Over the last 7 days, the Indian market has remained flat, but it has seen a substantial 44% increase over the past year with earnings forecasted to grow by 17% annually. In this thriving environment, identifying high growth tech stocks like Coforge and other prominent players can be crucial for investors looking to capitalize on India’s dynamic tech sector.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Coforge | 14.80% | 22.73% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let’s uncover some gems from our specialized screener.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

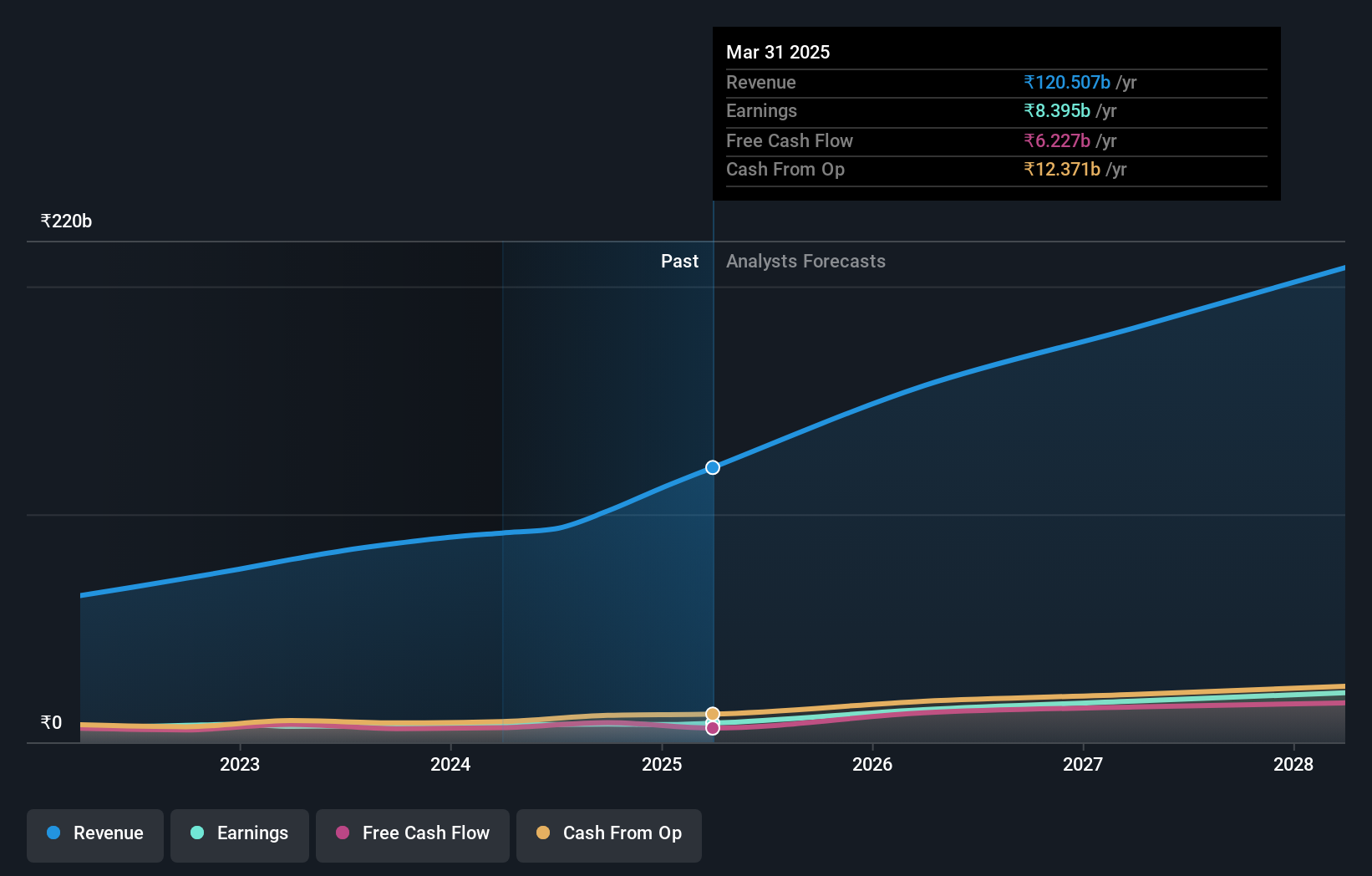

Overview: Coforge Limited offers information technology and IT-enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific, with a market cap of ₹475.29 billion.

Operations: Coforge Limited generates revenue primarily from its Software Solutions segment, which contributed ₹93.59 billion. The company operates across multiple regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Coforge’s strategic alignment with Salesforce to launch the ENZO platform underscores its commitment to sustainability and technological innovation, addressing critical decarbonization challenges for businesses. This collaboration not only enhances Coforge’s service offerings but also positions it favorably within the tech ecosystem as enterprises increasingly prioritize ESG criteria. Financially, Coforge is poised for robust growth with earnings expected to surge by 22.7% annually, outpacing the Indian market’s forecast of 17.2%. Additionally, its revenue growth projection of 14.8% annually further solidifies its competitive stance in a rapidly evolving industry landscape where technological adaptability and sustainability are key drivers of success.

- Dive into the specifics of Coforge here with our thorough health report.

-

Examine Coforge’s past performance report to understand how it has performed in the past.

C. E. Info Systems (NSEI:MAPMYINDIA)

Simply Wall St Growth Rating: ★★★★★★

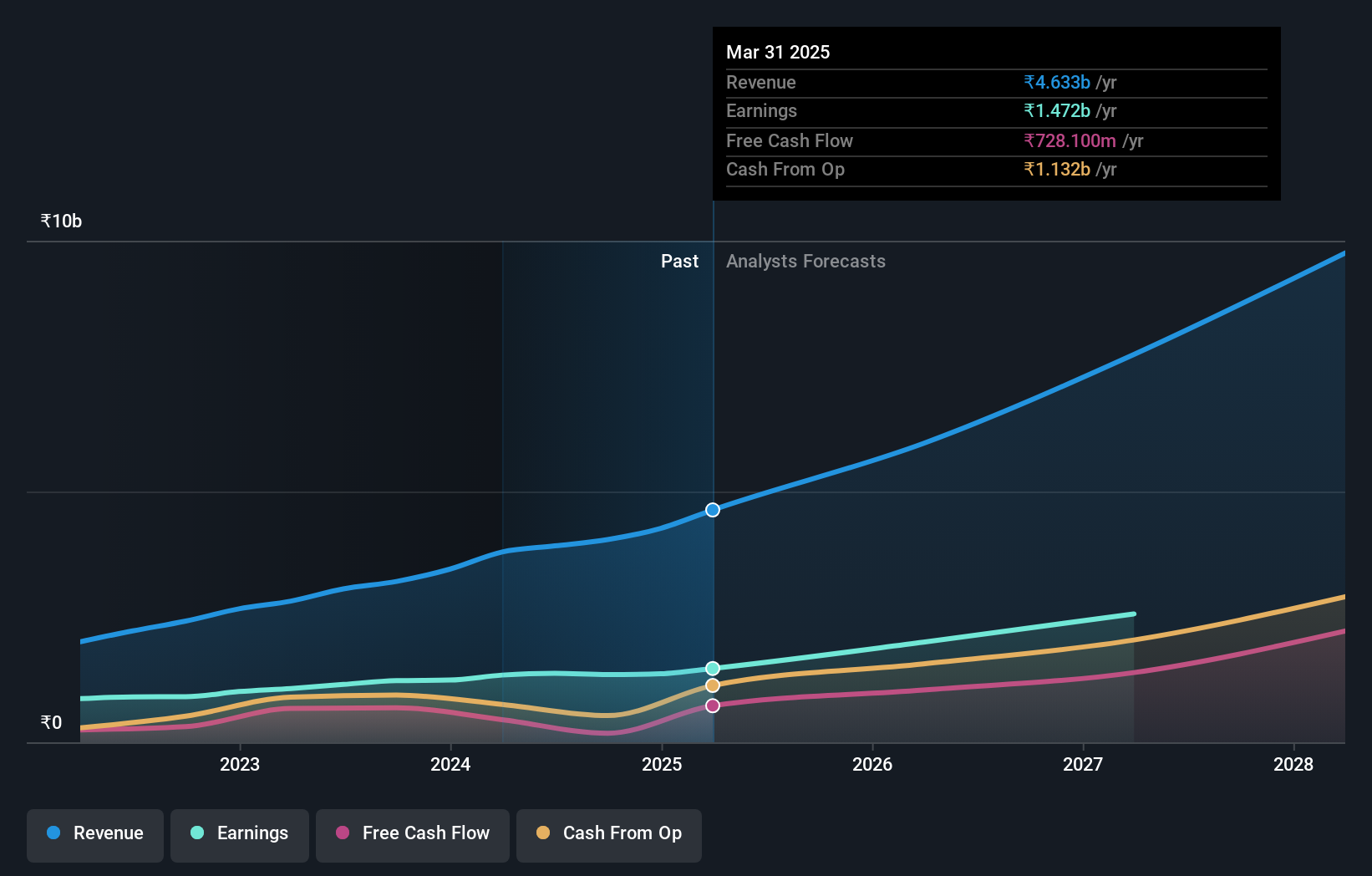

Overview: C. E. Info Systems Limited offers digital mapping, geospatial software, and location-based Internet of Things (IoT) technology solutions in India with a market cap of ₹119.67 billion.

Operations: The company generates revenue primarily from map data and related services, including GPS navigation, location-based services, and IoT solutions, totaling ₹3.92 billion. The net profit margin stands at 32.02%.

C. E. Info Systems, amid a vibrant tech landscape in India, showcases robust growth with its recent partnership with Zoomcar enhancing the Mappls App, reflecting innovative strides in travel technology. The company’s R&D expenditure aligns with its strategic initiatives, underpinning its commitment to technological advancement and market competitiveness. This focus on innovation is mirrored in their financial performance; revenue surged by 29.9% this year while earnings grew by 26.4%, signaling strong operational execution and market presence. Such dynamics are pivotal as the firm continues to expand its digital mapping and location-based services, ensuring it remains integral to India’s tech-driven ecosystem transformations.

- Click here and access our complete health analysis report to understand the dynamics of C. E. Info Systems.

-

Explore historical data to track C. E. Info Systems’ performance over time in our Past section.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in the areas of recruitment, matrimony, real estate, and education and related services in India and internationally, with a market cap of ₹1.06 trillion.

Operations: The company generates revenue primarily from its recruitment solutions segment, which brought in ₹19.05 billion, followed by the real estate platform 99acres with ₹3.67 billion.

Info Edge (India) has demonstrated a strategic focus on innovation, with R&D expenses reflecting a commitment to advancing its technological capabilities. The company’s recent decision to invest INR 4.2 crores in Nexstem India underscores its drive towards enhancing AI and machine learning platforms, aligning with industry trends towards digital transformation. Financially, Info Edge is robust; it reported a significant revenue increase to INR 8.28 billion this quarter, up from INR 6.9 billion the previous year, and net income surged by 23.6% to INR 2.33 billion, indicating strong market execution and growth potential in high-tech sectors in India.

Summing It All Up

- Dive into all 38 of the Indian High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com