In This Story

After a hectic week filled with major earnings reports, an AI summit, robotaxis, and key inflation data, this coming week will be shorter but still significant.

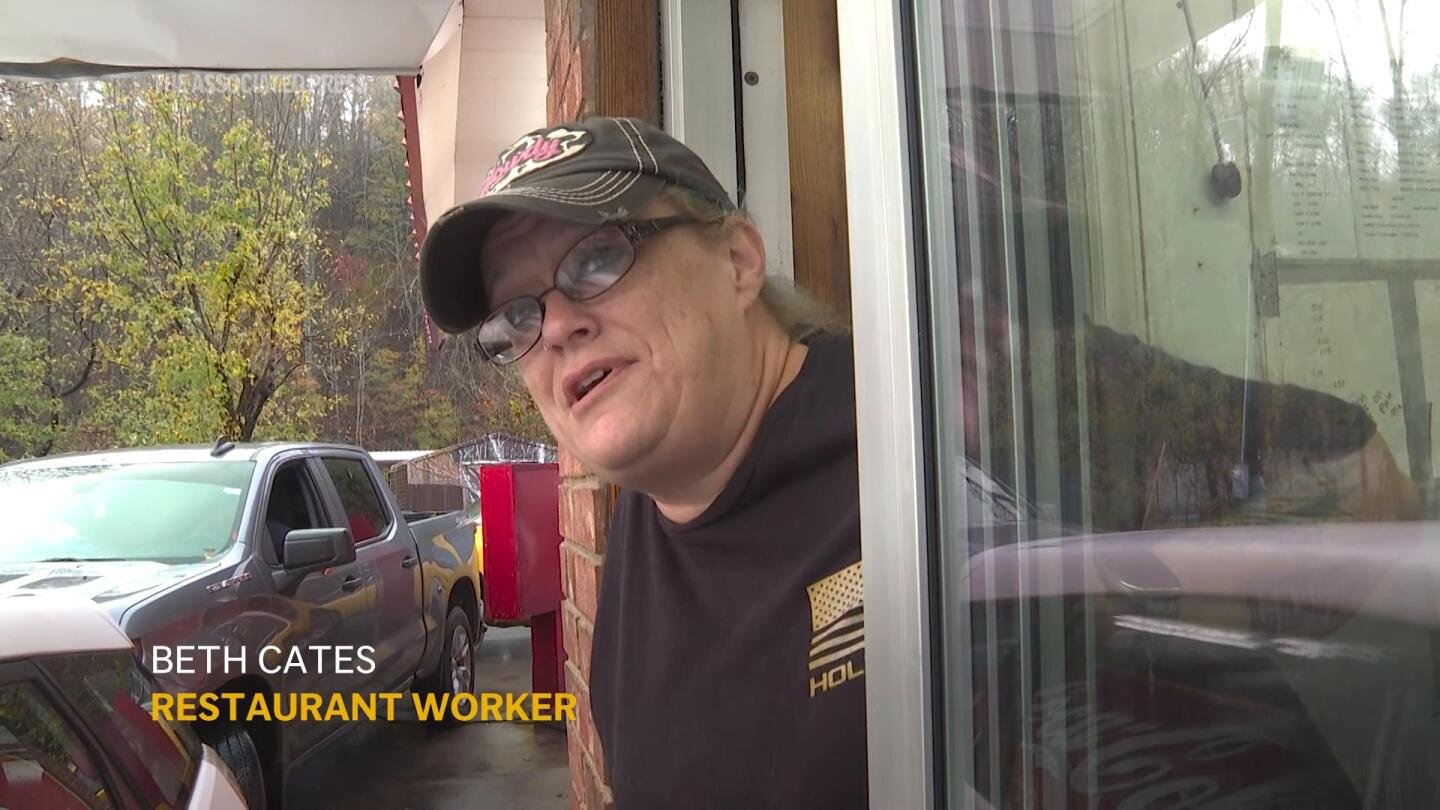

California’s new $20 minimum wage for fast food workers didn’t cost jobs, study says

Here’s what’s on the agenda for the week ahead.

Is the stock market closed on Columbus Day?

No, the New York Stock Exchange (ICE) and the Nasdaq (NDAQ) will remain open Monday during Columbus Day, also known as Indigenous Peoples’ Day.

But bond markets will be closed.

Big bank earnings

Several major banks and financial institutions are set to release their quarterly earnings, offering valuable insights into their performance and broader economic trends. Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C) will kick off the week with their earnings reports Tuesday, shedding light on how well these financial giants have navigated recent market volatility.

Discover Financial Services (DFS) and Citizens Financial Group (CFG) will reveal their financial health Wednesday, providing a closer look at consumer credit trends and regional banking performance. On Thursday, earnings from Morgan Stanley (MS), Blackstone (BX), and M&T Bank Corporation (MTB) will follow, giving insight into investment banking, private equity, and regional banking sectors. Finally, the week closes Friday with American Express (AXP) reporting its earnings.

Netflix and other important earnings

On Tuesday, Johnson & Johnson (JNJ), UnitedHealth Group (UNH), and Walgreens (WBA) will release their earnings reports before the opening bell, offering a glimpse into the healthcare and insurance sectors. On Thursday, the spotlight shifts to technology and travel, as Taiwan Semiconductor Manufacturing Company (TSM), Netflix (NFLX), American Airlines (AAL), and Alaska Airlines (ALK) will release their financial report cards.

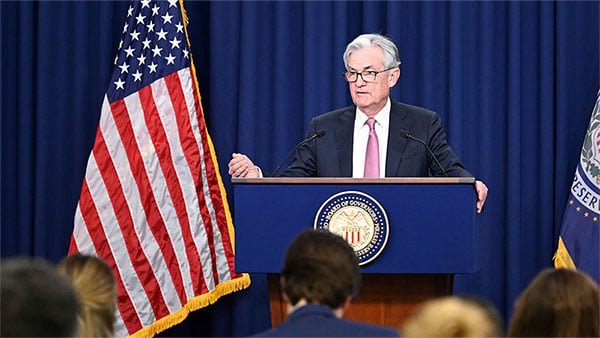

Macroeconomic data to watch

While this week won’t bring any blockbuster macroeconomic reports, several key indicators will still provide valuable insights into the health of the U.S. economy. On Wednesday, the Import Price Index for September will be released, offering a glimpse into inflationary pressures from imported goods.

On Thursday, initial jobless claims will provide an updated snapshot of the U.S. labor market. The release of U.S. retail sales data will shed light on consumer spending patterns, a key driver of economic growth. Industrial production data will offer insights into manufacturing output and factory activity nationwide. Additionally, homebuilder confidence for October will gauge the housing market’s health, providing an outlook on construction activity and the broader real estate sector.