As global markets respond to China’s robust stimulus measures and the U.S. technology sector sees significant gains, Sweden’s tech landscape remains a focal point for investors seeking high growth opportunities. In this article, we will explore three promising Swedish tech stocks, including Paradox Interactive, that exemplify strong fundamentals and potential for growth in the current market environment.

Top 10 High Growth Tech Companies In Sweden

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Truecaller |

20.32% |

21.61% |

★★★★★★ |

|

Fortnox |

20.04% |

22.24% |

★★★★★★ |

|

Bonesupport Holding |

33.76% |

31.20% |

★★★★★★ |

|

Xbrane Biopharma |

53.90% |

118.02% |

★★★★★★ |

|

Scandion Oncology |

40.71% |

75.34% |

★★★★★★ |

|

Hemnet Group |

20.13% |

25.41% |

★★★★★★ |

|

Skolon |

31.76% |

121.72% |

★★★★★★ |

|

BioArctic |

42.38% |

98.40% |

★★★★★★ |

|

Yubico |

20.52% |

42.35% |

★★★★★★ |

|

KebNi |

34.75% |

86.11% |

★★★★★★ |

Let’s review some notable picks from our screened stocks.

Paradox Interactive

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) develops and publishes strategy and management games for PC and consoles across various global regions, with a market cap of SEK19.19 billion.

Operations: The company generates revenue primarily from developing and publishing strategy and management games for PC and consoles, with SEK2.48 billion derived from computer graphics. The business operates across North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific regions.

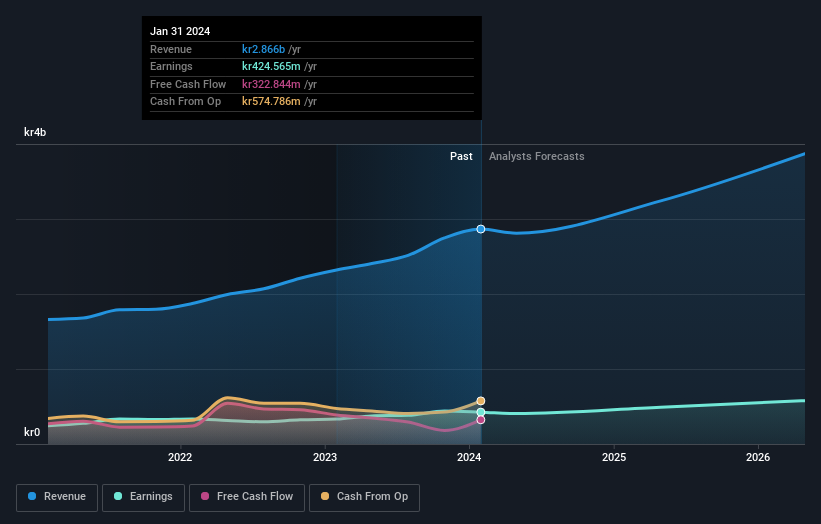

Paradox Interactive, a Swedish game developer, is navigating a challenging landscape with its recent financial performance reflecting a significant one-off loss of SEK 167.4 million. Despite this setback, the company’s future looks promising with an expected annual earnings growth of 40.4%, outpacing the Swedish market projection of 15.1%. This growth is underpinned by robust R&D investments that not only fuel innovation but also align with industry shifts towards digital and subscription-based models, ensuring sustained revenue streams. The launch of new expansions like “Grand Archive” for Stellaris signifies Paradox’s ongoing commitment to enhancing player experience and expanding its product portfolio, potentially driving future revenue growth forecasted at 9.1% annually—faster than the broader market’s 0.9%.

Sectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe with a market cap of SEK54.10 billion.

Operations: Sectra generates revenue primarily from its Imaging IT Solutions segment (SEK2.67 billion) and Secure Communications segment (SEK388.55 million). The company focuses on medical IT and cybersecurity solutions across several European markets.

Sectra, a Swedish tech firm, stands out with its recent robust financial and operational performance. In the last quarter alone, revenue surged to SEK 739.48 million from SEK 603.03 million year-over-year, underpinned by a notable increase in net income to SEK 80.4 million from SEK 61.56 million, reflecting a strategic emphasis on innovation and market expansion. The company’s commitment to R&D is evident as it propels growth significantly above the industry norm; earnings are expected to climb by an impressive 21.2% annually compared to the broader Swedish market’s projection of just 15.1%. Additionally, Sectra is enhancing its service delivery through pioneering cloud-based solutions in healthcare imaging—demonstrated by successful deployments in Belgium hospitals—potentially setting new standards for operational efficiency in the sector.

-

Click to explore a detailed breakdown of our findings in Sectra’s health report.

-

Gain insights into Sectra’s past trends and performance with our Past report.

Vitrolife

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market cap of SEK34.01 billion.

Operations: The company generates revenue through three main segments: Genetics (SEK1.25 billion), Consumables (SEK1.57 billion), and Technologies (SEK708 million). The primary focus is on assisted reproduction products.

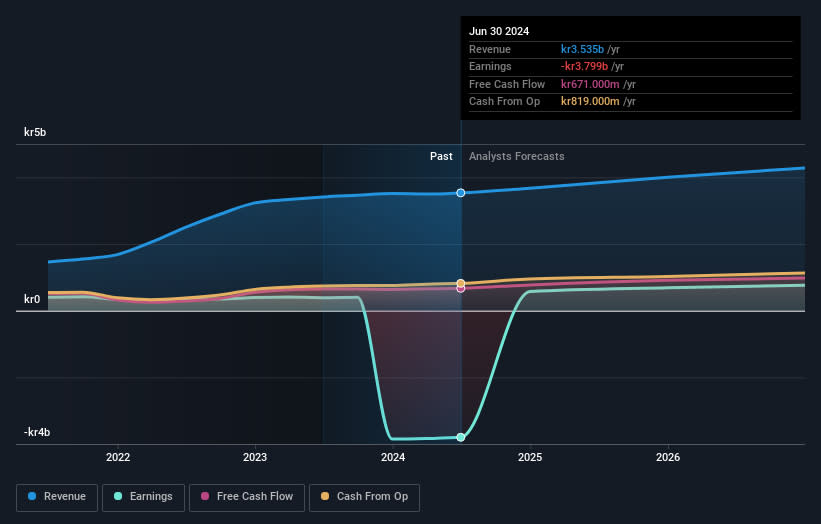

Vitrolife, a Swedish biotechnology firm, demonstrated robust financial performance with second-quarter sales rising to SEK 941 million from SEK 905 million year-over-year and net income increasing to SEK 143 million from SEK 106 million. This growth is underpinned by a significant forecasted annual earnings increase of 105.9%, positioning the company for profitability within three years. Despite its current non-profitable status, Vitrolife’s commitment to innovation is evident in its R&D investments which have strategically positioned it above the Swedish market’s average growth rate of 0.9% per year with a revenue growth forecast of 7.9%. Recent presentations at industry conferences underscore its active engagement in expanding market reach and influence within the biotech sector.

-

Take a closer look at Vitrolife’s potential here in our health report.

-

Evaluate Vitrolife’s historical performance by accessing our past performance report.

Next Steps

-

Gain an insight into the universe of 81 Swedish High Growth Tech and AI Stocks by clicking here.

-

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Searching for a Fresh Perspective?

-

Explore high-performing small cap companies that haven’t yet garnered significant analyst attention.

-

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

-

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:PDX OM:SECT B and OM:VITR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com