- In recent months, Hub Group has drawn renewed attention as multiple banks initiated or upgraded coverage with positive ratings while the company broadened its brokerage, final-mile, and dedicated logistics offerings through tuck-in acquisitions. This combination of favorable analyst sentiment and incremental service expansion has shifted how investors weigh the company’s operational execution against its historically modest growth and profitability.

- One particularly interesting angle is that this wave of bullish research has arrived even as Hub Group’s long-term returns on capital and share repurchase follow-through have trailed peers, raising questions about whether its evolving service mix can eventually close that performance gap.

- We’ll now examine how this fresh analyst optimism around Hub Group’s tuck-in acquisitions and expanded logistics offerings might reshape its investment narrative.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hub Group Investment Narrative Recap

To own Hub Group, you need to believe its shift toward broader, tech-enabled logistics and tuck-in acquisitions can eventually translate into better returns on capital despite historically modest growth. The recent wave of upbeat analyst coverage supports that narrative in the short term, but does little to reduce the key risk that soft freight demand and revenue per load pressure could prolong earnings volatility.

Among the recent developments, Wells Fargo’s initiation of coverage with a supportive rating and a US$47.00 price target stands out, because it aligns directly with the market’s focus on Hub Group’s expanding brokerage, last mile, and dedicated offerings as potential earnings catalysts, even as past capital deployment and underused share repurchase capacity remain areas of investor debate.

Yet investors should be aware that if digital freight platforms and direct shipper carrier links keep advancing faster than Hub Group’s own technology investments…

Read the full narrative on Hub Group (it’s free!)

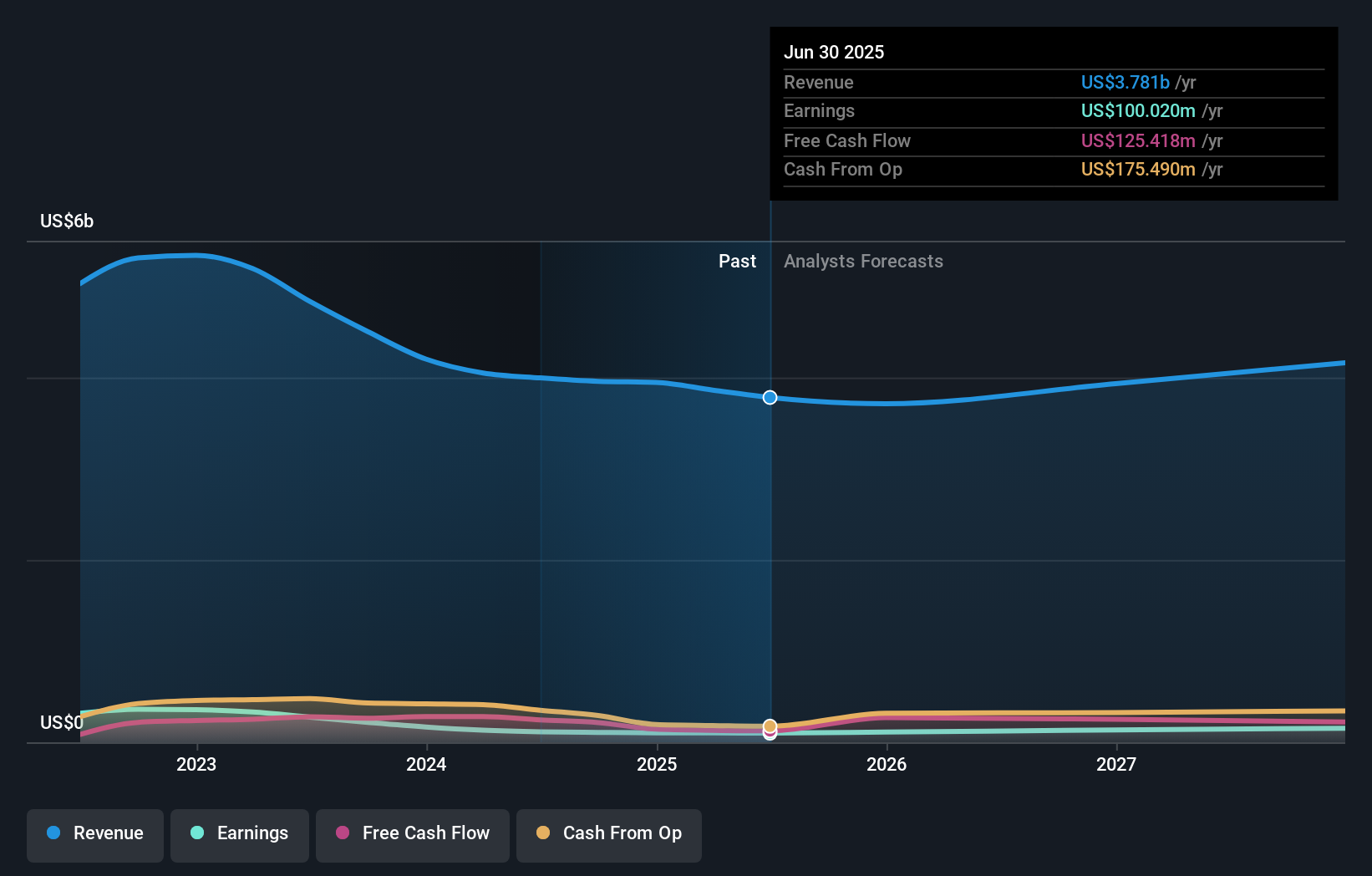

Hub Group’s narrative projects $4.3 billion revenue and $164.5 million earnings by 2028. This requires 4.3% yearly revenue growth and a $64.5 million earnings increase from $100.0 million today.

Uncover how Hub Group’s forecasts yield a $39.94 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from about US$39.94 to US$66.75, underlining how far apart investor views can be. You can weigh those against the risk that weaker intermodal and logistics revenue, if prolonged, could still pressure margins and returns despite recent optimism.

Explore 3 other fair value estimates on Hub Group – why the stock might be worth as much as 62% more than the current price!

Build Your Own Hub Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Hub Group’s overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com