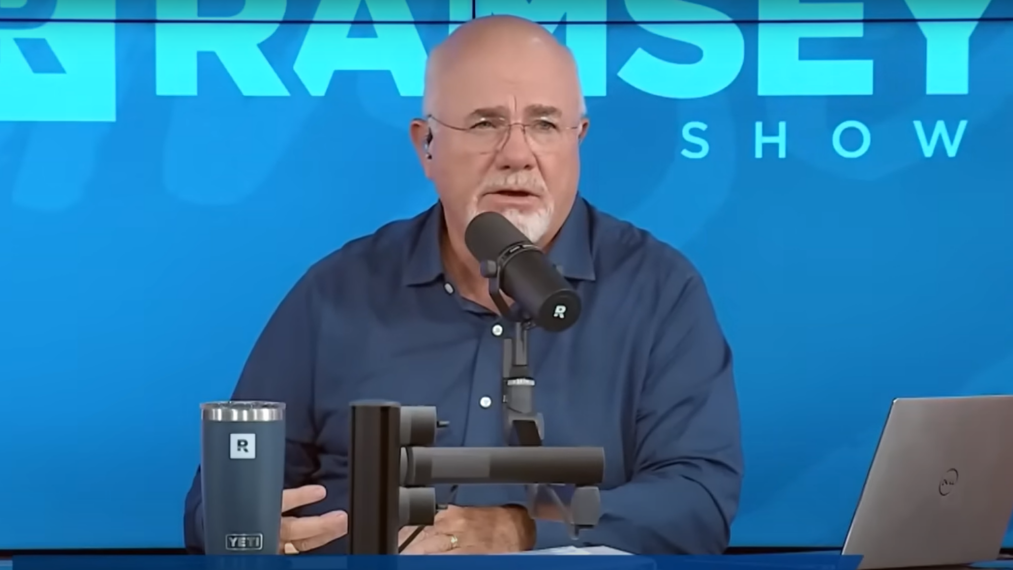

Dave Ramsey, the personal finance expert, provided guidance to a 29-year-old caller from Washington D.C. facing nearly $1 million in debt. In the YouTube video, the newly married woman sought Ramsey’s advice on his radio show to navigate their substantial debt without resorting to bankruptcy. Their financial obligations encompassed a mortgage, student loans, credit cards, personal loans and car loans.

Ramsey detailed their debt, highlighting a $210,000 mortgage, $335,000 in student loans and considerable credit card and personal loan debt. He labeled their situation as absurd, pointing out the stark contrast between their lifestyle and their income. Despite their advanced degrees and government jobs, which brought in a combined income of about $230,000, the couple was fully aware of their dire financial straits. “You’re scared, and you should be. You’re disgusted, and you should be,” Ramsey affirmed, emphasizing the gravity of their predicament.

Don’t Miss:

-

For many first-time buyers, a house is about 3 to 5 times your household annual income – Are you making enough?

-

Are you rich? Here’s what Americans think you need to be considered wealthy.

The solution, according to Ramsey, involved a drastic lifestyle overhaul. He warned, “I’m getting ready to destroy your life as you know it,” advocating for extreme frugality and a significant reduction in spending. The essence of his advice was encapsulated in the directive to adopt a “beans and rice, rice and beans” lifestyle, symbolizing the need to cut back on all non-essential expenditures. This approach necessitated selling off non-essential assets and embracing a simpler way of life.

Ramsey’s guidance didn’t just focus on financial strategies but also addressed the emotional and spiritual growth that comes from facing and overcoming such challenges. He remarked, “You’ve been living at about 10x where you’re supposed to live. You’ve gotten used to spending like you’re in Congress. It’s going to crush a lot of crap in your soul that caused you to do this.” He underscored the importance of confronting the behaviors and attitudes that led to their debt, even predicting that the process would lead them to a point where societal perceptions and materialistic desires would no longer influence their choices.

The financial expert didn’t shy away from illustrating the stark realities of their journey ahead, including the prospect of driving a “piece-of-crap car” as a testament to their commitment to financial recovery. He candidly stated, “You’re gonna pull up at a stoplight driving a piece-of-crap car next to people that have an income a fourth of yours but a nicer car than yours,” emphasizing the humility and sacrifice required to escape their financial quagmire.

Trending: The average American couple has saved this much money for retirement — How do you compare?

Ramsey anticipated the social and familial skepticism the couple would face, suggesting, “Your friends are gonna think you’ve lost your mind and your mother’s gonna think you need counseling.” This advice highlighted the broader societal challenges and the pressure to conform to certain financial behaviors, which they would need to overcome.

Ramsey suggested selling the condo they had put up for rent to jump-start their debt repayment, a move that could significantly dent their overall debt and symbolize their dedication to turning their financial situation around.

While not everyone may require Dave Ramsey’s specific guidance to set their financial course straight, the value of financial advising cannot be overstated in assisting individuals through their financial journey. Tailored advice from a financial adviser can be invaluable, offering personalized strategies that cater to an individual’s unique situation. This support is critical whether the objective is saving for retirement, preparing for a significant purchase or effectively managing debt.

Ramsey’s conversation with the couple serves as a powerful reminder of the pervasive issue of debt in America and underscores the importance of financial literacy. His tough-love approach, while daunting, provides a clear blueprint for those willing to confront their financial realities head-on and work diligently towards a debt-free future. Through this dialogue, Ramsey not only offers financial advice but also a path to personal and spiritual growth, challenging individuals to reconsider their values and the impact of their financial decisions on their lives.

Read Next:

-

Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

-

How to turn a $100,000 investment into $1 Million — and retire a millionaire.

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Tells 29-Year-Old With $1 Million In Debt He’s Going To Destroy Her Life As She Knows It – ‘Your Friends Are Going To Think You’ve Lost Your Mind And Your Mother Is Going To Think You Need Counseling’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.