The growth potential of cybersecurity is good news for CrowdStrike and its investors.

CrowdStrike Holdings (CRWD 0.79%) is one of the leaders in cybersecurity and continues to gain momentum by the day. When it released its Falcon platform in 2013, it was viewed as one of the pioneers of cloud-native solutions powered solely by artificial intelligence (AI).

Since its initial public offering (IPO) on June 12, 2009, CrowdStrike’s stock has increased by around 320%. Had you invested $25,000 in the company during that time and held on to the stock, your stake would be worth close to $116,000 today.

This amount would’ve been much higher in mid-July before CrowdStrike’s stock plunged due to a global IT outage it caused while attempting a software update. This massive mistake sent investors fleeing and the stock is now down over 28% since July 18.

Despite the catastrophic mishap that will surely linger over the company for the foreseeable future, I believe CrowdStrike is still very early in what it can ultimately become. Considering it has only been around since 2011, the company has plenty of time to create millionaires.

Growing at even a fraction of its recent years could do the trick

CrowdStrike has averaged over 40% annual returns since its IPO, over three times the S&P 500‘s performance during that span. It’s unreasonable to assume it can keep that momentum going for decades, but it doesn’t have to in order to create millionaires.

For an investment to go from $25,000 to $1 million in 20 years, it must grow just over 20% annually. To hit $1 million from $100,000 in 20 years, it must grow around 12.25% annually. It would be a magnificent feat to average 20% annual returns over two decades, but the latter option is very doable.

You never want to make assumptions about a stock’s future growth (or decline), but CrowdStrike is a leader in an industry that’s poised for explosive growth in the coming years.

The growth potential of the cybersecurity industry

Cybersecurity has gone from a luxury to a required expense for virtually any company with online operations. It’s essentially like insurance: You pay lower costs up front and over time to avoid much higher costs (to your finances and to your reputation) if your company falls victim to a cyberattack.

According to research from McKinsey, the total addressable market for cybersecurity solutions could end up being between $1.5 trillion and $2 trillion. As of 2022, the consulting firm estimated only $150 billion of it had been captured.

McKinsey says the gap is largely because of the lack of automation, high pricing, and insufficient service abilities, but that’s where CrowdStrike comes into the picture.

When in doubt, follow the customers

There are plenty of cybersecurity companies, but they’re not all created equal. CrowdStrike has consistently finished as one of the top ones dealing with endpoint security (endpoint meaning any device that connects to a network, like smartphones, laptops, desktops, and servers).

After its latest quarter (ended April 30), the company said, 65% of its customers were using five or more of its modules, 44% used six or more, 28% used seven or more, and the number using eight or more had increased 95% year over year. That’s a testament to how complete and effective its platform is.

It’s also worth noting that 62 of the Fortune 100 (the 100 largest U.S. companies by revenue) use CrowdStrike for their cloud security. At that size, companies demand extremely reliable and comprehensive protection, so their reliance on it demonstrates its reputation for delivering top-tier service.

It has great finances to go with its customer growth

Large companies come with large checkbooks, and it’s worked well for CrowdStrike’s financials. Since its business model depends on subscriptions, annual recurring revenue (ARR) gives good insight into its financial health. In its last quarter, CrowdStrike added $212 million in net new ARR, bringing its total to $3.65 billion, a 33% year-over-year increase.

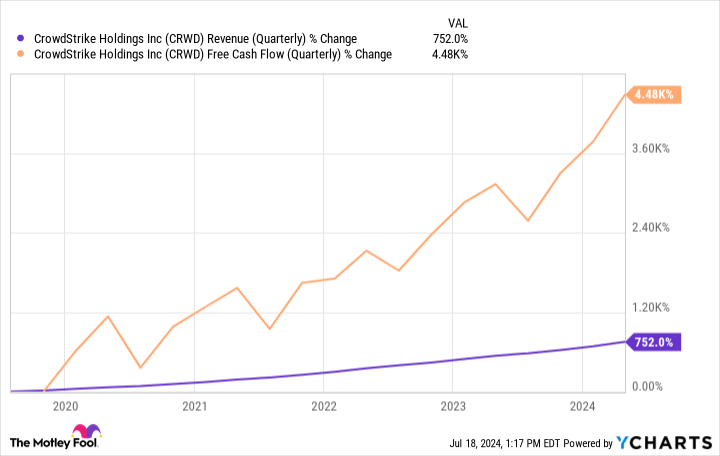

The $921 million in revenue in the quarter was up 33%, and its free cash flow was up 42% with increased margins.

CRWD revenue (quarterly); data by YCharts.

You still need to abide by conventional investing wisdom

Despite CrowdStrike’s past success and bright future, investors must not lose sight of the importance of diversification. The stock should be part of a well-rounded portfolio, and not the bulk of it. Any stock has volatility, but as a relatively new growth stock, CrowdStrike is more susceptible to it.

Embracing CrowdStrike’s potential while maintaining a balanced portfolio will help you benefit from its growth while hedging yourself against the unpredictable nature of an irrational stock market. With a bit of patience, CrowdStrike could be a stock that creates millionaires along its journey.

Stefon Walters has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.