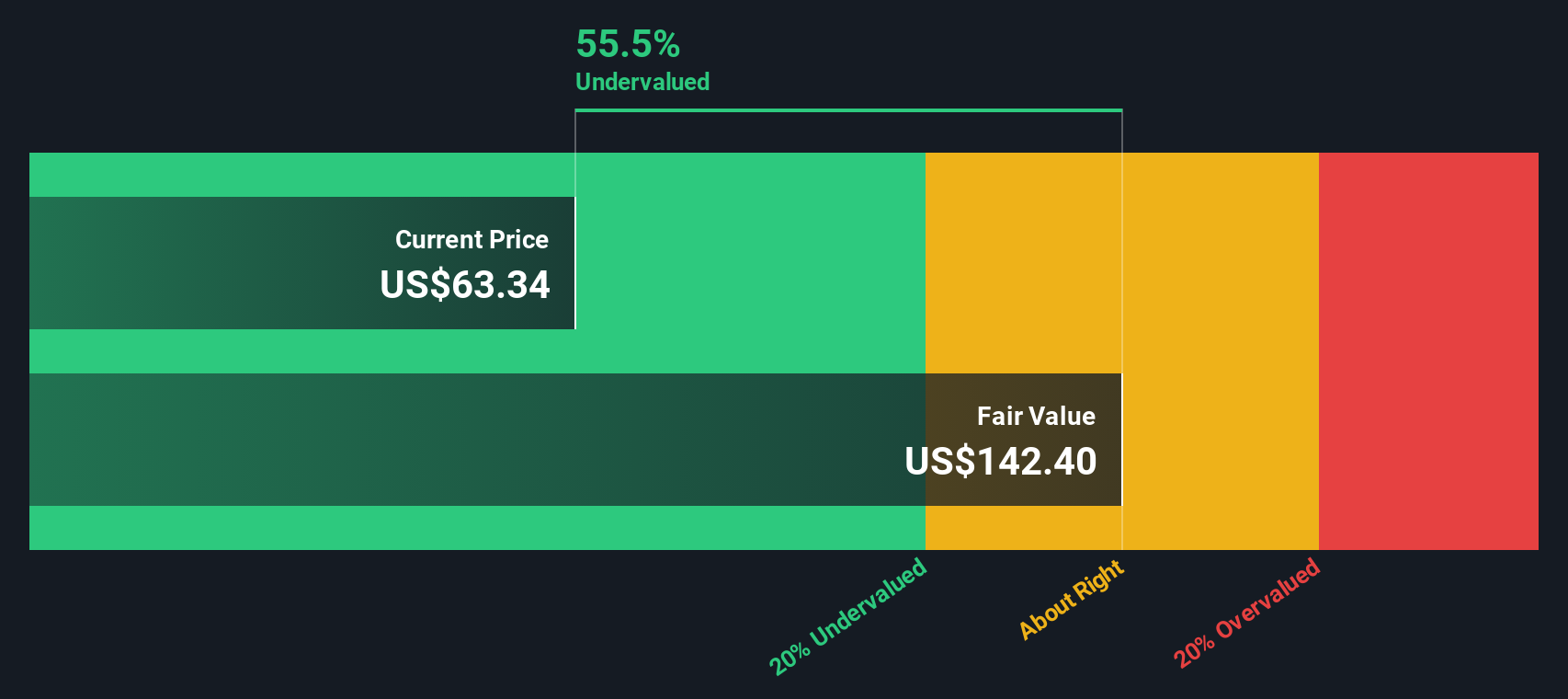

With the shares up strongly over the past year and trading only around 1% below the average analyst price target, the key question now is whether Brunswick still looks undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 8% Overvalued

Brunswick’s last close of $85.80 sits above the most followed fair value estimate of about $79.76, which hinges on a detailed long term growth story.

Brunswick’s ongoing expansion of high-margin, recurring revenue streams, such as digital boating services and the Freedom Boat Club, strengthens margin stability and earnings quality. This is reinforced by the successful launch of new franchise locations (e.g., Dubai) and the continued global leadership of the club model.

Curious how a leisure manufacturer gets a premium valuation tag? This narrative leans heavily on recurring revenue, richer margins, and a future earnings profile that looks very different to today.

Result: Fair Value of $79.76 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this premium story can quickly look different if tariffs raise costs or if weaker demand in value boats undercuts volumes and squeezes margins.

Find out about the key risks to this Brunswick narrative.

Another Take: Cash Flows Tell a Different Story

While the popular narrative flags Brunswick as around 8% overvalued versus a fair value of $79.76, our DCF model points in the opposite direction. On this view, Brunswick’s current $85.80 price sits well below an estimated future cash flow value of $180.49, which would frame the shares as materially undervalued. When one model sees limited upside and another suggests a wide gap the other way, which set of assumptions do you trust more: growth expectations or cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brunswick for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Brunswick Narrative

If you look at Brunswick’s numbers and story and come to a different view, you can stress test every assumption yourself and build a custom thesis in just a few minutes, starting with Do it your way.

A great starting point for your Brunswick research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Brunswick has sharpened your focus, do not stop there. A few minutes with the right screeners can surface other opportunities you might wish you had seen earlier.

- Spot potential bargains by scanning these 872 undervalued stocks based on cash flows built around cash flow and valuation checks that can help you prioritise where to research next.

- Ride major technology shifts by filtering for these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Target higher income potential by reviewing these 13 dividend stocks with yields > 3% that combine yield with business fundamentals rather than just chasing the highest payout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Brunswick might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com