In the context of recent developments, Germany’s DAX Index has seen a notable rise of 1.46%, buoyed by the European Central Bank’s decision to cut interest rates for the second consecutive meeting, which has fueled expectations for further monetary easing and bolstered investor sentiment across major stock indexes in Europe. As we explore high-growth tech stocks in Germany, it’s crucial to consider companies that are well-positioned to leverage current economic conditions, such as those with robust innovation capabilities and adaptability to evolving market dynamics.

Top 10 High Growth Tech Companies In Germany

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Formycon |

32.50% |

30.82% |

★★★★★☆ |

|

Ströer SE KGaA |

7.50% |

29.71% |

★★★★★☆ |

|

Exasol |

14.66% |

117.10% |

★★★★★☆ |

|

Stemmer Imaging |

13.34% |

23.20% |

★★★★★☆ |

|

ParTec |

41.16% |

63.31% |

★★★★★★ |

|

cyan |

28.13% |

71.18% |

★★★★★☆ |

|

medondo holding |

35.61% |

82.66% |

★★★★★☆ |

|

Northern Data |

31.58% |

73.23% |

★★★★★☆ |

|

Rubean |

55.25% |

67.67% |

★★★★★☆ |

|

Pantaflix |

20.93% |

113.65% |

★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

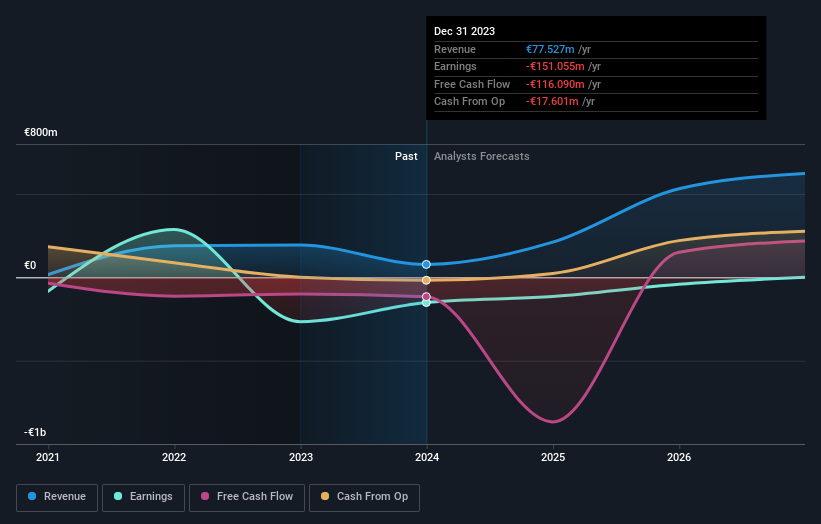

Northern Data

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG develops and operates high-performance computing infrastructure solutions for businesses and research institutions worldwide, with a market capitalization of €1.94 billion.

Operations: The company generates revenue primarily through its Peak Mining segment (€156.13 million) and Ardent Data Centers (€31.46 million), with additional contributions from Taiga Cloud (€22.13 million). The Consolidation segment reflects a negative impact of €178.50 million on the overall financial performance.

Northern Data’s trajectory in the high-growth tech sector is marked by significant revenue and earnings projections, with an anticipated annual revenue growth of 31.6%, surpassing the German market average of 5.5%. Despite current unprofitability, the firm is expected to shift towards profitability within three years, a testament to its strategic direction and market adaptation. Recent inclusion in the S&P Global BMI Index underscores its expanding influence and investor confidence. Moreover, R&D investments are pivotal, aligning with industry demands for innovation in software technology—a sector moving swiftly towards SaaS models. This focus on development promises to enhance Northern Data’s competitive edge while fostering sustainable growth amidst a volatile share price landscape.

-

Click to explore a detailed breakdown of our findings in Northern Data’s health report.

-

Gain insights into Northern Data’s historical performance by reviewing our past performance report.

init innovation in traffic systems

Simply Wall St Growth Rating: ★★★★☆☆

Overview: init innovation in traffic systems SE, along with its subsidiaries, offers intelligent transportation systems solutions for public transportation globally and has a market cap of €370.36 million.

Operations: Init’s primary revenue stream is derived from wireless communications equipment, generating €235.67 million.

Init innovation in traffic systems SE, a player in the German tech landscape, has shown resilience with a 25.3% increase in sales to EUR 114.49 million over the last six months from EUR 89.63 million year-on-year. Despite a slight dip in net income from EUR 3.03 million to EUR 2.42 million this quarter, annual forecasts are optimistic with earnings expected to grow by an impressive 21.6%. This growth is supported by substantial R&D investments which are crucial as the company adapts to evolving market demands and strengthens its competitive position within the tech sector. The firm’s commitment to innovation is evident as it continues investing heavily in R&D, aligning its strategy with industry trends towards more sophisticated technological solutions. These strategic decisions are set against a backdrop of increasing revenue projections of 12.5% per year—outpacing the German market average of 5.5%. With these dynamics at play, init innovation stands poised for significant advancements, leveraging robust development activities that promise to drive future growth and enhance its market footprint amidst fierce competition.

SAP

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services globally and has a market capitalization of approximately €254.83 billion.

Operations: SAP generates revenue primarily from its Applications, Technology & Services segment, which contributed €33.27 billion. The company focuses on providing a comprehensive suite of software solutions and related services worldwide.

SAP SE, a stalwart in the German tech arena, recently revised its 2024 earnings guidance upwards, reflecting robust growth prospects with cloud and software revenue expected to surge by 10% to 11%. This adjustment is underpinned by a significant R&D commitment—10.3% of total revenue—fueling innovations like the AI copilot Joule and enhancing SAP’s competitive edge in business process automation. Moreover, the firm’s strategic share repurchases, totaling €2.62 billion for 1.43% of its shares this year, underscore confidence in its financial health and future growth trajectory. These moves are pivotal as SAP continues to outperform market expectations with an anticipated annual profit spike of 40.5%, positioning it well within Germany’s high-tech sector landscape.

-

Get an in-depth perspective on SAP’s performance by reading our health report here.

-

Review our historical performance report to gain insights into SAP’s’s past performance.

Summing It All Up

-

Discover the full array of 39 German High Growth Tech and AI Stocks right here.

-

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

-

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DB:NB2 XTRA:IXX and XTRA:SAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com