The Switzerland market ended modestly higher on Tuesday, tracking positive cues from across Europe, amid continued optimism about an interest rate cut by the Federal Reserve on Thursday. In this favorable market environment, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on the momentum.

Top 10 High Growth Tech Companies In Switzerland

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

LEM Holding |

8.69% |

18.38% |

★★★★☆☆ |

|

ALSO Holding |

11.99% |

23.95% |

★★★★☆☆ |

|

Santhera Pharmaceuticals Holding |

26.80% |

35.40% |

★★★★★★ |

|

Comet Holding |

21.22% |

47.97% |

★★★★★★ |

|

Temenos |

7.59% |

14.32% |

★★★★☆☆ |

|

SoftwareONE Holding |

8.60% |

52.57% |

★★★★★☆ |

|

Cicor Technologies |

7.10% |

27.73% |

★★★★☆☆ |

|

Basilea Pharmaceutica |

8.99% |

36.39% |

★★★★★☆ |

|

Sensirion Holding |

13.96% |

104.68% |

★★★★☆☆ |

|

Kudelski |

12.23% |

121.75% |

★★★★☆☆ |

Let’s review some notable picks from our screened stocks.

ALSO Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.27 billion.

Operations: ALSO Holding AG generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). The company focuses on providing technology services within the ICT industry across various international markets.

ALSO Holding AG, a prominent player in Switzerland’s tech sector, reported half-year sales of €4.28 billion and net income of €41.66 million. Despite a 20.4% earnings drop over the past year, its future annual profit growth is forecasted at an impressive 24%, outpacing the Swiss market’s 11.7%. The company invests significantly in R&D to innovate within its distribution and service segments, ensuring long-term growth prospects despite recent volatility in share prices.

-

Navigate through the intricacies of ALSO Holding with our comprehensive health report here.

-

Understand ALSO Holding’s track record by examining our Past report.

Comet Holding

Simply Wall St Growth Rating: ★★★★★★

Overview: Comet Holding AG, with a market cap of CHF2.45 billion, provides X-ray and radio frequency (RF) power technology solutions through its subsidiaries across Europe, North America, Asia, and internationally.

Operations: Comet Holding AG generates revenue primarily through its three segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million).

Comet Holding AG, a notable tech firm in Switzerland, reported half-year sales of CHF 189.32 million and net income of CHF 4.06 million, reflecting significant growth from CHF 1.94 million a year ago. Despite a volatile share price recently, the company’s earnings are forecasted to grow at an impressive 48% annually over the next three years, outpacing the Swiss market’s average of 11.7%. With R&D expenses constituting a substantial portion of their budget and revenue expected to grow at 21.2% per year, Comet’s innovative strides in semiconductor and X-ray technology position it well for future advancements.

-

Get an in-depth perspective on Comet Holding’s performance by reading our health report here.

-

Assess Comet Holding’s past performance with our detailed historical performance reports.

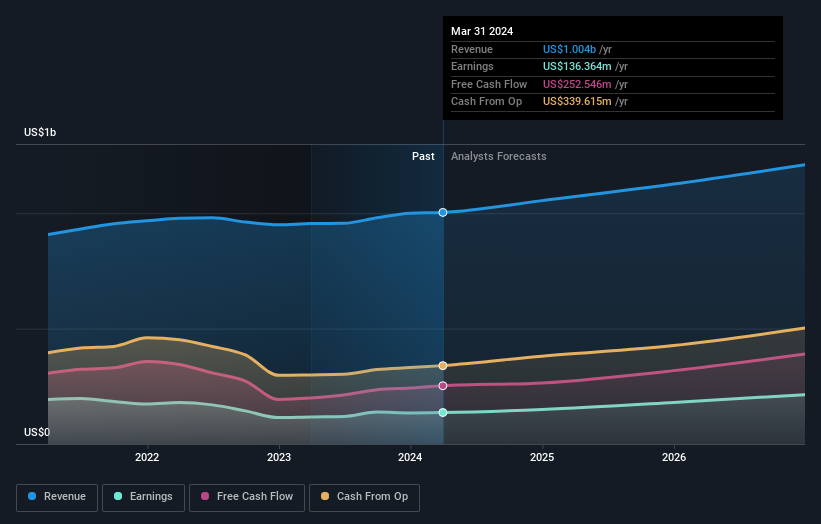

Temenos

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions worldwide and has a market cap of CHF4.38 billion.

Operations: Temenos AG generates revenue primarily through its product segment, which accounts for $879.99 million, and its services segment, contributing $132.98 million.

Temenos, a prominent player in the software industry, is forecasted to see earnings grow by 14.3% annually, outpacing the Swiss market’s average of 11.7%. The company has recently repurchased 4.45% of its shares for CHF 200 million and reported Q2 revenue of USD 248.39 million with net income slightly down at USD 37.06 million from the previous year’s USD 38.31 million. With R&D expenses constituting a significant portion of their budget, Temenos’ focus on SaaS models ensures recurring revenue and positions it well for future growth in digital banking solutions.

-

Click here and access our complete health analysis report to understand the dynamics of Temenos.

-

Examine Temenos’ past performance report to understand how it has performed in the past.

Where To Now?

-

Unlock our comprehensive list of 10 SIX Swiss Exchange High Growth Tech and AI Stocks by clicking here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Seeking Other Investments?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:ALSN SWX:COTN and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com