Everyone likes a bargain. But in the stock market, mindlessly chasing what looks cheap can get you in a heap of trouble.

If you buy a steak for $5, it usually tastes like cheap meat. But investors can make big money when they find a prime cut of meat sitting on the sale rack. That’s getting value for your money, and it’s primarily how Warren Buffett has done so well throughout his decades-long career.

So, where are the deals in a market hitting all-time highs? Here are three great consumer stocks trading at absurdly good prices today. And while price is not value, with their shares trading from $15 to $170, buying full shares of these stocks is within the reach of even those with not much money to invest.

1. Amazon

How is e-commerce and cloud company Amazon (NASDAQ: AMZN) a bargain after galloping up 70% over the past year? I’ll show you. Amazon is unique. Like many companies, it reinvests its profits into the business to create growth, but few do it at the level Amazon does.

That’s how Amazon became the dominant e-commerce company in America (38% market share) as well as the world’s largest cloud platform (31% share), and is becoming a media giant that did $47 billion in ad revenue in 2023 and will stream an exclusive National Football League playoff game next season.

When looking at the stock’s price tag, I like to look at how much operating cash flow investors get for their money. That’s what Amazon’s daily operations make before management reinvests in the business. Using a price-to-operating-cash-flow ratio, you can see that Amazon is still way below where it’s traded over the past decade. Additionally, Amazon is (by far) making more money per share than ever.

Investors have made a lot of money by holding Amazon stock for years. Today, Amazon is one of the world’s largest corporations, so investors shouldn’t expect the business to continue multiplying in size like it has in the past, but Amazon is too good a company for the stock to trade this cheap.

2. Altria

Tobacco company Altria (NYSE: MO) has seen its share price slide for several years, giving investors $5-steak vibes. However, the future could look brighter than the recent past. Altria’s core business, selling smokeable products, has remained financially durable despite years of declining volumes.

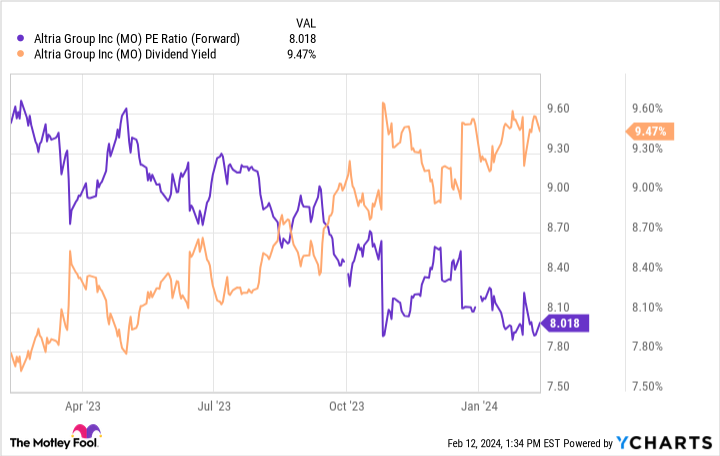

Long-term investors shouldn’t buy the stock based on that alone, but it does support one of the highest dividend yields you’ll find. Altria’s dividend yield is nearly 10%, and the company’s steady profits and 79% dividend payout ratio mean it’s sustainable.

Over time, Altria will need to grow different revenue streams, and it does have potential with Njoy, a heat-not-burn tobacco device it acquired rights to for $2.75 billion last year. Altria will apply the Marlboro name to the Njoy device as a smokeless cigarette alternative. It also has On!, an oral nicotine pouch brand.

You can see the stock’s price-to-earnings ratio and dividend yield in the chart below.

Lastly, Altria owns a stake in Anheuser-Busch InBev worth roughly $13 billion. Management could cash that in to help fund Altria’s pivot away from cigarettes.

While there are long-term concerns about Altria’s cigarette business, the dividend is rock-solid today, and the stock trading at 8 times earnings gives investors a cheap enough buying price to take on some of that risk.

3. Coupang

Much like Amazon, South Korean company Coupang (NYSE: CPNG) built an e-commerce business and is expanding. The company has a quarter of South Korea’s e-commerce market, where it’s famous for delivering 99% of orders by the next day, often within hours of being placed. Coupang also offers customers online grocery delivery, meal delivery, and media and payment services.

Coupang’s active customer base was 20 million as of the third quarter of last year, up 14% year over year. South Korea’s population is just 52 million, so management has expanded into Taiwan, where it’s heavily investing to establish itself. That unlocks a new market with an additional 23 million people.

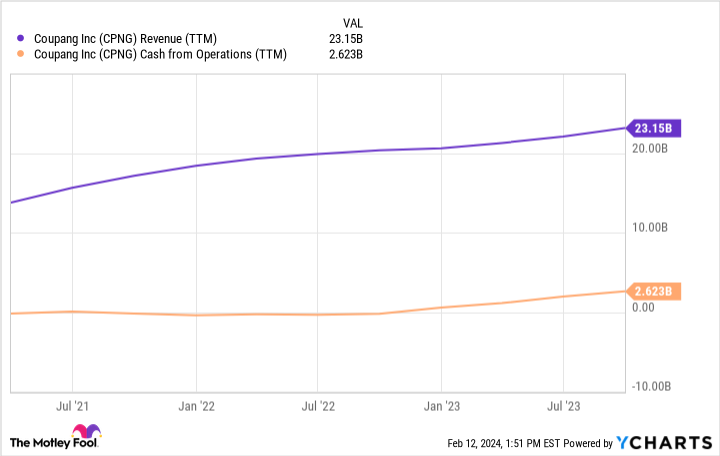

Management has said that its Taiwan expansion is going well and it will lean into the investment to keep pushing that forward. Coupang’s operating cash flow has surged over the past year despite its losing money on its non-commerce businesses. That’s a good sign that the core commerce business can support the broader company.

You can see revenue and cash from operations trends in the chart below.

Applying the same logic to value this stock as I used on Amazon, Coupang is trading at only 10 times its operating cash flow, just half what Amazon trades at. Coupang may not be as established as Amazon, but the company is on great financial footing. It has nearly $5 billion in cash on its balance sheet against just over $1 billion in debt. The business generated $1.8 billion in free cash flow over the past year and is set to grow. Coupang deserves far more respect than Wall Street is giving it.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Coupang. The Motley Fool has a disclosure policy.

Have $500? 3 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now. was originally published by The Motley Fool