If you want to take advantage of high interest rates to boost your savings, you may be looking for alternatives to a savings account. Certificates of deposit and Treasury bills offer annual percentage yields (APYs) of 5.00% or better and can be excellent options to maximize your savings.

But which of those is better for you? When weighing CDs vs. Treasury bills, here’s what you need to know to decide.

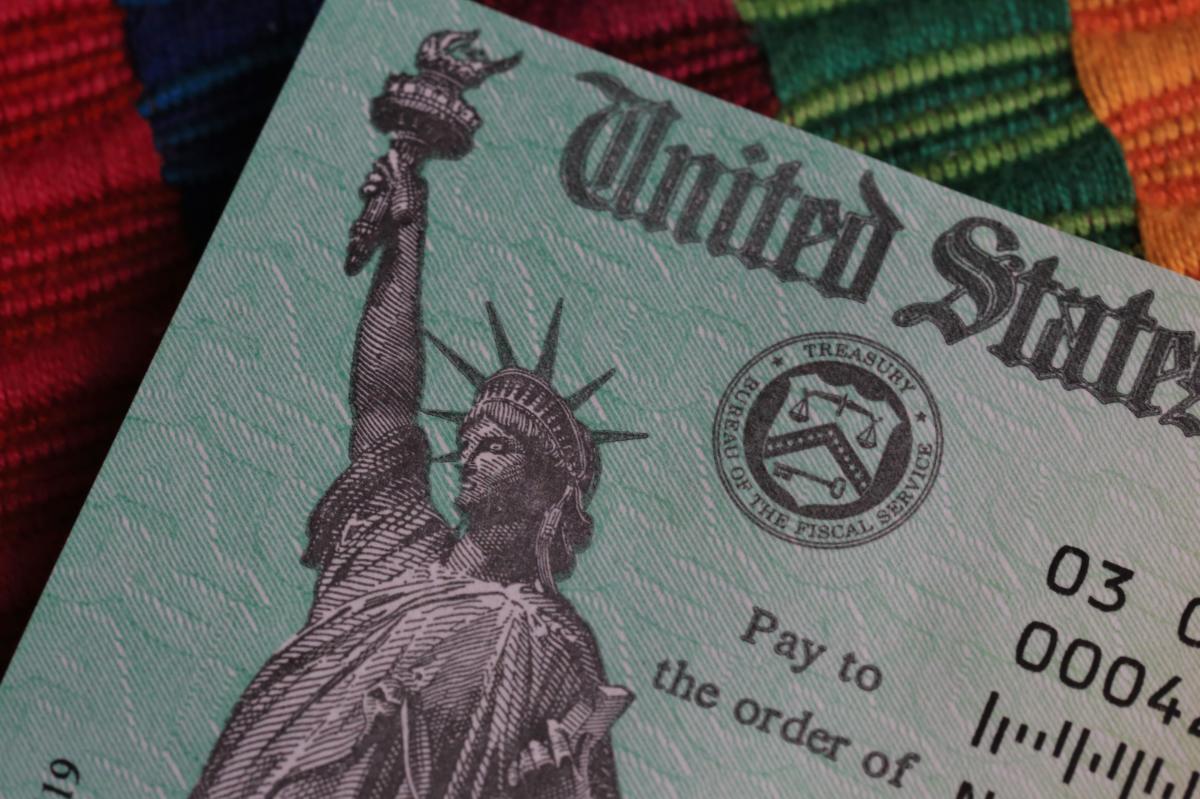

What are Treasury bills, and how do they work?

Lately, interest in Treasury securities has skyrocketed. From 2011 to 2021, just 2.4 million accounts were created on the TreasuryDirect website. But in 2022 alone, 3.7 million people opened new accounts.

What’s behind the demand? Treasury securities, including Treasury bills, also known as T-bills, offer higher APYs than many other savings options right now. And Treasury securities are among the safest places to put your money because they are backed by the full faith and credit of the U.S. government.

They’re shorter-term securities; they have maturity dates of one year or less. You can purchase a T-bill with a maturity date of four, eight, 13, 17, 26, or 52 weeks.

T-bills are sold at a discount from the face value of the bill; when the bill matures, you’re paid the full face value. As of the end of January 2024, the discount produces returns equivalent to 4.57% to 5.29% APY.

With their maturity dates and returns, T-bills can be useful tools to help you reach short-term financial goals, such as saving for a down payment to buy a home or a new car.

What are CDs?

Historically, CDs have been one of the less popular deposit accounts. According to the Federal Reserve, just 6.5% of American adults held a CD as of 2022, the last available data.

But with interest rates higher than they’ve been in years past, more people are interested in opening CD accounts than before.

When you open a CD, you deposit money into an account and agree to leave it there — without any withdrawals or additional deposits — for a specific period, such as 12 months. CD terms can vary significantly between banks; you can find terms as short as one month or as long as 10 years.

Most CDs pay a fixed rate of interest for the length of their terms. However, the money in the CD cannot be touched until the CD matures. If you withdraw money before its maturity date, you’ll be hit with an early withdrawal penalty. Typically, you’ll have to forfeit some of the interest you’ve earned.

CDs are a safe investment; the interest rate is fixed for the CD’s term, and your deposit in a CD is backed by the Federal Deposit Insurance Corporation (FDIC). With FDIC insurance, deposits of up to $250,000 per depositor per bank are protected against bank failures.

Tax considerations

If you’re deciding between CDs and Treasury bills, you should consider how each of them are taxed.

Treasury bills and taxes

With Treasury bills, the money you earn — the difference between the discounted purchase price and its face value at redemption — is taxable as income on your federal tax return. However, Treasury bills are exempt from state or local taxes.

If you own Treasury bills, the U.S. Department of the Treasury will send you and the IRS Form 1099-INT, Interest Income. The form will list the amount of interest that you earned during the tax year.

Treasury bill earnings or interest is reportable in the year you sell it; the sell date may be a different tax year than when you bought it. For example, if you bought a Treasury bill with a 52-week maturity in April 2023, it would mature — and you’d earn money — in 2024, so you’d report the earnings for the 2024 tax year.

CDs and taxes

CDs earn interest throughout their terms. The interest you earn on a CD — even if you leave it untouched — is taxable as income. CD interest is taxable at the federal, state, and local levels, meaning CDs carry potentially more of a tax burden than Treasury bills.

As with T-bills, the interest you earn on a CD will be reported on Form 1099-INT. With a CD whose term crosses across tax years or is multiple years in length, you’ll receive a 1099-INT for each year that you earn interest.

Face-off: CDs vs. Treasury bills

CDs and Treasury bills provide advantages over traditional savings accounts, but there are some key differences to keep in mind:

-

Taxation: Your earnings with both T-bills and CDs are taxable as income. However, CDs are taxable at the federal, state, and local levels, but T-bills are only subject to federal income taxes.

-

Earnings: A CD pays interest at regular intervals throughout its term. Once it matures, you receive the principal and the earned interest. T-bills work differently; they don’t pay interest. Instead, you purchase them at a discount, and the difference between the purchase price and the face value at the time of its maturity date is how much money you earn.

-

Issuer: T-bills are backed by the full faith and credit of the U.S. government, and you can purchase up to $10 million in T-bills (in non-competitive bids). By contrast, CDs are issued by banks, and they’re backed by FDIC insurance. Under FDIC rules, deposits of up to $250,000 are protected per depositor and per bank.

-

Maturity length: Treasury bills have limited term options; terms range from four to 52 weeks. With CDs, you have more options. CD terms can be a few months or several years. A CD with a longer term allows you to lock in a certain APY for a lengthy period.

-

Investment amount: The minimum purchase amount for Treasury bills is $100. With CDs, the minimum investment varies by bank, but it can be as high as $1,000 or more. A higher minimum investment requirement can be challenging for those who are just starting out or have limited cash.

-

Liquidity: CDs are not liquid accounts; the money is locked until the CD’s maturity date, or you’ll have to pay hefty penalties. T-bills provide more liquidity; they can be sold if you need cash fast.

Making an informed decision

Now that you know the key features of CDs and Treasury bills, you can decide which option is better for your needs. If you’re still unsure, consider these scenarios:

-

If you’re saving for a goal less than a year away: If you’re saving money for a goal with a short-time horizon, T-bills can make more sense than CDs. They provide a higher APY than savings accounts, and they’re more liquid than CDs.

-

If you want to invest a significant amount of money: With CDs, FDIC insurance only applies to up to $250,000 of deposits per depositor, per bank. If you plan on investing more than that, you’ll have to spread your money across multiple banks. T-bills may be a simpler option; they’re backed by the government, and you can invest up to $10 million.

-

If you want to lock in a high APY for several years: With today’s current rates, you may want to lock in a high APY for a longer period, such as five to 10 years. If that’s the case, CDs are the clear winner over T-bills. The maximum term for a T-bill is 52 weeks, while CDs can have terms as long as 10 years.

Both CDs and Treasury bills are safe options that can help you grow your money faster. Which tool is better for you depends on your goals, how liquid you need your money to be, and time horizon.

Once you’ve made a decision, you can purchase T-bills online through TreasuryDirect, or view the best CD rates to open a new account.