Amidst a backdrop of renewed fears about global economic growth, France’s CAC 40 Index has seen a notable decline, mirroring broader European market trends. As investors navigate these turbulent waters, identifying high-growth tech stocks like Lectra and others can offer potential opportunities for those looking to capitalize on innovation and resilience in the French market.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 12.59% | 27.33% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| VusionGroup | 21.32% | 25.74% | ★★★★★★ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Valneva | 24.22% | 28.34% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA provides industrial intelligence solutions for fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of approximately €1.07 billion.

Operations: Lectra SA generates revenue primarily from the Americas (€172.65 million) and the Asia-Pacific (€118.54 million) regions, with a notable segment adjustment of €209.13 million. The company focuses on providing industrial intelligence solutions tailored to fashion, automotive, and furniture markets globally.

Lectra’s earnings are projected to grow at an impressive 29.3% annually, significantly outpacing the French market’s 12.3% growth rate. Despite a recent net income of €12.51 million for H1 2024, down from €14.47 million last year, their R&D expenses reflect a strong commitment to innovation with considerable investment in new technologies and software solutions. Revenue is expected to rise by 10.4% per year, faster than the national average of 5.7%, showcasing its robust growth potential in the tech sector.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

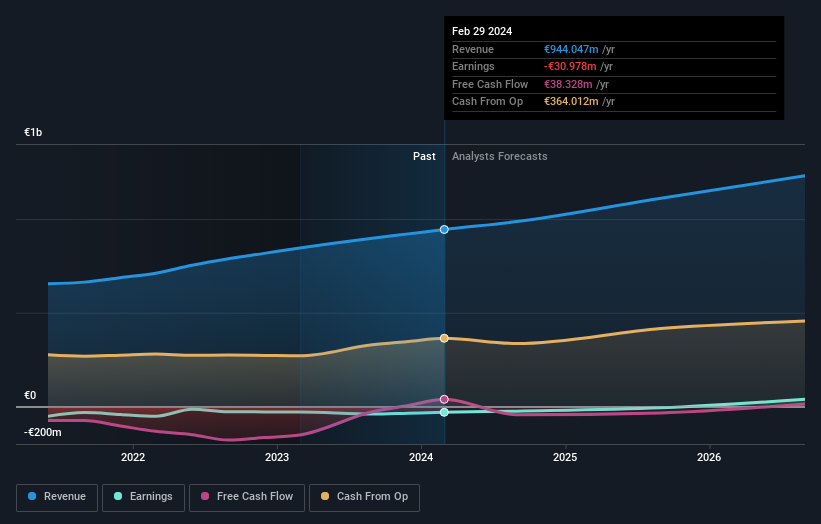

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally with a market cap of approximately €1.15 billion.

Operations: OVH Groupe S.A. generates revenue primarily from three segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud services (€185.43 million). The company operates globally, providing a range of cloud-based solutions to its clients.

OVH Groupe is forecasted to grow earnings by 101.1% annually, reflecting a promising trajectory despite its current unprofitability. The company’s revenue is expected to increase at a rate of 9.7% per year, outpacing the French market’s 5.7%. Notably, OVHcloud recently launched ADV-Gen3 Bare Metal servers powered by AMD EPYC 4004 Series processors, enhancing performance and network capabilities for diverse applications like SaaS and PaaS solutions. With an emphasis on innovation, OVH allocated €50 million in R&D expenses last year to drive technological advancements and sustainability initiatives within their data centers.

- Delve into the full analysis health report here for a deeper understanding of OVH Groupe.

-

Review our historical performance report to gain insights into OVH Groupe’s’s past performance.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market cap of approximately €2.31 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to approximately €801.96 million. The company’s digitalization solutions are deployed across Europe, Asia, and North America.

VusionGroup’s recent partnership with Ace Hardware to integrate advanced digital shelf label (DSL) technology across over 5,000 stores underscores its innovative edge. The company forecasts annual revenue growth of 21.3%, outpacing the French market’s 5.7%. With R&D expenses reaching €50 million last year, VusionGroup demonstrates a strong commitment to technological advancements. Earnings are expected to grow at an impressive rate of 25.7% annually, reflecting robust future prospects in the tech-driven retail sector.

- Click here and access our complete health analysis report to understand the dynamics of VusionGroup.

-

Examine VusionGroup’s past performance report to understand how it has performed in the past.

Summing It All Up

- Delve into our full catalog of 45 Euronext Paris High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com