Shares of Nvidia remained a hot commodity on the stock market in 2024 with solid gains of 58% already, which is not surprising as the chipmaker is already projected to deliver another outstanding year of revenue and earnings growth because of the booming demand for graphics cards used in artificial intelligence (AI) servers.

However, there is another semiconductor bellwether whose shares have gained solid momentum on the market. ASML Holding (NASDAQ: ASML) stock is already up 25% in 2024, and management’s comments in the company’s latest annual report indicate that it could keep heading higher as the year progresses.

Let’s look at the reasons why ASML stock’s bull run is set to continue in 2024. We will also check why it could turn out to be a solid bet for investors looking to buy a semiconductor stock right now but may not be comfortable with Nvidia’s rich valuation.

ASML Holding will benefit from higher chip spending in 2024

ASML CFO Roger Dassen remarked in the company’s annual report that the semiconductor equipment market is now in recovery mode:

We believe that the market has now reached the lowest point of the dip, and although we cannot predict the exact nature of the slope ahead, the recovery is nascent. The longer-term trends are unmistakable — artificial intelligence, electrification, and the energy transition are happening, and those factors are underlined by the large number of fabs that are set to open in the next couple of years. All of these new fabs will need our tools.

According to the semiconductor industry association SEMI, 42 new semiconductor fabrication plants are set to begin operations in 2024. That’s a big jump over just 11 fabs that went into operation last year, as well as the 29 new fabs that went online in 2022. This explains why the spending on semiconductor manufacturing equipment that ASML sells is expected to increase in 2024, following a 6% decline in 2023 to $100 billion. By 2025, SEMI predicts equipment spending will jump to a record $124 billion.

This jump in equipment spending is already driving solid growth in ASML’s sales orders. The Dutch company received bookings worth 9.2 billion euros in the fourth quarter of 2023. That was a big jump as compared to bookings of 2.6 billion euros in the third quarter of 2023. As a result, ASML’s order backlog stood at an impressive 39 billion euros at the end of the previous quarter.

That’s higher than the company’s revenue forecast for the current year. ASML delivered 27.6 billion euros in revenue in 2023, and it expects a similar level of revenue in 2024. However, the sizable backlog and the uptick in semiconductor spending could eventually help the company deliver stronger growth and help ensure that ASML stock’s bull run continues. What’s more, ASML is confident of delivering a sharp jump in revenue in 2025 as well.

The company reiterated its 2025 revenue guidance of 30 billion euros to 40 billion euros for 2025, along with a gross margin of 54% to 56%. It won’t be surprising to see ASML hitting the higher end of that guidance range, considering the backlog it is sitting on, as well as the fact that the company is going to raise the production capacity of its latest extreme ultraviolet lithography (EUV) machine, which is priced at $350 million.

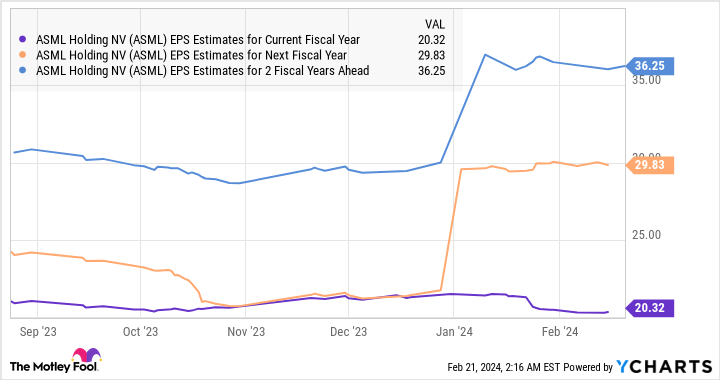

All this indicates why analysts are expecting a significant jump in the company’s earnings from 2025.

Investors can expect the stock to jump strongly in 2024 and beyond

We have already seen that ASML is capable of delivering stronger earnings growth than what analysts are anticipating, thanks to improving market conditions and its backlog. But even if the company’s earnings jump to $36 per share in 2026 and the stock trades at 35 times forward earnings at that time — equal to its five-year average forward earnings multiple — its stock price could jump to $1,260. That would be a 38% jump from current levels.

However, the market could reward ASML with a higher earnings multiple, considering the potential acceleration in its growth. Nvidia, for instance, trades at a whopping 96 times earnings and 40 times sales. ASML’s price-to-sales ratio, on the other hand, is much cheaper at 12. ASML, therefore, gives investors an avenue to capitalize on the semiconductor industry’s growth at a much cheaper multiple, which is why they should consider buying it before it soars further.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia: This Stock Is Poised for a Potential Bull Run in 2024 was originally published by The Motley Fool