Futures are pointing to a mixed open for major U.S. indexes on Monday as the stock market looks to rebound from a sharp sell-off at the end of last week.

Futures tied to the Dow Jones Industrial Average were down 0.1%, while S&P 500 and Nasdaq 100 futures rose 0.1% and 0.3%, respectively. Stocks are coming off their worst weekly performance since September, with the S&P 500 and Nasdaq Composite losing 1.3% and 2.2%, respectively, as the post-election rally that had boosted stocks to record highs lost steam.

Shares of AI investor favorite Nvidia (NVDA), which will release its highly anticipated earnings report on Wednesday, were down 2.5% in premarket trading following reports that the company’s new Blackwell chips have faced overheating issues.

Shares of Tesla (TSLA) were up 6% this morning on a report that President-elect Donald Trump’s transition team is planning a federal framework for fully self-driving vehicles, as investors bet on easier rules for the company’s robotaxi.

Other mega-cap tech stocks were mostly higher, with Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and Amazon (AMZN) rising, while shares of Meta Platforms (META) were down slightly.

Among other noteworthy movers, Super Micro Computer (SMCI) shares were up 11%, following reports that the beleaguered server maker is expected to submit a plan today for its delayed annual report that could help the server maker avoid a Nasdaq delisting.

The yield on 10-year Treasurys, which is sensitive to expectations around interest rates, rose to 4.47% from 4.43% on Friday, trading at its highest levels since early July. The yield has risen in recent weeks as investors have adjusted their expectations on how aggressive the Federal Reserve will be as it cuts interest rates. Last week, Fed Chair Jerome Powell said that the central bank isn’t in a hurry to cut rates as inflation is on a bumpy path toward the Fed’s target.

Bitcoin was trading at around $89,500, after rising above $92,000 overnight. The cryptocurrency hit record highs above $93,000 last week amid investor optimism that the Trump administration and a crypto-friendly Congress will implement measures that benefit the asset class.

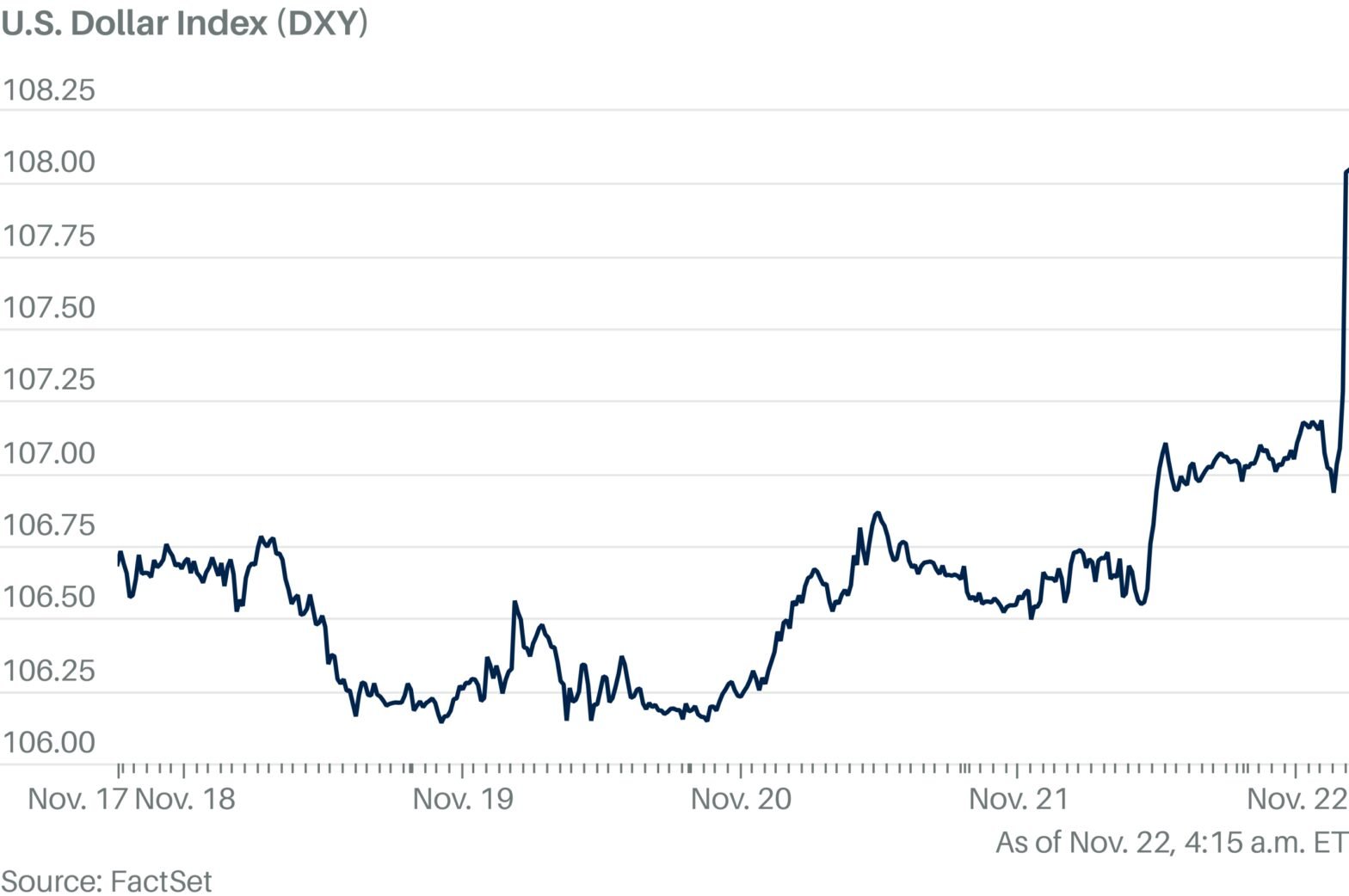

Gold futures were up 1.5% to $2,610 an ounce this morning. The precious metal, which hit record highs above $2,800 earlier this month, has lost ground as the U.S. dollar has strengthened since the presidential election.

Tesla Jumps as Trump Reportedly Plan to Ease Self-Driving Rules

20 minutes ago

Shares of Tesla (TSLA) moved higher in premarket trading Monday following a report that President-elect Donald Trump’s transition team is planning a federal framework for fully self-driving vehicles, as investors bet on easier rules for the company’s robotaxi.

Tesla CEO Elon Musk, who is part of Trump’s inner circle, benefits under such a framework as he has made the robotaxi, a vehicle that will be able to drive itself without human supervision, a key focus of the EV maker’s future.

According to Bloomberg, Trump’s transition team members have told advisers they plan to make a federal framework for fully self-driving vehicles one of the Transportation Department’s priorities.

At the moment, companies looking to sell vehicles without steering wheels or foot pedals en masse, something Tesla is planning, face significant regulatory hurdles, the report said. Present U.S. rules also pose big obstacles for Tesla’s plans for a robotaxi, including a cap that limits their deployment, the report added.

Wedbush analysts reiterated their outperform call on the EV maker, saying a federal framework would be “bullish for Tesla” and a “huge step forward in easing US rules for self-driving cars.”

Wedbush, which has a $400 price target on the EV maker, said last week that Tesla, which is less reliant on credits than smaller upstarts, could even benefit from less government support for EVs, Investors expect a Trump presidency to roll back EV credits given under the Biden administration.

Tesla shares, which have gained more than 30% since election day, were up 6% in recent premarket trading.

Major Index Stock Futures Mixed

20 minutes ago

Futures tied to the Dow Jones Industrial Average were down 0.2%.

TradingView

S&P 500 futures were up fractonally.

TradingView

Nasdaq 100 futures were up 0.2%.

TradingView