As global markets navigate the complexities of AI disruption and fluctuating economic indicators, investors are increasingly seeking stability amidst volatility. Dividend stocks, known for their potential to provide consistent income and mitigate risk, have become an attractive option in such uncertain times.

Top 10 Dividend Stocks Globally

Click here to see the full list of 1225 stocks from our Top Global Dividend Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Nicca ChemicalLtd (TSE:4463)

Simply Wall St Dividend Rating: ★★★★☆☆

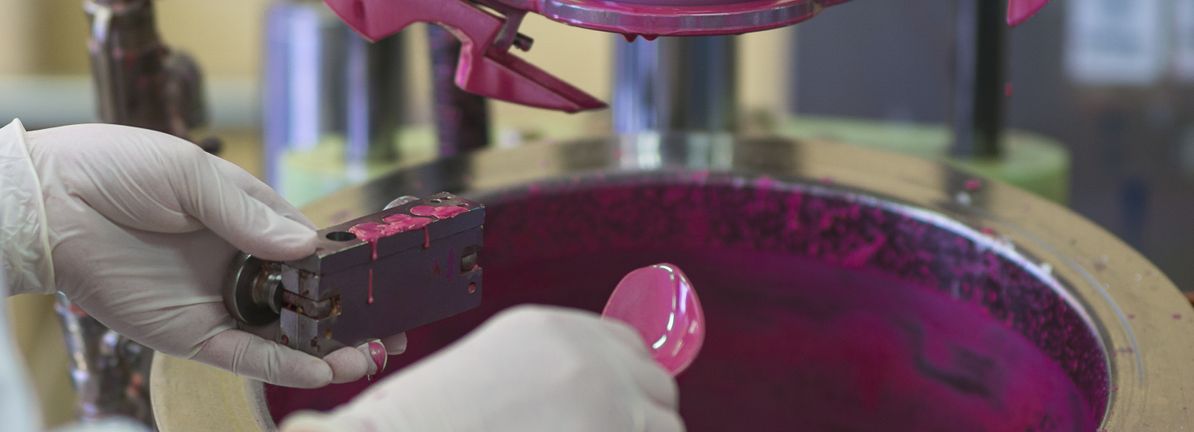

Overview: Nicca Chemical Co., Ltd. is engaged in the manufacture and sale of surfactants for various industries including textiles, metals, and cleaning agents both in Japan and internationally, with a market cap of ¥27.44 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue through its surfactants used in textile chemicals, metals, pulp and paper, paints, dyes, synthetic resins, and dry and professional cleaning agents.

Dividend Yield: 3.4%

Nicca Chemical Ltd. offers a dividend yield of 3.42%, ranking in the top 25% of JP market dividend payers, yet its sustainability is questionable due to insufficient free cash flow coverage. Although the payout ratio stands at a manageable 35.9%, dividends have been volatile over the past decade with significant annual drops exceeding 20%. Despite trading at 39.7% below estimated fair value, investors should be cautious about reliability given historical volatility and lack of free cash flow support.

- Click here and access our complete dividend analysis report to understand the dynamics of Nicca ChemicalLtd.

- The valuation report we’ve compiled suggests that Nicca ChemicalLtd’s current price could be quite moderate.

Mabuchi Motor (TSE:6592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mabuchi Motor Co., Ltd. manufactures and sells small motors in Japan, Europe, North America, and internationally with a market cap of ¥417.33 billion.

Operations: Mabuchi Motor Co., Ltd.’s revenue segments include the manufacture and sale of small motors across various regions, including Japan, Europe, and North America.

Dividend Yield: 3.3%

Mabuchi Motor’s dividend payments have been volatile over the past decade, though they recently announced a significant increase to JPY 67.00 per share for 2025, before a stock split in January 2026. Despite a reasonable payout ratio of 50%, dividends remain low compared to top-tier JP market payers. Earnings surged by over 100% last year, yet forecasts indicate potential declines ahead, raising concerns about future dividend stability despite current coverage by earnings and cash flows.

- Navigate through the intricacies of Mabuchi Motor with our comprehensive dividend report here.

- The valuation report we’ve compiled suggests that Mabuchi Motor’s current price could be inflated.

Akatsuki (TSE:8737)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Akatsuki Corp., along with its subsidiaries, operates in the real estate and securities sectors in Japan, with a market cap of ¥20.34 billion.

Operations: Akatsuki Corp. generates revenue through its Securities Related Business, which contributes ¥15.26 billion, and its Real Estate Related Business, which brings in ¥45.22 billion.

Dividend Yield: 4%

Akatsuki’s dividend yield of 4.03% ranks in the top 25% of JP market payers, but its dividends have been volatile and not well-covered by free cash flows, despite a low payout ratio of 29.3%. Earnings grew by 33.2% last year, yet high non-cash earnings raise quality concerns. The company’s recent ¥1 billion fixed-income offering could impact future cash flow management and dividend sustainability as it trades at a discount to fair value estimates.

- Take a closer look at Akatsuki’s potential here in our dividend report.

- Our expertly prepared valuation report Akatsuki implies its share price may be lower than expected.

Next Steps

- Click through to start exploring the rest of the 1222 Top Global Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com