Over the last 7 days, the Indian market has experienced a 4.7% drop, yet it remains up by an impressive 39% over the past year with earnings projected to grow by 17% annually. In this dynamic environment, identifying high growth tech stocks involves focusing on companies with strong fundamentals and innovative capabilities that can capitalize on these favorable long-term growth forecasts.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Coforge | 15.29% | 23.11% | ★★★★★☆ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Syrma SGS Technology | 21.86% | 32.67% | ★★★★★☆ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

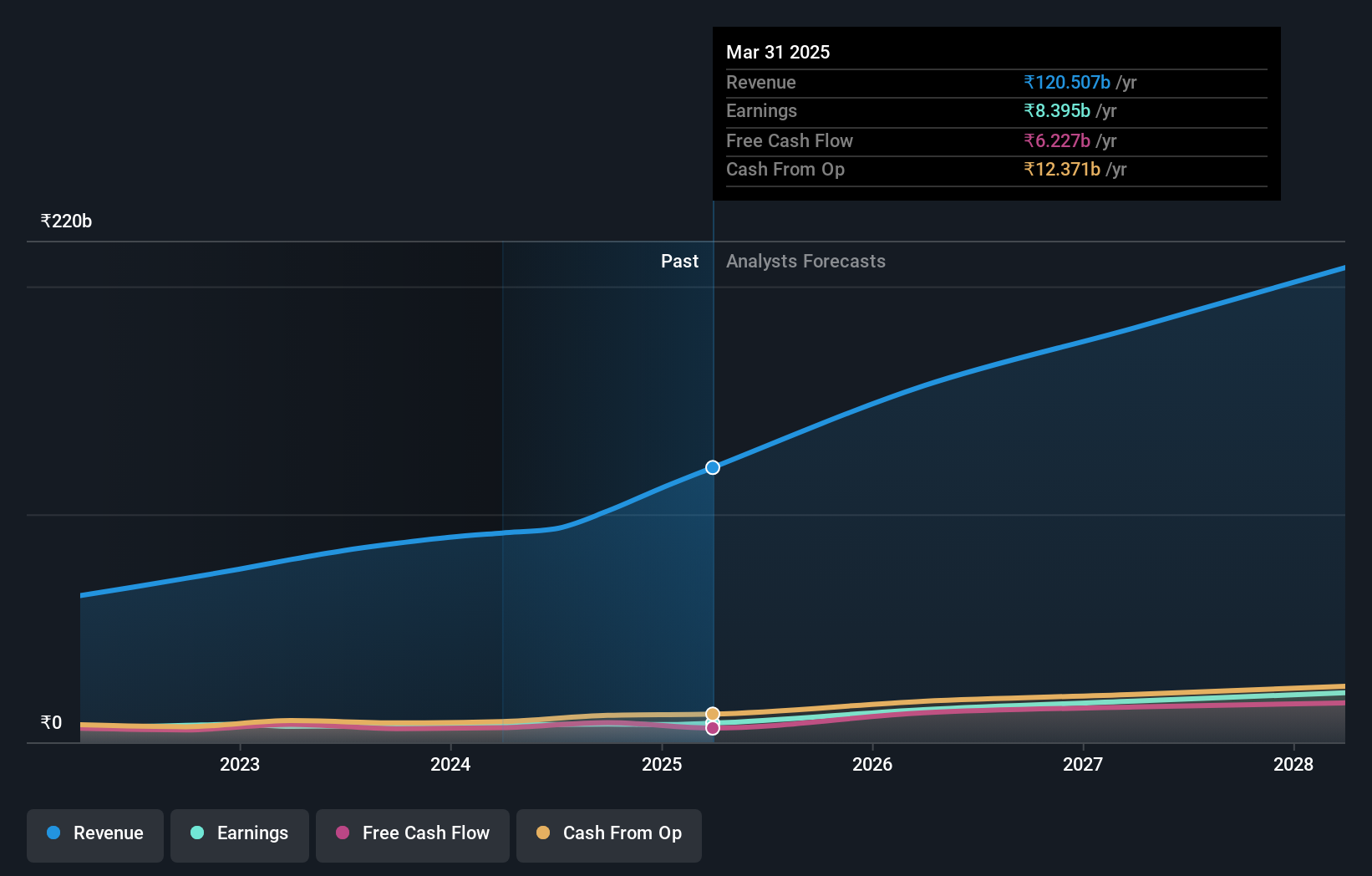

Overview: Coforge Limited is a company that offers information technology and IT enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific with a market capitalization of ₹488.33 billion.

Operations: Coforge Limited generates revenue primarily from its Software Solutions segment, totaling ₹93.59 billion.

Coforge’s strategic initiatives, such as its recent collaboration with Salesforce to launch ENZO for decarbonization solutions, highlight its commitment to innovation and sustainability in the tech sector. This move not only enhances its service offerings but also positions it well within the growing demand for environmental technology solutions. Despite a challenging market, Coforge’s financial performance remains robust with a 15.3% revenue growth forecasted annually and an even more impressive expected annual earnings growth of 23.1%. These figures suggest a strong trajectory, underpinned by strategic partnerships and forward-thinking solutions that could reshape industry standards and client engagements in significant ways.

- Get an in-depth perspective on Coforge’s performance by reading our health report here.

-

Understand Coforge’s track record by examining our Past report.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

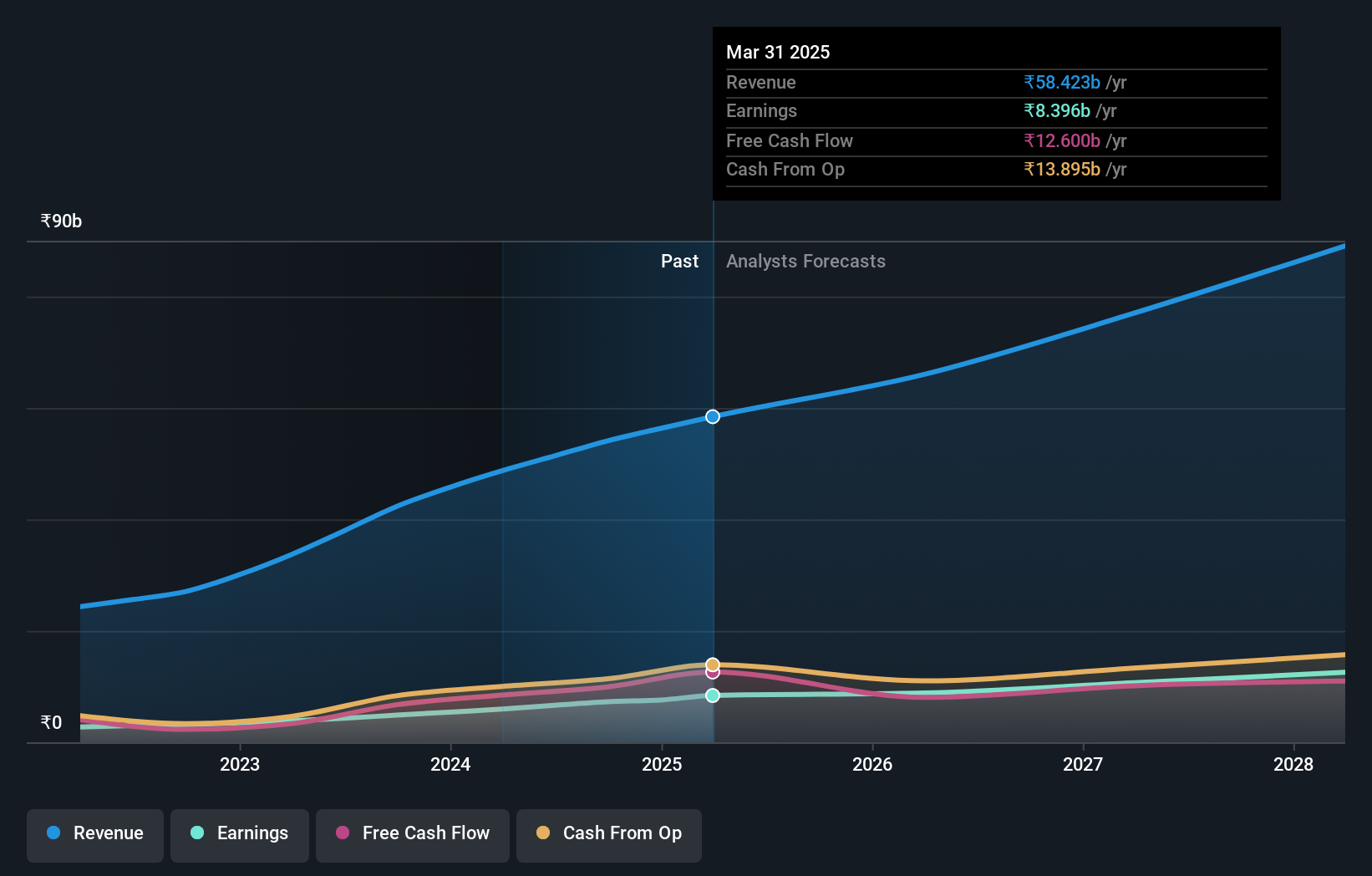

Overview: KPIT Technologies Limited specializes in delivering embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across the Americas, the United Kingdom, Europe, and globally, with a market cap of ₹464.87 billion.

Operations: KPIT Technologies focuses on providing advanced software and digital solutions tailored for the automobile and mobility industries, leveraging expertise in embedded systems and artificial intelligence. The company operates across multiple regions, including the Americas, UK, Europe, and other international markets.

KPIT Technologies, navigating through a competitive tech landscape in India, has demonstrated robust financial and operational growth. With a revenue increase of 16.2% per year, KPIT outpaces the Indian market average of 10%. This growth is complemented by an impressive earnings surge of 54.7% over the past year, significantly ahead of the industry’s 32.4%, showcasing its ability to scale efficiently in a dynamic environment. The company’s commitment to innovation is evident from its R&D spending trends which are strategically aligned with its growth trajectory—ensuring sustained advancements in software solutions. Looking ahead, KPIT’s forecasted annual earnings growth rate of 19.3% suggests it is well-positioned to maintain its upward momentum amidst evolving technological demands.

- Dive into the specifics of KPIT Technologies here with our thorough health report.

-

Review our historical performance report to gain insights into KPIT Technologies”s past performance.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

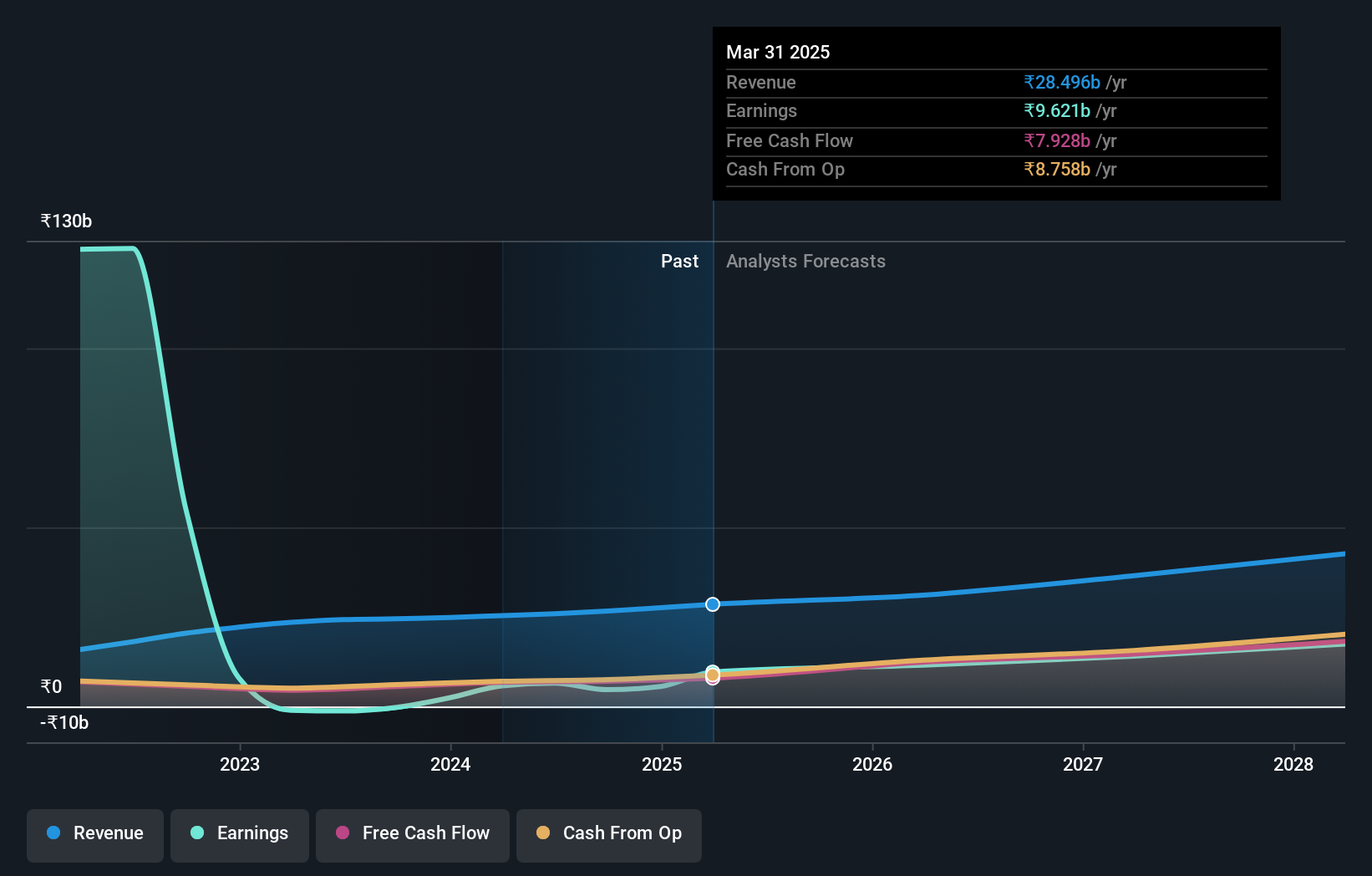

Overview: Info Edge (India) Limited is an online classifieds company offering services in recruitment, matrimony, real estate, and education both in India and internationally, with a market cap of ₹1.07 trillion.

Operations: The company generates revenue primarily through recruitment solutions, contributing significantly to its income, followed by real estate services under the 99acres brand. Recruitment Solutions account for ₹19.05 billion, while 99acres for Real Estate brings in ₹3.67 billion.

Info Edge (India) has demonstrated a strong trajectory in the tech sector, with its revenue forecast to grow at 13% annually, outpacing the Indian market average of 10%. This growth is bolstered by an impressive anticipated annual earnings increase of 23.6%, reflecting robust operational efficiency and market positioning. The company’s recent strategic investment of approximately INR 4.2 crores in Nexstem India underscores its commitment to nurturing innovation through significant R&D expenditures, aligning with broader industry trends towards digital transformation and technological integration.

Where To Now?

- Reveal the 39 hidden gems among our Indian High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St’s portfolio to get a 360-degree view on how they’re shaping up.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com